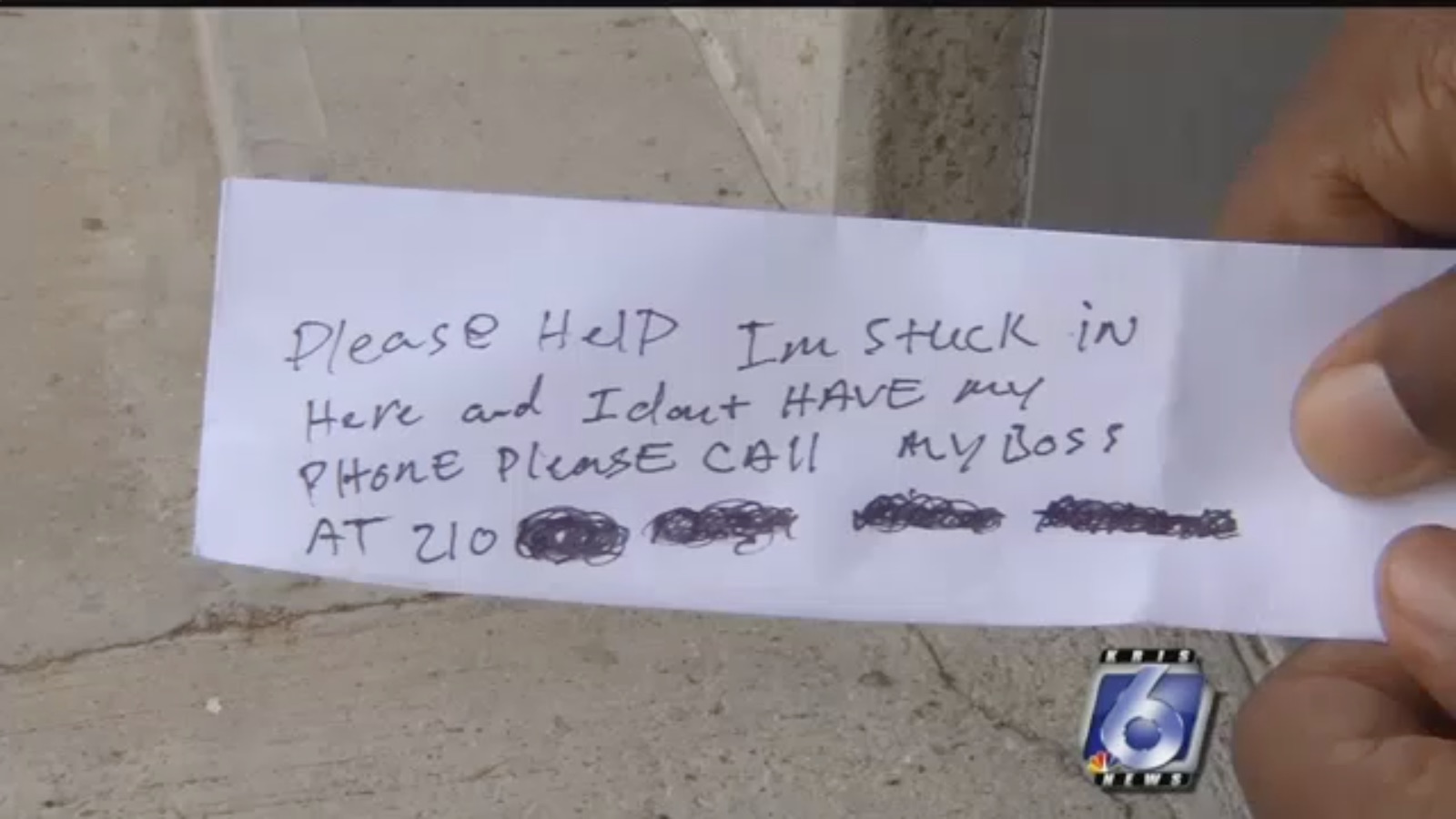

What would you do if you were withdrawing cash from the ATM outside your bank, and received a note pleading for help along with the receipt? That scenario played out in Texas this week as a man sent to change a lock behind a Bank of America ATM instead locked himself inside without his phone, and had to plead for help from what we’re guessing were some very confused bank customers. [More]

bank of america

Bank Of America, Delta Pull Funding From “Julius Caesar” Production Seen As Critique Of Trump

