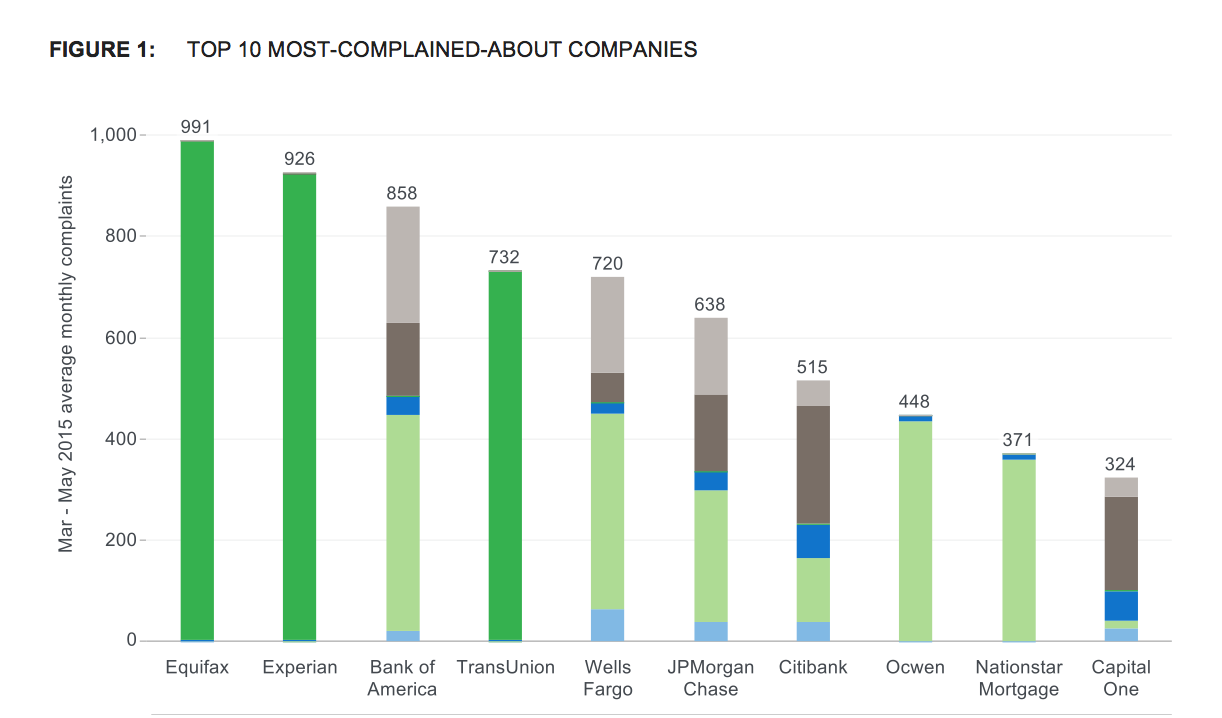

The Consumer Financial Protection Bureau has released its latest report on the various complaints the agency has received about banks, lenders, debt collectors, and other financial services. Amid a sudden increase in the number of complaints involving credit report errors, the country’s largest credit bureaus now dominate the top of the CFPB’s list of most complained-about companies. [More]

bank of america

Credit Bureaus, Bank Of America, Wells Fargo Top List Of Most Complained-About Financial Companies

From Apple To Walmart, Over A Dozen Of The Biggest Businesses In The U.S. Sign On To White House Climate Pledge

A huge number of the world’s nations are coming together in Paris this December to negotiate an agreement to stem emissions and forestall further climate change. Ahead of this winter’s United Nations talks, however, some well-known names here at home are pledging their own contributions to the cause. [More]

Consumers’ Changing Banking Habits Led To 1,400 Bank Of America Branches Shuttering, More Cuts To Come

Over the past several years, Bank of America has revamped the way it provides banking services in an effort to cut costs and respond to consumers’ changing banking habits. Those operation modifications have not only included shutting down some drive-thru windows, but the closure of nearly a fifth of the company’s branches. [More]

Four Years After Reaching Deal With Regulators, Six Banks Still Haven’t Fixed Foreclosure Problems

