Nearly two years after AT&T was hit with a $105 million settlement over bill-cramming — the practice of letting third parties place questionable or false charges on customers’ phone bills — the Federal Communications Commission says the company has agreed to pay another $7.5 million to close the book on additional cramming accusations involving a bogus directory assistance service. [More]

bill cramming

AT&T Penalized $7.75 Million For Allowing Scammers To Charge Bogus “Directory Assistance Service” Fees

Company Caught Switching Customers’ Phone Service Without Permission

So your phone company calls you and says there’s a new plan that can save your on your phone bill, or maybe to let you know that you’re being overcharged for your current service. So you go ahead and switch to the more sensible plan, only to find out weeks later that you’ve actually been switched over to a new service provider you’ve never heard of — and to a plan that costs more than your old one. This was a reality for dozens of people who complained to the FCC about a Michigan-based company that now faces a potential $2.4 million fine. [More]

NJ Residents Call For Info On Sprint Refund, Get Phone Sex Line Instead

Earlier this week, Sprint and Verizon reached multimillion-dollar settlements with federal regulators for allowing third parties to bill for unwanted and unauthorized add-on services. But when New Jersey residents tried to call the Sprint information number given out by the state’s attorney general, they were in for another telephonic surprise. [More]

Verizon, Sprint To Pay $158 Million To Settle Wireless Bill-Cramming Allegations

Several months after AT&T and T-Mobile reached multimillion-dollar settlements with federal regulators to close the books on allegations of bill-cramming — illegal, unauthorized third-party charges for services like premium text message subscriptions — both Sprint and Verizon have also decided to pay the regulatory piper. Combined, the two wireless companies will pay $158 million to settle cramming claims with the FCC and the Consumer Financial Protection Bureau. [More]

CFPB Lawsuit: Sprint Made Millions Off Consumers Acting As A “Breeding Ground” For Bill-Cramming

Just a day after rumors surfaced that Sprint could be facing a $105 million from the Federal Communications Commission for allegedly overcharging customers using a practice known as “bill-cramming,” the Consumer Financial Protection Bureau has filed a lawsuit against the carrier for the bogus charges placed on customer’s phone bills. [More]

FCC Reportedly Planning To Fine Sprint $105M For Wireless Bill-Cramming

Just two months after the Federal Communications Commission imposed its largest fine on AT&T for overcharging consumers using a practice known as “bill-cramming,” the regulator is reportedly poised to saddle Sprint with the same $105 million fine for similar practices. [More]

AT&T To Pay $105 Million To Settle Wireless Bill-Cramming Charges

In a few minutes, the Federal Trade Commission, the FCC and attorneys general from 50 states and the District of Columbia will announce a $105 million deal with AT&T that settles allegations that the company has profited off the practice known as “bill-cramming,” third-party charges illegally placed on customers’ wireless bills without authorization. [More]

