A hush fell over the AIG conference room on the day that their Worst Company in America 2009 trophy was unveiled. The eyes of every executive in the room sparkled with just a bit of pride. “Well done, everyone,” said the man at the head of the table. “But we mustn’t rest on our gilded-feces laurels. It’s time to begin our work for next year’s competition.”

bonuses

Banks Use Life Insurance Policies To Fund Executive Bonuses

Here’s a morbid bit of creative accounting, courtesy of the Wall Street Journal: if you work for Bank of America, J.P. Morgan Chase, or Wells Fargo, your employer may have taken out a life insurance policy on you.

Remember How Mad You Were About Those AIG Bonuses? They're Bigger Than You Thought

So, remember those bonuses everyone was so mad about? Well, it turns out that they were bigger than originally disclosed. A lot bigger.

Chicago Tribune Fires Reporter Covering The Recession

Let’s pause a moment to consider this sentence from Crain’s Chicago Business. “On the same day the Chicago Tribune cut 53 jobs from its newsroom, its parent Tribune Co. asked a Bankruptcy Court to approve of $13.3 million in bonuses and other incentive payments to 703 employees.”

Fannie And Freddie To Pay $210 Million In Retention Bonuses

Fannie Mae and Freddie Mac are preparing to hand out $210 million in taxpayer-funded retention bonuses to 7,600 employees. No bonus will exceed $1.5 million, but more than half of all Freddie and Fannie employees will receive an average bonus exceeding $24,000.

AIG Financial Products Employee's Public Resignation Letter

Here is a resignation letter sent on Tuesday by Jake DeSantis, an executive vice president of the American International Group’s financial products unit, to Edward M. Liddy, the chief executive of A.I.G. It was published in the New York Times.

AIG Big Bonus Getters Will Return Their Cash

You can put down your pitchforks, NY AG Cuomo told reporters this afternoon that most of the AIG big bonus receivers had agreed to return their bonuses. 9 of the top 10 bonus recipients, and 10 of the 15 bonus recipients in the infamous financial products services division, will return their monies. The holdouts were mainly overseas workers and those outside NY jurisdiction. The total remittance comes to about $30 million. Great, can we get back to fixing the economy now? Thanks.

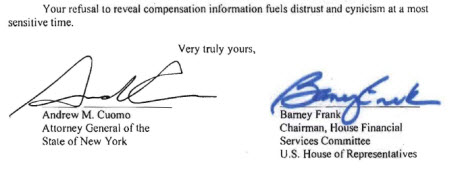

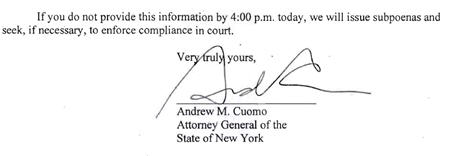

AIG Turns Over The Names Of Bonus Recipients

AIG has complied with Andrew Cuomo’s subpoena and turned over the names of the bonus recipients. The NY AG has released a statement about the issue, which you can read inside.

Congress Considering Sending The IRS After AIG

The Washington Post says that the House will vote this afternoon on a bill that would seek to impose a 90% tax on the AIG bonuses. The Senate Finance Committee is also working on similar legislation, but have not yet scheduled a vote.

Obama, Congress, Knew About AIG Bonuses For Months

The AIG furor continues as it turns out Obama and Congress knew about the AIG bonuses for months but previously, on the advice of lawyers, felt powerless to stop them. Question for the audience: is figuring out what happened with the AIG bonuses fundamentally important to get the economy back on track, or is it just another media circus sideshow?

How Do You Solve A Problem Like AIG? Suicide.

Another day, another livid politician. Senator Charles Grassley of Iowa told a Cedar Rapids radio station that the AIG executives who are taking bonuses should, as an alternative, kill themselves.

NY Attorney General To AIG: You Have Until 4:00 PM To Give Us The Names

Andrew Cuomo has written a letter to AIG in which he explains that they will turn over the names of those employees from the Financial Products subsidiary (that’s the division that brought down the company) who are receiving bonuses by 4:00 pm today or they are coming at them with subpoenas. Yes, ladies and gentlemen, it’s another awesome Andrew Cuomo letter after the jump.

AIG To Use Bailout Cash To Pay $165 Million In Bonuses. Yes, Seriously

So, those guys at AIG who underwrote trillions of dollars worth of credit default swaps backed by securitized mortgages? The ones the Times says were “at the very heart of A.I.G.’s worldwide conflagration?” They’re taking $165 million of our bailout money for bonuses. Because if we don’t pay them, these people—described by AIG’s government-appointed Chairman Ed Liddy as the “best and brightest talent”—will apparently leave to go ruin some other country’s financial system, and we can’t have that. Liddy acknowledged that the bonuses were “distasteful and difficult” before saying that he had “grave concern about the long-term consequences” of not paying up.

NY AG To Find Out Who Got The Merrill Bonus Money "By Whatever Means Is Necessary"

The NY AG has served Bank of America with a subpoena after they refused to release the names of the individuals who received over $3 billion in bonuses while Merrill Lynch was hemorrhaging money.

Merrill Lynch CEO: "Nothing Happened In The World Or The Economy" That Would Justify Suspending Bonuses

You know how Merrill Lynch recently lost $15 billion? Remember how we’re in a unbelievably huge global financial crisis that threatens to unravel the fabric of our economy? John Thain says that’s no reason not to pay billions of dollars in bonuses.

Despite Economic Disaster, Wall Street Collected $18.4 Billion In Bonuses

Bonuses are for a job well done, right? Well, despite the economic disaster, it seems that the folks on Wall Street rewarded themselves with $18.4 billion in bonuses in 2008, which is around the same amount as they received in 2004 — when the Dow was “flying above 10,000, on its way to a record high,” says the New York Times.