Back in 2011, several of the nation’s largest banks entered into a settlement with federal regulators that required the institutions to correct widespread foreclosure abuses that helped to trigger the housing crisis. While the agreement was revised in 2013 to make things a bit easier for the offending banks, regulators today announced that six of the lenders – including JPMorgan Chase and Wells Fargo – still haven’t met requirements and face new restrictions on their mortgage operations. [More]

Consumers Can’t Void Second Mortgage In Bankruptcy, SCOTUS Rules

Consumers taking out a second mortgage will now have to consider the fact that if they encounter financial difficulties and file for bankruptcy, they won’t be able to strip off the additional loan obligation. [More]

JPMorgan Chase, Bank Of America Agree To Wipe Debt Cleared By Bankruptcy From Credit Reports

Two of the country’s largest banks are finally getting around to removing the debt consumers eliminated during bankruptcy proceedings from their credit reports, a move that puts Bank of America and JPMorgan Chase in line with federal law. [More]

NFL Linebacker Files $20M Lawsuit Against Bank Of America For Alleged Fraud

When looking to manage one’s money, it wouldn’t be unusual to seek advice from the financial professionals at one of the country’s largest banks. But an NFL linebacker says his decision to rely on Bank of America to manage his finances cost him millions of dollars and led to the closing of his budding restaurant business. [More]

Morgan Stanley To Pay $2.6B To Settle Charges Of Selling Troubled Mortgages Leading Up To The Financial Crisis

The Department of Justice has struck a multi-billion dollar deal with Morgan Stanley in what is expected to be one of the last major steps in resolving investigations related to banks’ roles in the subprime mortgage crisis. [More]

Bank Of America Closing Some Drive-Up Windows In Response To Changing Consumer Banking Habits

If your next trip to the bank involved going to the drive-thru, you might find no one there to greet you. That could certainly be the case if you put your financial needs in the hands of Bank of America, which has plans to close some of its drive-thru windows this year. [More]

N.C. Homeowners Wonder How Banks Could Disappear Charlotte’s NASCAR Debt While Taking Their Houses

The magical disappearance of debt sounds like a wonderful thing, doesn’t it? Unless of course, someone else is getting their debt canceled while you’re still stuck in the mud. When homeowners in foreclosure in Charlotte, N.C. heard that the city wouldn’t have to pay back millions of debt it owed Bank of America and Wells Fargo for a underperforming NASCAR Hall of Fame, they couldn’t help but ask why they’re still facing the loss of their homes. [More]

Former Countrywide Exec Who Helped Secure Bank Of America’s Billion-Dollar Settlement Gets $57M

Back in August, the Department of Justice announced a record-setting $16.65 billion settlement with Bank of America to resolve multiple federal and state claims involving the bank’s bad behavior leading up to the collapse of the housing market. Now, the former executive who became a whistle-blower to assist federal prosecutors in the matter is set to receive $57 million of the hefty settlement. [More]

Bank Of America’s Laughable Defense For 5 Years Of Unwanted Robocalls

Earlier today, we told you about a $1 million judgement against Bank of America for making five years of unwanted robocalls to a couple who sent the bank multiple cease and desist demands. Since then, BofA has reached out to Consumerist with an explanation that is too funny to just post as an update within that story. [More]

Bank Of America Must Pay Family $1 Million For 5 Years Of Unwanted Robocalls

If you’ve got a problem paying your mortgage, the bank is allowed to call you about collecting that debt. But after you’ve repeatedly told the bank — verbally and in writing — to stop robocalling your cellphone, it should do so. And if a recent ruling by a federal court in Florida holds up, Bank of America will have to fork over more than $1 million to a couple who say the bank spent five years ignoring their demands for the calls to cease. [More]

Bank Of America Says Online Banking Has Been Restored After Outage

After Bank of America customers complained this afternoon of not being able to access their accounts online for a few hours, the bank said the issue has been fixed. [More]

Bank Of America Apologizes After Some Customers Using Apple Pay Report Double Charges

If you’re a Bank of America customer who’s used Apple Pay, you might want to check your statement right about now and make sure you don’t have duplicate charges. Some BofA customers are reporting trouble with double charges, prompting the bank to apologize to those affected. [More]