FTC Gives Wireless Industry Suggestions On How To Not Be Bill-Cramming Jerks

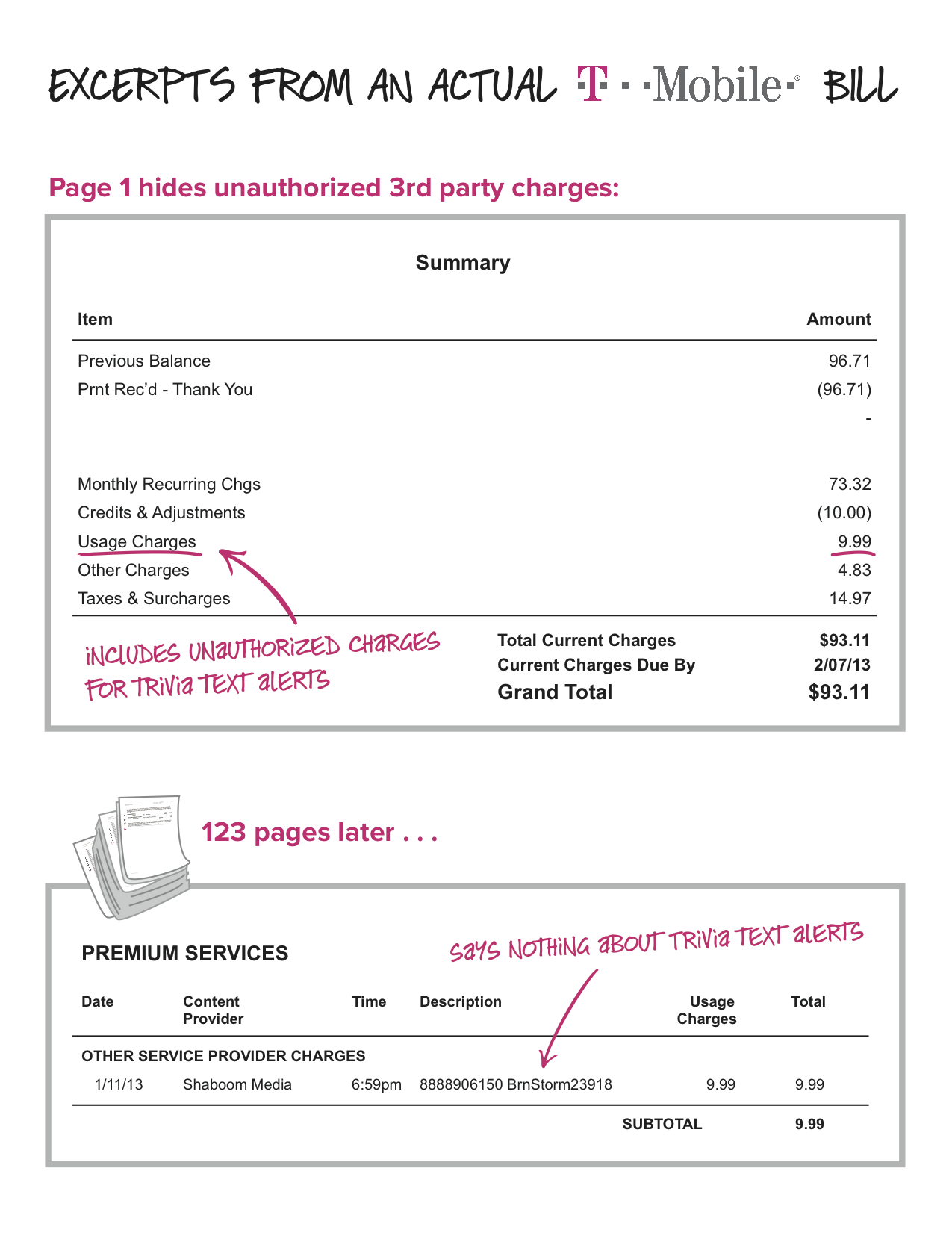

Earlier this year, the Federal Trade Commission sued T-Mobile, accusing the wireless company of making hundred of millions of dollars off of so-called “premium” text-messaging subscriptions that were often never requested by subscribers. To preempt others from getting involved in illegal “bill cramming,” the FTC is asking carriers to implement policy changes now instead of waiting until it’s too late. [More]

T-Mobile: We Shouldn’t Be Sued Over Bill-Cramming Because We’re Not Doing It Anymore & We’re Super-Sorry

Earlier this afternoon, the Federal Trade Commission filed a complaint against T-Mobile, alleging the wireless carrier made hundreds of millions of dollars off of bogus premium text-messaging charges “crammed” onto customers’ bills. The response from T-Mobile CEO John Legere isn’t exactly what you would describe as contrite. [More]

T-Mobile Accused Of Making A Ton Of Cash From Bogus Charges On Phone Bills

T-Mobile, a company that has tried to position itself as being consumer-friendly, has been accused by federal regulators of being anything but friendly. The self-described “Un-carrier” has been accused in federal court of making hundreds of millions of dollars off of so-called “premium” text-messaging subscriptions that were often never requested by subscribers. [More]

FTC Accuses Company Of Cramming Millions Of Dollars Of Bogus Charges On Wireless Bills

In the first case of its kind for the wireless industry, the Federal Trade Commission has accused a company and its owners of raking in millions of dollars by charging wireless customers for text services they never signed up for. [More]

FTC: Wireless Customers Should Be Able To Block All Third-Party Charges To Phone Bill

While the FCC has recently enacted rule changes that make it more difficult for predatory third-party businesses to cram unwanted and unauthorized charges on consumers’ landline phone bills, it is still in the process of considering what to do about bill-cramming for wireless customers. For what it’s worth, the folks at the Federal Trade Commission have chimed in with their suggestion: Wireless providers should be required to give customers the option to block all third-party charges from their bills. [More]

FTC Goes After Nation's Largest 3rd-Party Billing Company For Profiting Off Bill-Cramming

The federal crackdown on the practice of landline bill-cramming — the slathering on of charges for often unauthorized third-party services onto consumers’ phone bills — continues, with the Federal Trade Commission accusing the country’s largest third-party billing business of attempting to cram $70 million worth of bogus charges down consumers’ throats. [More]

FCC Approves Anti-Cramming Rules For Landlines, But Nothing Yet On Wireless

It’s been almost a year since the FCC finally got around to considering rule changes to keep landline phone service providers from padding customers’ bills with charges for third-party services that range from long-distance service to yoga classes. Today, the commission announced some new regulations — but they only goes so far in protecting consumers. [More]