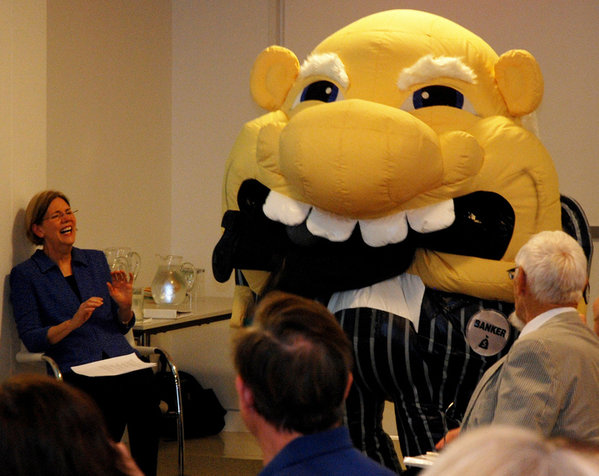

Over the years, banks across the country have modified their policies regarding overdraft fees to comply with federal regulations — including requiring consumers to opt-in to the costly protection. Despite this, account holders spend nearly $32 billion each year on the fees. And according to a new report, that likely won’t end anytime soon, as most large U.S. banks continue to charge high, sometimes exorbitant overdraft fees. [More]

banks

Bank Overdraft Policies Have Improved, But Not Enough To Protect Most Consumers

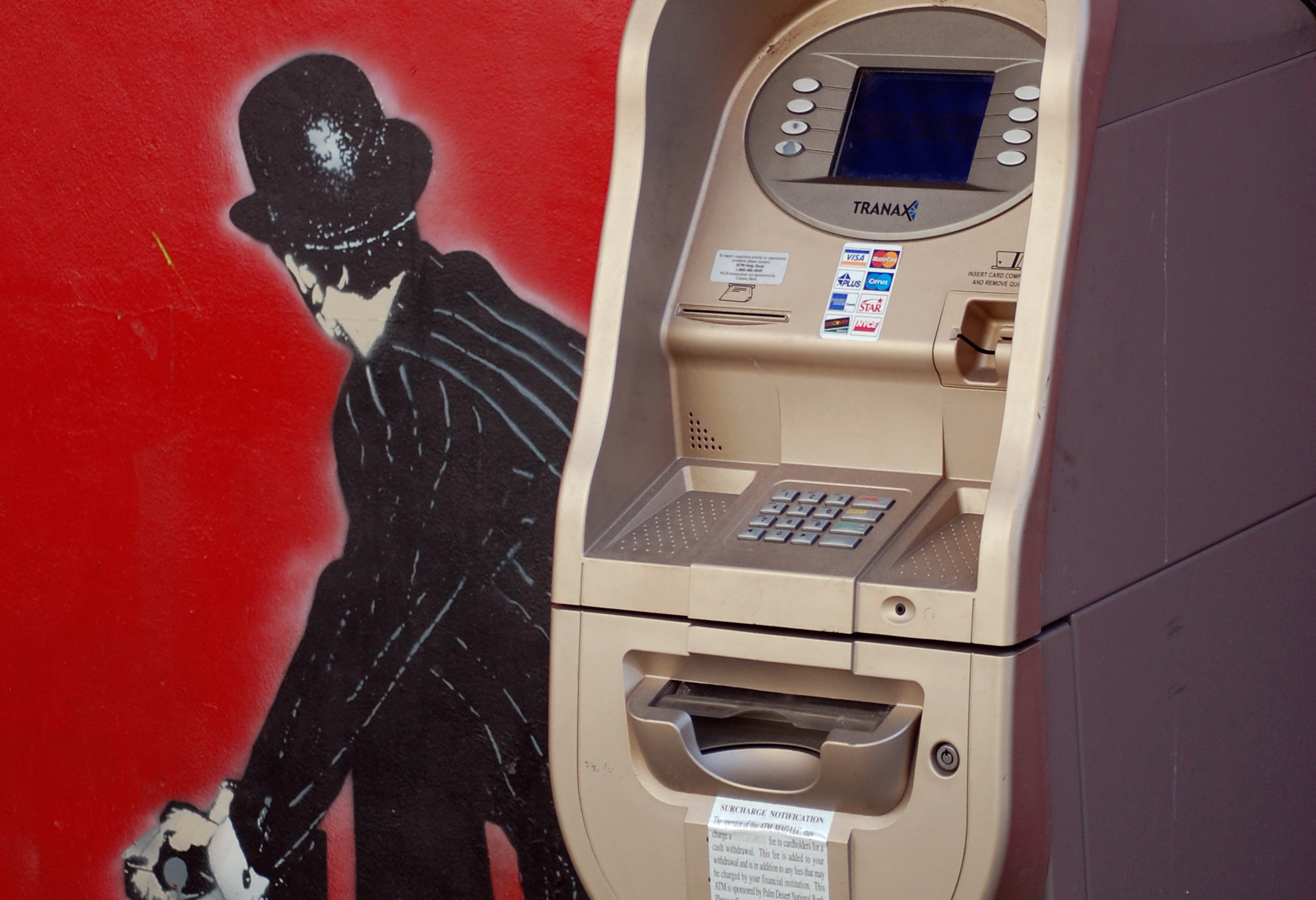

Woman Returns $380 Bank ATM Spat Out Of Deposit Slot Instead Of Pocketing It

When there’s free money involved, there’s always going to be the temptation to take it, even if you know it’s not right. But yet another good consumer has done an honorable deed, this time by returning almost $400 that unexpectedly shot out of a drive-thru bank ATM. [More]

Did Morgan Stanley Advisors Push Customers Into Unneeded Loans?

