Tax forms mailed out by your bank contain all sorts of information you probably don’t want to land in the hands of a random stranger: Name, address, partial Social Security number, account number, and more. Yet, one large bank screwed up and sent this sensitive information to the wrong customers. [More]

bank error not in your favor

Former Wells Fargo Employees: Borrowers Forced To Pay For Bank’s Mortgage Delays

Even though you can now get an initial approval for a home loan in a few minutes, the actual underwriting process can take so long that the interest rate you were promised at the beginning has since increased. If the delay is the borrower’s fault, they can usually pay a hefty fee to extend that lower rate, but if the bank caused the delay, it usually eats that charge. However, some former Wells Fargo workers say the bank forced borrowers to pay for these rate extensions even when it was Wells’ fault. [More]

My Bank Overdrafted My Account By Putting Two Holds On One Deposit; Doesn’t Care

Imagine that you do everything you can to avoid overdrafting your bank account, only to find that your bank has gone ahead and pushed you into the red — and that it doesn’t really care. [More]

Costco Citi Card Users Receive Cancellation Notices, Are Very Confused

Costco, Citibank, Visa, and all of the companies’ customers had plenty of notice that the warehouse club’s store-branded credit card would be switching from American Express to a Citi Visa card. The transition didn’t go very smoothly for some members, but everyone assumed that the transition-related problems would be over by now. Nope. Some customers received cancellation notices at the end of last week, and are now very confused. [More]

Banks Urge Congress To Continue Renewing Their “Get Out Of Jail Free” Cards

Nestled deep in the text of the lengthy contracts for most credit cards and bank accounts are little clauses that not only prohibit harmed customers from suing their bank or card issuer, but also prevents them from banding together with similarly injured consumers to argue their dispute as a group. In October, the Consumer Financial Protection Bureau announced it would consider limits on these clauses, but now the banking industry is trying to use its leverage with D.C. lawmakers to shut down that process. [More]

“Incorrect Keystroke” Allows Comcast To Withdraw $500 From Non-Customer’s Bank Account

We’ve told you before about Comcast not really paying attention to the payments it receives — like the woman who accidentally sent them her rent check and found that it had been deposited in the cable company’s account — but here’s a story of a man who isn’t even a Comcast customer but found that $500 had been taken out of his bank account anyway. [More]

Bank Of America Dispenses Phantom Cash, Uberbank Bureaucracy Doesn't Seem Too Worried

Sometimes, our mailbag reads like some kind of reality-based personal finance version of the Penthouse Forum. “I never understood why people are so angry with big banks,” our readers type, “until one of those horror stories happen to me.” That’s sort of what happened to Kestris. She and her husband are longtime Bank of America customers who never really had any problems with the bank. Until they did. It was a big one: when they withdrew their rent from an ATM, the machine made bill-counting whirring noises, but dispensed no cash. [More]

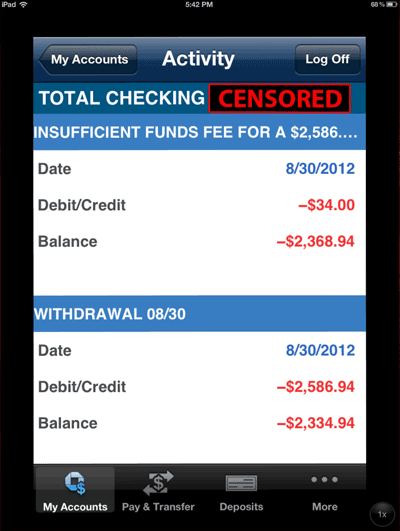

A Chase Bank Teller Makes A Mistake, I Spend The Long Weekend $2,300 Overdrawn

Jason began his holiday weekend with an unpleasant surprise. When he checked his bank account on his iPad, he saw that it was overdrawn. It was overdrawn by a lot. More than two thousand dollars. Jason hadn’t made any huge withdrawals from his account, and neither had any other authorized person. Was he the victim of identity theft? Fraud? ATM skimmers? How could someone take out money that wasn’t there? It turns out that it was quite easy: it just required a one-digit error in the account number. [More]

Bank Of America Tells Family It Won't Foreclose, Tries To Foreclose Anyway

For two years, a family in Washington state has been waiting for Bank of America to get its act together and finally figure out whether it’s evicting them or whether it’s going to adjust their mortgage. [More]

Is 3 Weeks Too Long To Wait For My Bank To Refund $1,200 It Took By Mistake?

Consumerist reader Josh is currently staring at a depleted checking account — and it could be several weeks before it’s back to looking healthy again — all because his mortgage lender screwed up some paperwork. [More]

Wells Fargo Admits To Sending Thousands Of Statements To Wrong Addresses

Need another reason to make the move to paperless bank statements? How about the fact that one of the nation’s biggest banks managed to send thousands of its customers’ statements to the wrong people? [More]

Chase Freezes Couple's Account, Screws Up Their Life, With No Explanation

A Washington state couple with tens of thousands of dollars in their Chase checking, savings and retirement accounts recently came home to find a letter from the bank telling them that, oh, by the way, your accounts are now frozen. [More]

Man Pays Bank Of America Mortgage On Time, Still Ends Up In Foreclosure & Has Credit Ruined

Ever since the housing bubble burst, we’ve run a number of stories about homeowners who had been told the only way they could qualify for a loan modification was to stop paying their mortgage for a few months, only to end up in foreclosure because the lender had no record of a modification application. This is not one of those stories, though the ending is the same. [More]

Bank Of America Freezes Customer's Accounts After Nearly $3 Million In Mysterious Overdrafts

An unemployed single mom in Orlando either managed to overdraft nearly $3 million from her accounts at Bank of America or the bank’s computers went haywire and mistakenly debited each of her three accounts to the tune of around $900,000. Regardless, the woman says BofA is attempting to close those accounts, leaving her and her family in dire financial straits. [More]

Wells Fargo Repossesses Fully Paid-Off Car

Looks like banks are really bad at more than just home foreclosures. A woman in Tacoma, WA, was left car-less after Wells Fargo had her vehicle repossessed, even though she owned her car outright. [More]

Citicard Thinks You Need To Pay Off $3,422 Credit Card Balance Twice

Jon tells Consumerist had things arranged very nicely with his credit card from Citi. He would use his credit card for purchases, then pay the balance off at the end of every month. He set up his account to auto-debit the credit card balance from his checking account every month. One month, he paid his balance of more than $3,000 early. The autopay from his checking account went through anyway. Jon would like his money back. [More]