Big data isn’t an entirely new concept: We have an entire division of the U.S. government dedicated to quantifying our nation’s population, and the Census Bureau has been doing so in its current form since 1902. The scope, quantity, and granularity of the data has changed, though, and Facebook in particular specializes now in knowing pretty much everything about everyone. But someone is clearly wrong, because the two have population estimates that just don’t match. [More]

big data

Would You Pay $10 For Unlimited Monthly Movie Theater Visits?

Almost two decades ago, Netflix offered an appealing option to fine-weary movie lovers: Unlimited DVD rentals that customers could keep for as long as they wanted. A company run by one of the founders of Netflix is trying a similar tactic to get movie fans back into theaters by letting customers have unlimited visits for a flat fee. The cost: $10 per month, and signing over your movie habits to Big Data. [More]

AT&T Says It Has Blocked One Billion Robocalls In 5 Months

At the end of last year, AT&T launched a service that would let its mobile phone customers block some nuisance robocalls from some devices. The service serves as a spam filter for eligible users’ phones and also lets them report and block numbers that place unwanted calls. AT&T announced today that its expanded call-blocking service has blocked more than 1 billion robocalls, an important milestone. [More]

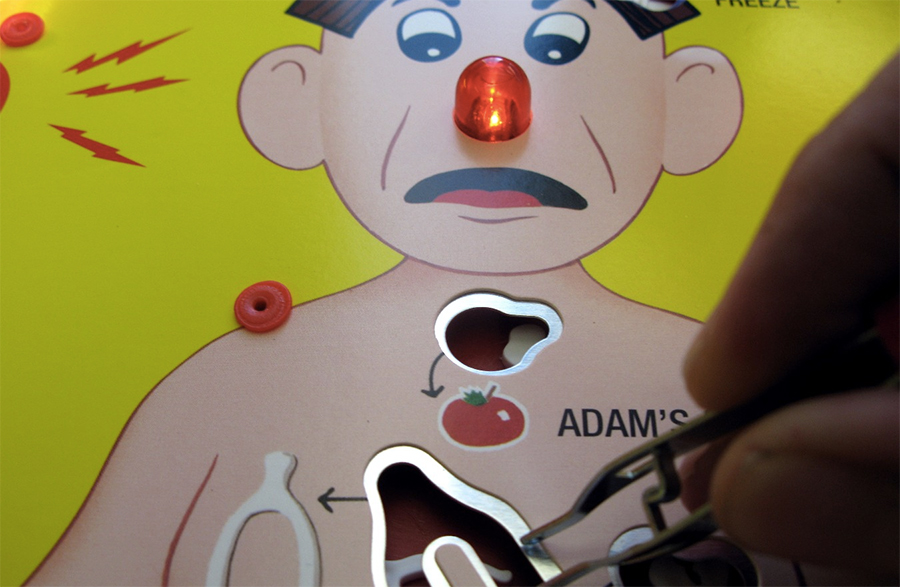

Police Charge Arson Suspect Based On Records From His Pacemaker

How would you weigh the choice to have a pacemaker implanted if you knew that information from the device could be used against you in a criminal case? A man in Ohio is having his own cardiac rhythm used against him as he faces charges of aggravated arson and insurance fraud. This week, he pleaded not guilty to those charges. [More]

Why Is It So Hard To See What’s Inside The “Black Box” Determining What Prices You Get Online?

You’re a savvy shopper, a well-educated consumer. You know to shop around to look for the best price on something before you fork over your cash. And after doing all your homework, you find out from Facebook that a friend on the other side of the country got the same item from the same website for less than you just paid. Why? How? Because an algorithm decided how much each of you should pay, and there’s nothing you can do about it. [More]

Facebook Fires Humans, Hires Robots To Tell You What’s Hot Today

If you’ve ever looked at the Trending Topics in the top right of your Facebook newsfeed, just to see chatter about some video game character right next to news about a massive natural disaster, you’ve probably thought, “who on earth is deciding what shows up here?” Well, now it’s what, not a who, and it… might still need some refining. [More]

Facebook Now Using Your WhatsApp Data For Advertising

Back in 2014, Facebook acquired messaging service WhatsApp in a headline-grabbing $16 billion deal. WhatsApp, though, had been built around respecting users’ privacy, while Facebook is, well, the exact opposite of that. [More]

Here’s How Airbnb Uses The Data It Collects In Every Part Of The Company

Websites collect information about the people who use them, and the people who end up not using them. If you’ve even visited the website of Airbnb, the company has used your data to improve its offerings or its site in some way. [More]

Medical Data Privacy Laws Don’t Actually Cover Apps, Wearables, And Other Consumer Stuff