It’s been more than 2,000 years since Julius Caesar was assassinated by a group of Roman senators, and more than 400 years since William Shakespeare immortalized the dirty deed. The Bard’s Julius Caesar has been staged, adapted, and reinterpreted countless times since, and Caesar never manages to escape the blade. However, two major backers of New York’s Shakespeare in the Park have pulled their support for this year’s production of the play after complaints that this Caesar looks a little too similar to our current President. [More]

Former Bank Of America VP Accused Of Making $2.7M In Bogus Donations

A former Bank of America executive, along with her husband and another person, have been accused of bank fraud for their alleged involvement in an embezzlement scheme that involved making millions of dollars of fake donations in the bank’s name. [More]

Supreme Court Says Cities Can Sue Banks Over Fair Housing Violations

The U.S. Supreme Court ruled this morning that cities are allowed to sue banks for alleged violations of the Fair Housing Act if the city is able to show that it was harmed by a bank’s discriminatory actions. [More]

Make Sure You Destroy That Check After A Mobile Deposit

With the convenience of mobile banking services, it’s pretty easy to deposit check by just taking a couple of photos with your phone. But it’s important to remember that you still have to be careful about what happens to that paper check; just ask the Arizona woman who is out $1,500 after using the Bank of America mobile app to deposit a check [More]

Feds Give Up Trying To Hold Bank Of America Accountable For Countrywide’s “Hustle” Mortgage Scam

A nasty four-year legal battle between the Justice Department and Bank of America over a massive mortgage-related scam run by Countrywide Financial has come to a whimpering conclusion, with the DOJ opting to not appeal its most recent defeat in the case. [More]

Bank Of America Experiences Teller System Outage

For a few hours this afternoon Bank of America customers may have had a bit of difficulty obtaining funds from their accounts if they prefer to speak to an actual human and not an ATM. That’s because for a short time, the system used by tellers was down. [More]

Airbnb Hosts Having Difficulty Refinancing Homes

Until recently, home loans generally covered two types of properties: primary residences or investments. That was before services like Airbnb allowed anyone with an extra room to make a bit of extra money by renting it out for short periods of time. This blurred line between “my house” and “my investment” is causing trouble for some homeowners when they go to refinance their mortgages. [More]

Why Are There Still So Many Bank Branches Everywhere? Because You Keep Going.

If you live in a certain kind of urban area, you see it all the time: those new mixed-use buildings go up, and on the ground floor of practically every single one there’s a bank branch or two. And if you thought to yourself, “Why are there so freaking many bank branches opening in an era when all the young folk living in those buildings bank by phone?” you’re not alone. But it turns out there’s an easy reason that bank branches keep proliferating: customers are using ’em. [More]

Bank Of America Won’t Have To Pay $1.2 Billion For Countrywide’s “Hustle” Mortgage Scam

Nearly eight years after Bank of America bailed out Countrywide Financial, a federal appeals court has ruled that BofA should not have been held liable for Countrywide’s “Hustle” scam in which the company sold Fannie Mae and Freddie Mac a ton of poorly underwritten mortgages knowing that they were worthless. [More]

Bank Of America To Allow Android Pay Cash Withdrawals At Some ATMs

Back in January, Bank of America jumped on the card-free bandwagon by developing new ATMs that allow customers to withdraw cash or complete other tasks using their cellphones instead of their bank cards. This week, the company took that initiative a step farther, announcing it would let customers perform those tasks through Android Pay. [More]

North Carolina Governor Tweaks Anti-LGBT Law; Critics Say It Doesn’t Change Much

Only hours after Deutsche Bank canceled its plans to expand its presence in North Carolina — and following a similar decision last week by PayPal — the state’s governor has signed an executive order that softens some aspects of a controversial bill that restricts cities’ ability to protect the rights of people based on sexual preference or gender identification. [More]

Facebook, Reddit, Wells Fargo, Bank Of America CEOs Among Those Urging North Carolina To Repeal New Anti-LGBT Law

Earlier this month, in a hurried legislative process, North Carolina lawmakers passed HB2, a bill that overrides and prevents local governments from establishing anti-discrimination rules against gay and transgender people. This morning, advocacy groups delivered a letter to NC Gov. Pat McCrory signed by top executives from more than 100 companies, all calling for the state to repeal the law. [More]

Student Loan Companies Tell Congress: Debt-Collection Robocalls Are In Borrowers’ Best Interest

Show me someone who supports robocalls, and I’ll show you someone that has very few friends. Which is why it’s baffling that the Senate has yet to act on a bill introduced last fall that would close a loophole allowing the government to make debt-collection robocalls. But you know who does support robocalls? The student loan companies that are currently trying to convince Congress that these invasive annoyances are really for our benefit. [More]