With college tuition continuing to increase, it probably won’t surprise many people to learn that college graduates are leaving school burdened with more loan debt. According to a new report, the average amount of student loan debt for new graduates has passed $30,000 for the first time. [More]

borrowing

1-in-5 Auto Title Loans Lead To Vehicle Seizure

When seeking an infusion of cash to make ends meet, consumers may turn to payday loans, cash advance loans, or auto title loans. While each of these short-term, high-interest loans pose a financial risk to borrowers, only one has the ability to take away what is often a person’s largest asset: their vehicle. And, according to a new report, one-in-five consumers who take out a single-payment auto title loan have their car seized by lenders. [More]

Student Loan Debt For Recent College Graduates Increases Again

With college tuition prices continuing to rise, you might assume that college students are entering the real world with more debt on their shoulders. According to a new report, that assumption would be correct.

[More]

Credit Card Issuers Increase Limits For Subprime Borrowers; Raise Concerns About Risks

As the economy continues to improve, credit card issuers have begun to loosen their vice grip on lending standards in order to raise borrowing limits for consumers. But the move to provide extend credit to those with blemished histories has raised concerns with consumer groups. [More]

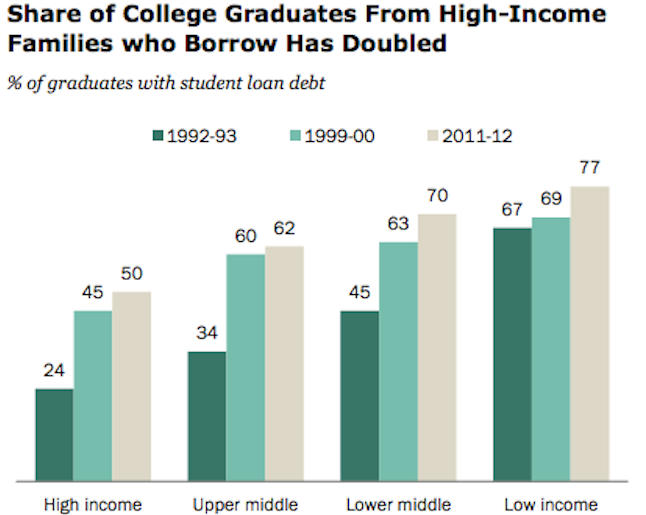

Percentage Of Rich Kids Needing Student Loans Has Doubled Since 1992

At one time, prospective college students from affluent families could count on having their tuition paid for by their parents or college savings accounts. But times have changed and now even students from the highest income brackets are borrowing to finance their high education dreams. [More]

Mortgages Slightly Easier To Get For Prime Borrowers, Still Tough For Subprime Applicants

Ten years ago, a potential home buyer could walk into a Countrywide office and get pre-approved for a half-million dollar home loan based on a bank statement written in crayon on a restaurant place mat and a pinky swear that the loan could be paid back. We all know too well the results of those lax standards, which is why regulators and banks ramped up restrictions on lending to the point where applying for a home loan is like auditioning for American Idol, without the washed-up celebrity appearances. But a new survey says that lenders are easing up… a bit. [More]

Not-So-Fun Facts About Home Equity Lines Of Credit

Homeowners whose property is worth more than what they owe have the option of using their equity to get a hold of more money. Home equity lines of credit can fund education expenses, home improvements or help you pay off debt with higher interest. The credit can be a lifesaver, but can also get users in trouble. [More]

California Hits Up 8 Banks For $5.4 Billion In loans

Fearful that federal debt problems would leave it hanging, California has passed the hat around to eight banks and wound up with loans for $5.4 billion. The interest rate: an astoundingly low 0.237 percent. [More]

Debt-Riddled Illinois Is A Subprime Borrower

Illinois credit rating sucks, which is unfortunate for the Sucker State, because it needs to borrow millions of dollars to pay its bills. This means that the state is paying a premium for the loans, which are going to be used to improve roads, bridges and schools. As a product of Illinois’ public schools, I can honestly say that the $900 million in new bonds it is issuing will not be enough. Whether this is because we are too poorly educated to figure out how much money is actually needed, or because it really isn’t, no one can say. [More]

Credit Unions Dive Into The Student Loan Market

Private loans are the worst type of student debt, but the best place to get them may be your local credit union. Like most credit union products, their loans are usually a better deal with more favorable terms than similar loans from bigger banks.

President Obama Meets With Credit Card Executives Today To Tell Them They Are Not Approved

It’s a good week for consumer protection against abusive credit card practices. Yesterday, the House Financial Services Committee approved the Credit Cardholders’ Bill of Rights, and this afternoon President Obama is meeting with officials from 14 credit card companies to tell them “that greater consumer protections are coming for their customers, with or without their cooperation.”

../..//2009/04/02/mortgage-rates-are-at-a/

Mortgage rates are at a record low of 4.78%, according to Freddie Mac. [Bloomberg]

A Big-Ass List Of Student Loan Resources

It’s a tough economic climate to be graduating from school — and maybe an even tougher one for those of you trying to get financial aid. We’ve put together a list of some financial aid and student lending resources to help make things easier.

Prepare For A Budget Meltdown By Conducting A Financial Fire Drill

You’re fired! Now what? It’s the nightmare scenario, and you can prepare for it by conducting a financial drill. Take a moment and pretend you have no income. Ask how you would pay pay for rent and food, and what lifestyle changes you could make on two week’s notice. To guide your planning, the New York Times has a few unorthodox and downright scary suggestions that are worth considering in a worst case scenario.

Economy: "Consumers Have Thrown In The Towel"

Consumer spending is down and credit card defaults are up!

Car Title Loans Are Liable To Leave You Taking The Bus

You surely already know better, because you’re a loyal Consumerist reader, but stay far, far away from the form of legalized usury known as car title loans! CNN has published an overview of the industry, noting that APRs frequently exceed 200%, and that added fees and loan “rollover” options help keep borrowers in a cycle of debt.

House Passes Credit Card Bill Of Rights… But Senate Is Too Busy With The Bailout

The House of Representatives passed legislation that’s commonly known as the Credit Cardholders’ Bill of Rights today, but the bill is expected to be ignored by the Senate while they work on that whole $700 billion bailout thing.