The future’s really cool sometimes: We get to use all sorts of new technology tools and cloud-based services to help us manage our health. That constellation of apps, trackers, tests, and gadgets gives huge insight into our health and bodies, which is useful to millions… but it also lets a stunning amount of the most personal data out into the wild, unregulated and uncontrolled. [More]

JCPenney Has Lots Of Data On Shoppers, Isn’t Using It For Anything

The new CEO of JCPenney, a chain of department stores that had a brief and disastrous attempt at becoming more hip and upscale, says that the company is done “patching holes” in its business, and that it’s time to start building itself up for the future. That includes something that retailers now generally take for granted: using its customer data to sell more stuff to the customers that it has. [More]

Pitfalls Of Big Data: Test Prep Company Charges By Geography, Ends Up Charging More By Race

Many teenagers’ parents want to give their kids every possible advantage when it comes to the SATs. They pony up a few thousand dollars and buy Junior a test-prep course. It’s expensive, but at least it’s the same kind of expensive for everyone, right? Well, no, it’s not. And worst of all: there sure is an awfully high correlation between the race of the family doing the buying and the price that they get charged. [More]

![The process for Facebook loan approval. [Click To Enlarge]](../../consumermediallc.files.wordpress.com/2015/08/screen-shot-2015-08-05-at-9-32-15-am.png?w=300&h=225&crop=1)

Facebook Patent Would Allow Lenders To Determine Creditworthiness By Looking At Your ‘Friends’

Earlier this year Facebook announced it would dip its toes into the pool of mobile payments by launching a system that allowed users to send money to friends via the Messenger app. Now it appears the company may take things a bit farther after receiving approval for a patent this week that would allow creditors to determine whether or not someone is worthy of a loan based on their circle of friends on the social networking site. [More]

Your Personal Information Is Probably Going To Be For Sale When The Company You Gave It To Is

You’ve signed up for a dating site, and it has promised up and down not to sell your data for marketing purposes. One year in, so far so good. Except the site folds, and someone else buys its assets — and those assets include all your personal info. The new owners made no privacy promise, and now your likes, dislikes, and dating history are floating down you-know-what creek without you. [More]

Privacy Advocates Abandon Facial Recognition Policy Talks In Protest

Facial recognition still kind of sounds like science fiction, but is a tech reality. It is, however, still a fairly new and unregulated reality — nobody quite knows how to handle it. So the Commerce Department brought together privacy advocates and industry representatives to hammer out a new code of conduct… and it is not going well. In fact, several of the advocates claim, the process is so broken that it can’t be fixed, and they are walking out. [More]

Big Data Predicts Pollen Levels, Keeps Allergy Medicines In Stock

Here in the Northeast, people who are allergic to pollen are having a harsh spring. They should take comfort, though, that there isn’t a corresponding shortage of allergy medicines, as there apparently was five years ago. Drug companies have learned how to take global climate data and turn it into more plentiful antihistamines when people need them. [More]

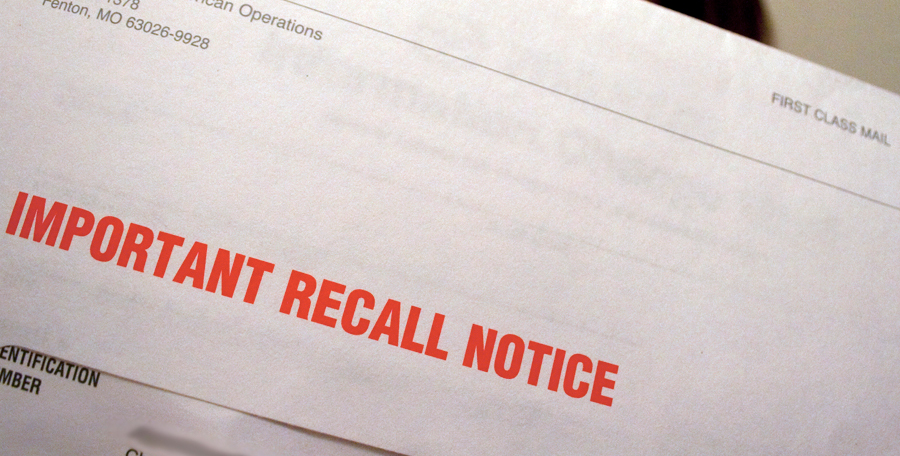

Big Data Is Here To Stay. So Can We Use It To Make Recalls Actually Work?

Sometimes products are unsafe. From bacteria-filled food to shrapnel-shooting airbags, on occasion even the most conscientious company will find itself needing to recall a product if it turns out to be harmful to consumers. But recalls are a big pain in the butt all around. One of the biggest issues? Actually letting consumers know that the stuff in their hands or on their shelves has, in fact, actually been recalled. [More]