As Halloween draws closer, here’s a reminder of what you should really be scared of: ATM skimmers, or devices that attach to cash machines to slurp up customers’ card numbers and PINs. You should also be afraid of adults in creepy baby doll masks. According to police in Minnesota, a recent crime there incorporates both of these terrifying prospects, with a mask-wearing suspect accused of placing skimmers on ATMs in two counties and stealing tens of thousands of dollars. [More]

banks

ATM Fees Hit New Highs Because Fewer People Are Using ATMs

Between the rise of e-commerce, credit/debit card use, and mobile payment platforms, the days of “running to the ATM” for enough cash to get through the day are gone for many people. That’s one of the reasons why, according to a new survey of banks, out-of-network ATM fees and overdraft charges are hitting new highs. [More]

It’s Not Just You: Writing A Check Can Be Tricky

Between credit cards, online payment services, and good ol’ cash, many consumers have sequestered their checkbooks into cupboards and drawers that seldom see the light of day. Still, not everyone has left their checkbooks to waste away; many consumers use the notebooks from time to time, whether it be paying a bill, rent, or other expenses where plastic or cash aren’t options. [More]

Only One Bank Was Indicted For Mortgage Fraud Tied To The 2008 Collapse — And It Was Innocent

If you’ve walked Canal St. in lower Manhattan’s Chinatown, you’ve probably passed by the modest headquarters of Abacus Federal Savings, a family run community bank that has served New York City’s Chinese immigrant population for more than three decades. It’s more than a mile away — and a world apart — from the more famous banks on Wall Street whose reckless behaviors during the housing bubble led to trillions of dollars in economic loss, the failure of financial institutions nationwide, an unprecedented federal bailout of the banking and auto industries, and continued fraud by big banks in a rush to foreclose on large numbers of homes as quickly as possible. [More]

Lost Your Chase Debit Card? You Can’t Get It Replaced At A Branch Anymore

Whether it was due to theft, fraud, forgetfulness, or calamity, many of us have needed to replace our debit cards post-haste. For many JPMorgan Chase customers, that usually just meant popping by the neighborhood branch and getting a replacement in minutes. So why has the bank reportedly ditched this convenient and popular program? [More]

Sen. Cory Booker Concerned Over Hefty Overdraft Fees, Seeks Info From Top Banks

Each year, banking customers spend an estimated $32 billion on overdraft fees. While many banks have modified their policies regarding the costly fees, recent reports found those changes aren’t enough to protect most consumers. Now, in an effort to add to those protections, one lawmaker is pressing banks for more information on their policies. [More]

