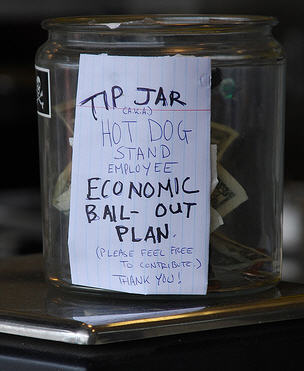

Last week I was watching Lou Dobbs while scrubbing my dentures and complaining about joint pain (two of those things are true, sadly), and I saw a segment on Ohio congresswoman Marcy Kaptur, who is encouraging homeowners to stay put in their foreclosed houses. She argues that many of the loans made during the subprime fiasco may not be legit, and that you should seek legal counseling and demand a mortgage audit from the bank before leaving. Kaptur admits her advice doesn’t trump the sheriff knocking at your door with an eviction notice, but a real estate lawyer told the Toledo Blade that otherwise she has a point.

bailout

White House To Citi: Don't Even Think About Buying Luxury Jets With Taxpayer Money

Yesterday, we wrote that Citigroup had decided to spend $50 million of its bailout money on a French luxury jet to ferry execs around town. The White House was not pleased about this.

Bailed Out Citigroup Stimulates French Economy By Purchasing $50 Million Corporate Jet

With $45 billion in taxpayer funds burning a hole in its pocket, Citigroup is purchasing a $50 million Dassault Falcon 7X, according to the New York Post. Apparently none of the existing jets that ferried execs to Washington to ask for bailout funds was ironic enough.

Citibank Will Split Into Two Companies, Promises To Lend To Consumers

Vikram Pandit, CEO of Citigroup, announced today that the company would be split after reporting a net loss for 2008 of $18.72 billion. He also promised to put the money from the $700 bailout to work by extending credit to consumers and businesses… responsibly.

Federal Reserve: Don't Get Excited, We're Not Done Bailing Out Banks Yet

Federal Reserve chairman Ben Bernanke said that the $800 billion stimulus plan being discussed by the new administration might “provide a significant boost to economic activity,” but that it wouldn’t work without more bank bailouts.

Bailed Out Bank Executives Got $1.6 Billion

A study by the Associated Press says that executives at bailed out banks got $1.6 billion in salaries, bonuses, and other benefits — including cars, personal use of company jets, and country club memberships.

Bush Approves Auto Industry Bailout

President Bush has approved a $17.4 billion auto bailout, with $13.4 billion in emergency loans to prevent the collapse of GM and Chrysler and another $4 billion to be handed out in February.

Chrysler Shuts Down All Production

Friday will be the last day of production as Chrysler shuts down for 30 days — citing lack of available consumer credit.

AIG Ad Is Optimistic, Ready To March Down The Field For A Comeback Win

The fall of AIG is old news, but we had to laugh at this ad from the October issue of Money magazine sent in by reader Tom.

Investors Willing To Pay The Treasury To Borrow Their Money

Here’s a sad bit of news, investors are so shaken that they’re willing to put their money into Treasury bills — even if it means losing money.

On Heels of Bailout, Citi Raises Rates on Millions of Cardholders

We know the credit markets remain seized: late on Black Friday when no one was listening, the Federal Reserve issued a statement that its emergency lending to banks had increased over the prior week. Thus, massive amounts of money continue to flow to large financial institutions in an effort to stimulate economic activity, but by all appearances the money is not flowing into the broader economy. Quite the contrary; as the Fed lowers rates and adds record amounts of loaned cash to bank balance sheets, big banks are actually increasing consumers’ cost of borrowing and reducing their lines of credit. Witness Citibank’s recent adverse actions against cardholders.

Consumers Don't Think Saving The Auto Industry Would Help The Economy

A majority, 61% of Americans are not in favor of bailing out the auto industry, says CNN/Opinion Research Corp. poll. Ford, Chrysler and GM have requested up to $34 billion dollars in emergency loans, but a majority of Americans polled thought that bailing out the automakers wouldn’t help the economy.

GM Begs For $12 Billion, May Sacrifice Saturn, Pontiac, Saab

GM desperately wants an invite to the bailout party — and has submitted a request for $12 billion dollars. In return, GM will attempt to return to profitability by “explor[ing] alternatives for the Saturn brand,” as well as cutting “product offerings” at Pontiac.

AIG: No Bonuses For Top Executives This Year

It’s apparently not entirely self-evident that when your company needs a taxpayer bailout you shouldn’t get a “bonus,” so money-sucking insurer AIG has written a letter to NY Attorney General Andrew Cuomo promising that their top executives will not get bonuses this year.

Stock Market Pleased By New Phase Of Bailout

Today the Federal Reserve announced the creation of a new special purpose entity that will buy consumer and business debt. Under the new plan, the Treasury will provide $20 billion dollars in of credit protection (from the Troubled Asset Relief Program) — and will absorb most of the losses, should they occur.

Auto CEOs Flew Private Jets To Washington To Ask For Your Tax Money

ABCNews says that the big three auto CEOs “flew to the nation’s capital yesterday in private luxurious jets to make their case to Washington that the auto industry is running out of cash and needs $25 billion in taxpayer money to avoid bankruptcy.”

GM's Prez Begs Customers To Plead On GM's Behalf

Consumerist reader Darkrose writes, “I just got this in my e-mail. Thought you guys might be interested in it.” In the email, GM’s president Troy Clarke is in high PR mode, pointing out the grave consequences and emphasizing that GM wants not “a bailout but rather a loan that will be repaid.” We thought other readers who aren’t GM customers would find it interesting.