Our post last Friday gave people some great business ideas. We appreciate the offers, but we must insist that you do not try to purchase Consumerist with doodle currency that you have minted yourself, probably while drinking. You can, however, try to bail out the auto industry with it if you want.

bailout

../../../..//2008/11/13/it-looks-like-the-auto/

It looks like the auto industry bailout doesn’t have the votes. [NYT]

The Tom Hanks Movie "The Money Pit" Is Actually A Documentary About Our Economy

Over at Slate they’ve realized that the Tom Hanks movie from the 80s “The Money Pit” is actually just a documentary about our current financial crisis and the bailout of AIG. Specifically, the scene in which the kitchen catches fire and the bathtub falls through the floor. (Video, inside…)

American Express Becomes A Bank… And Wants Bailout Money

American Express won U.S. Federal Reserve approval to become a bank holding company — giving it access to the bailout party as credit card defaults climb. Bloomberg News says that the Fed waived the usual 30 day waiting period because (in the words of Fed Chairman Ben Bernanke) we’re experiencing “unusual and exigent circumstances affecting the financial markets.” Today, American Express has requested $3.5 billion in taxpayer-funded capital from the federal government, says the WSJ.

GM Almost Out Of Cash, Looks To Washington For Bailout

GM is running out of money and may not have enough cash to continue running its business. They’ve burned through $6.8 billion in the last quarter and will exhaust their reserves by the end of 2008 without government intervention or a significant increase in auto sales. Which sounds more likely to you?

Credit Cards Scammers Pretend To Be From BBB

Robo-scammers are ringing up consumers and pretending to the Better Business Bureau, saying, “We’re from BBB – Because of bailout, we can offer you a low-rate credit card.” In this iteration, we see several three common scam characteristics combined: *Unexpected communication * Automated communication * Mention of topical event * Use of recognizable institution’s name * Money-saving opportunity. Investigators were unable to tell the exact nature of the scam. It could be been to steal your account numbers, or it might have just been a marketing affiliate’s sleazy way of generating leads for a credit card company trying to get people to transfer their balances. Complaints have been received about the scam at a BBBs serving Washington, West Oregon and Northern Idaho, as well as Midland,Texas.

AIG Says It Will Try Harder To Cut Costs, Begins By Canceling $10 Million Severance Package

AIG has been repeatedly called on the carpet over the past week or so for indefensible “business as usual” expenditures—a lavish corporate retreat, an executive hunting trip, and severance packages costing tens of millions of dollars. Now, after a meeting with NY Attorney General Andrew Cuomo, they’ve announced they’ll start trying harder to monitor and stomp out unnecessary expenses.

AIG Executives Help Themselves To $86,000 Hunting Trip

The AP is reporting that AIG executives aren’t done partying yet — they took an $86,000 hunting trip even as the company was requesting an additional $37.8 billion loan from the Federal Reserve. Meanwhile, New York attorney general Andrew Cuomo has said that as long as the company continues to be propped up by the taxpayer — he has the power under state business law to review and possibly rescind any inappropriate AIG spending.

The Bailout Bill Helps Renters Keep Their Homes

Great news for renters facing eviction due to foreclosure: any mortgage owner seeking assistance under Congress’ mammoth bailout bill is required to let paying renters stay in their homes.

Wells Fargo Wins, Will Buy Wachovia

Wells Fargo is the winner in the battle for Wachovia, says the New York Times. Apparently, Citibank became nervous about splitting the bank when they saw the size of the “bad assets” it would have to take on, and quietly walked away. The bank will continue to seek $60 billion in damages, however.

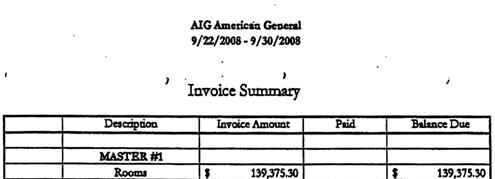

Confronted With Hotel Bills, AIG Says, "This Is Totally Normal!" And "We're Having Another One!"

AIG says that the “retreat” that ABC News reported on the other day was really just an event for AIG’s top independent agents — and that only 10 employees were present out of 100 attendees. Here’s how they explain in a press release:

After The Bailout AIG Bought Themselves A $440,000 "Retreat" At A California Resort

Now that AIG has been nationalized, some folks are wondering just how their tax dollars are being spent. If you’re among them, we have some bad news for you from ABC. They are reporting that papers uncovered by congressional investigators show that “less than a week after the federal government committed $85 billion to bail out AIG, executives of the giant AIG insurance company headed for a week-long retreat at a luxury resort and spa, the St. Regis Resort in Monarch Beach, California.” Ouch.

"Funny" Economic-Meltdown-Themed Marketing Fails To Impress Consumers

The Wall Street Journal says that big discounts and hilarious bailout-themed marketing has failed impress consumers, and retailers are expecting sales to worsen before they get better. Restoration Hardware launched a “bailout” themed promotion offering $100 off purchases of $400 or more at the home furnishings chain, while Steve Madden posted signs depicting “a declining stock chart and implored shoppers to “Sell Stocks, Buy Shoes.”

What Does The Bailout Mean For You?

So, Congress finally passed the bailout bill. You know about the Treasury’s newfound $700 billion, and you’ve heard about the snipped golden parachutes, but what does the 451-page week-old shotgun savior of a bill actually mean for you?

../../../..//2008/10/03/those-of-you-interested-in/

Those of you interested in watching the bailout bill debate in the House can see it streaming on CSPAN, or read a liveblog on the NYT.