If we’ve learned anything from Wells Fargo’s recent fake account fiasco, it’s that high-pressure sales tactics can lead to unethical and sometimes illegal behavior. But did similar sales quotas and incentives lead Morgan Stanley employees to push customers into unneeded loans? That’s a question regulators in Massachusetts aim to answer. [More]

Senators Ask For Investigation Into Possible Wage, Hour Violations By Wells Fargo

To say that Wells Fargo has been having a bad few weeks might be an understatement: from being ordered to pay $185 million for the opening and closing of two million unauthorized consumer accounts to being party to federal investigations and being grilled on Capitol Hill. But it doesn’t look like things are going to get any easier for the company, as lawmakers are now urging a probe into whether it violated labor laws. [More]

Nation’s Largest Privately-Owned Bank Must Return $28M To Credit Card Customers

The nation’s largest privately held bank sold its credit card customers on add-on programs intended to help cover their accounts when they faced unexpected hardships. However, the Consumer Financial Protection Bureau says the bank deceived customers about the reality of these and other programs and has ordered it to provide nearly $28 million in relief to hundreds of thousands of affected cardholders. [More]

Credit Card Numbers Aren’t Worth Much Now, So Hackers Want Your Mobile Banking Info

If you’re worried about the security of mobile banking, you’re not alone. Mobile banking apps use a wide array of complicated passwords, biometric tools (like thumbprint or facial scanning), and two-factor authentication to make sure you’re you before “you” try to mess with your money. But preventing anyone from being able to guess how to log in to your account does no good if your phone’s got malware on it that gives would-be baddies a wide-open back door. [More]

Costco Citi Card Users Receive Cancellation Notices, Are Very Confused

Costco, Citibank, Visa, and all of the companies’ customers had plenty of notice that the warehouse club’s store-branded credit card would be switching from American Express to a Citi Visa card. The transition didn’t go very smoothly for some members, but everyone assumed that the transition-related problems would be over by now. Nope. Some customers received cancellation notices at the end of last week, and are now very confused. [More]

There’s More Money Loaded On Starbucks Cards Than Customer Deposits At Several Banks

While we’re used to the idea of people keeping money in places other than bank accounts — preloaded debit cards, sock drawers, comic book collections — there’s one way consumers are storing their cash that’s more popular than several financial institutions: Starbucks cards. [More]

$5M Credit Card Skimming Scheme Nets Man Seven Years In Jail

A high-ranking member of the largest card-skimming operation in the U.S. will spend the next seven years in prison for his part in a scheme that used ATMs at several national banks to steal $5 million from credit card accounts.

Card Reissued Because Of A Breach? Good Luck Finding Out Where The Hack Happened

When a massive data breach happens at a retailer like Target or Home Depot, there’s little mystery as to why your bank is rushing you a new credit or debit card. But when your card is being replaced because of a lower-profile cybercrime, the odds are against you ever finding out why. [More]

Wells Fargo Corporate Banking Clients Can Soon Stare Deeply Into Their App To Sign In

Until we get to a Minority Report-like future, we’re all carrying around some unique forms of identification that even the most talented identity thieves can’t steal: our bodies. In an effort to beef up security by taking advantage of customers’ unique phyiscal attributes, Wells Fargo will offer some clients the option of signing into their mobile app accounts with eye scan verification, or face and voice recognition. [More]

Banks Turned Account Overdraft Fees Into $11.16B In Revenue Last Year

Banks with more than $1 billion in assets now need to report on how much revenue they bring in from overdraft fees and other charges. The first report on those numbers shows that banks made $11.6 billion last year from customers who overdrew their accounts.

[More]

Chase To Install Cardless ATMs That Offer A Variety Of Denominations

Bank customers weary of using ATMs for fear they’ve been compromised by ne’er-do-wells using skimmers to get their hands on card numbers have a new option. That is, if they bank with JPMorgan Chase, as the company is rolling out new cash machines that are not only cardless, but will let you take out money in a wider variety of denominations. [More]

The 3 Biggest Banks Extracted $6 Billion In ATM And Overdraft Fees From Us Last Year

Back in 1998, comedian Al Franken published a satirical novel where the fictional Al Franken ran a single-issue presidential campaign against ATM fees in 2000. A technical malfunction erased ATM deposits, making his single issue a crucial one, and Franken ended up in the White House. Today, he is a sitting U.S. senator, yet not involved in the 2016 presidential race where excessively high ATM fees are an actual issue being discussed. [More]

Banks Urge Congress To Continue Renewing Their “Get Out Of Jail Free” Cards

Nestled deep in the text of the lengthy contracts for most credit cards and bank accounts are little clauses that not only prohibit harmed customers from suing their bank or card issuer, but also prevents them from banding together with similarly injured consumers to argue their dispute as a group. In October, the Consumer Financial Protection Bureau announced it would consider limits on these clauses, but now the banking industry is trying to use its leverage with D.C. lawmakers to shut down that process. [More]