While a lot of focus has been put on scammers who trick homeowners into costly schemes by promising to reduce their mortgage payments, people are also being taken in by bogus businesses that claim to help with auto loans. [More]

auto loans

FTC Goes After Car Dealers For Lying To Customers About Trade-Ins

Have you ever seen a car dealership ad that promises to pay off the loan balance of your trade-in, even if you owe more than the value of the trade-in? Well, the Federal Trade Commission has stopped a handful of dealers from continuing to deceive buyers with this too-good-to-be-true offer. [More]

Auto Lenders Approving Car Buyers Who Can't Pay Their Mortgages

Usually, one of the main factors a lender uses to determine whether or not to let an applicant borrow money is the applicant’s history of paying back (or failing to pay back) other loans. But with so many Americans having skipped mortgage payments in recent years, auto lenders are apparently no long slamming the door on potential borrowers just because they weren’t able to keep current on their house payments. [More]

New Jersey Dealership Goes Under, Leaves Customers Without Titles To Their Cars

When Patrick Dunn’s auto dealership in New Jersey went out of business a few months ago, something weird happened to “40 or 50” customers who had bought cars from him, writes Bob Braun at NJ.com. The company Dunn had taken out business loans with, Automotive Finance Corporation (AFC), went to Arkansas and asked for reposession of the cars in New Jersey. The Arkansas department of motor vehicles assumed AFC meant for unsold cars on the lot, so they granted the request—and now AFC says it owns titles to cars that people are already driving and paying for.

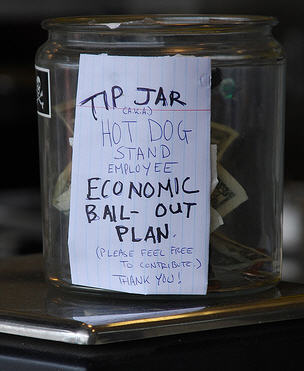

Stock Market Pleased By New Phase Of Bailout

Today the Federal Reserve announced the creation of a new special purpose entity that will buy consumer and business debt. Under the new plan, the Treasury will provide $20 billion dollars in of credit protection (from the Troubled Asset Relief Program) — and will absorb most of the losses, should they occur.

../../../..//2008/11/12/the-government-has-officially-announced/

The government has officially announced that they will not be buying troubled mortgage assets — the original point of the so-called Trouble Asset Relief Program, and will instead be offering the bailout money to financial firms that are getting hit with a wave of defaults in credit cards and car loans. [CNNMoney]

The Subprime Meltdown Is The Tip Of The Credit Iceberg

The ongoing subprime meltdown is merely the first destructive wave of credit catastrophe to wash over Wall Street, according to Slate’s resident explainer. Americans drunkenly bandy credit around in several forms: mortgages are the most prevalent loans turning sour, but credit card debt, student loans, and auto loans are silently conspiring to threaten our macroeconomic well-being.