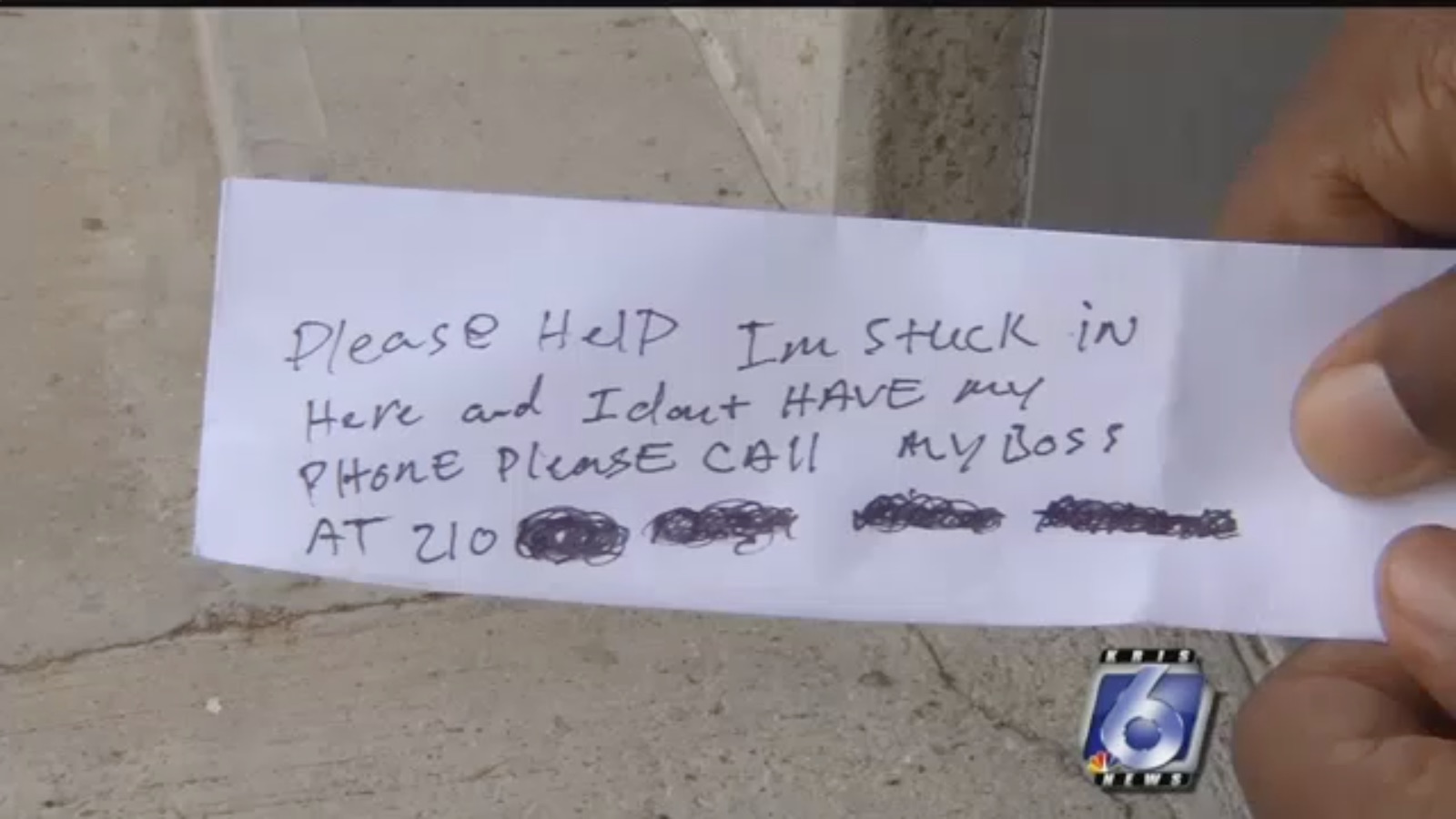

Man Trapped Behind Bank ATM Passes Notes To Customers Pleading For Help

What would you do if you were withdrawing cash from the ATM outside your bank, and received a note pleading for help along with the receipt? That scenario played out in Texas this week as a man sent to change a lock behind a Bank of America ATM instead locked himself inside without his phone, and had to plead for help from what we’re guessing were some very confused bank customers. [More]

AGs Blast Financial CHOICE Act, Urge Congress To Reject Proposed Bill

With legislation to roll back consumer protections and gut the Dodd-Frank Wall Street Reform and Consumer Protection Act expected to be discussed by the House as early as this week, several states are urging lawmakers to reject the legislation. [More]

Feds Shut Down Guaranty Bank, Closing Branches In Walmart, Kroger Stores

Last week, the Office of the Comptroller of the Currency shut down Guaranty Bank, which also did business as BestBank. While the shutdown and transfer process is supposed to be relatively simple for bank customers, they’re facing long lines at the remaining banks. [More]

Most Americans Favor Payday Loan Reforms

Despite claims from the payday loan industry that Americans don’t want reforms intended to prevent borrowers of these short-term loans from falling into a revolving debt trap, two new reports show that most people do think it’s time to rein in payday lending and provide more affordable loan options for borrowers in need. [More]

Wells Fargo Customers Won’t Need A Card To Get Cash At ATMs Anymore

Can’t be bothered to carry a debit card, but need some cash on the go? Not a problem for Wells Fargo customers with smartphones, as the bank is rolling out its cardless technology at all of its roughly 13,000 cash machines. [More]

Citizens Bank Glitch Makes Direct Deposits Disappear, Leaves Bills Unpaid

Citizen Bank customers expecting to see their paychecks added to the balance of their accounts Friday morning were disappointed to find that wasn’t the case: A glitch in the bank’s system prevented paychecks and other direct deposits from being processed. [More]

Lawmakers Urge In-Depth Review Of Santander Bank’s Practices After Discrimination Allegations

Santander Bank has faced a number of issues in recent years, from an investigation into its auto loan business to receiving a $10 million fine over alleged illegal overdraft practices. More recently, the company received a failing grade from regulators when it came to its community lending business, prompting lawmakers to condemn the bank’s alleged discrimination and urge federal banking regulators to review the financial institution’s practices. [More]

Wells Fargo To Stop Giving Branches A Heads-Up Before Inspections

Wells Fargo has rightly concluded that it should overhaul a lot of its sales practices after the fake account fiasco that cost the company $185 million in refunds and penalties and could cost it $4 billion in lost business. One change that the bank announced today is that it will no longer give branches a heads-up a day before corporate inspectors are scheduled to arrive. [More]

Trail Of Cash Leads Police To Bank Robbery Suspect

Forget a trail of bread crumbs, police said all they had to do to nab a bank robbery suspect was follow the literal trail of money he left behind. We would like to welcome you, sir, to the You Have Only Yourself To Blame Hall of Fame. [More]

Don’t Use Your ATM Card During A Bank Robbery Unless You Want To Get Caught

There are crimes that stymy, mystify, and otherwise confound veteran detectives for decades. And then there the crimes that are almost too easy to solve, thanks to the overly helpful, not quite so bright criminals that commit them. Like the would-be bank robber in San Diego who demanded money from a bank teller, but not until after he’d swiped his ATM card, providing the bank with everything needed to identify him. [More]

Retailers Ask Congress To Please Not Roll Back Dodd-Frank Debit Card Reforms

Both the banking industry and conservative lawmakers are hoping that the incoming Trump administration will agree to repeal the 2010 Dodd-Frank Financial Reforms, but many in the retail world are calling on Congress to retain at least the portion of the law involving debit card transactions. [More]