Customers have filed a class action suit against Fitbit, claiming that the company’s Charge HR and Surge fitness bands don’t accurately measure users’ heart rate during vigorous exercise. We’ll keep an eye on the lawsuit and let you know if it goes anywhere, but it probably won’t, and that’s what got our attention. The users filed a class action against Fitbit despite signing (well, clicking) away their right to do so when they registered their devices. [More]

arbitration

Got A Fitbit Or Other Gadget For Christmas? It’s Time To Opt Out Of Mandatory Arbitration!

Debt Collectors Can Sue You, But Court Might Not Let You Sue Debt Collector Back

A new report claims that a growing number of debt collectors are trying to exploit a legal loophole that allows them to bring potentially frivolous lawsuits against alleged debtors, but bars those defendants from bringing their own legal action against the debt collector. [More]

10+ Things Consumers Should Know About The New Federal Spending Bill

This morning, after months of slapping on, then removing, then replacing pork barrel riders on the federal Consolidated Appropriations Act of 2016, we finally know exactly which add-ons made it into the omnibus spending bill and which ones didn’t. [More]

Supreme Court Once Again Shows Its Disdain For Consumer Rights

For the third time in five years, the U.S. Supreme Court had a chance to reverse a terrifying trend in consumer rights by doing something, anything, to rein in “forced arbitration” clauses that strip consumers of their legal rights and effectively give companies a license to steal. And for the third time in five years, the SCOTUS majority showed its interests lie in protecting the coffers of big business rather than Americans’ access to the legal system. [More]

Banks Urge Congress To Continue Renewing Their “Get Out Of Jail Free” Cards

Nestled deep in the text of the lengthy contracts for most credit cards and bank accounts are little clauses that not only prohibit harmed customers from suing their bank or card issuer, but also prevents them from banding together with similarly injured consumers to argue their dispute as a group. In October, the Consumer Financial Protection Bureau announced it would consider limits on these clauses, but now the banking industry is trying to use its leverage with D.C. lawmakers to shut down that process. [More]

12 Things We Learned From The New York Times’ Investigative Report On Arbitration

Consumerist’s first post on the subject of arbitration, back in 2007, described a dispute that was ultimately resolved in the consumer’s favor. Since then, we’ve been against the practice, pointing out when popular companies change their terms of service to add arbitration clauses. It doesn’t matter, though, because arbitration can save companies so much money that they don’t especially care what we think. Sometimes. [More]

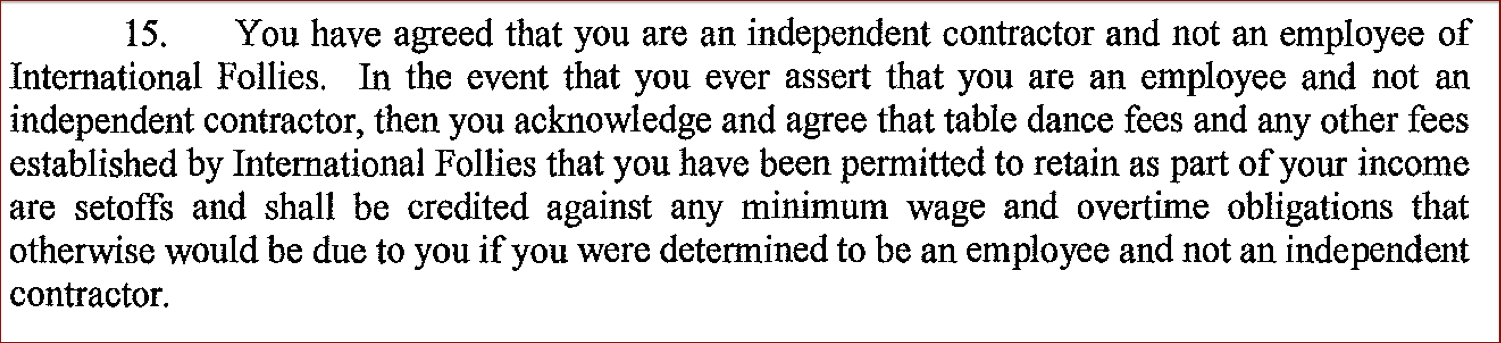

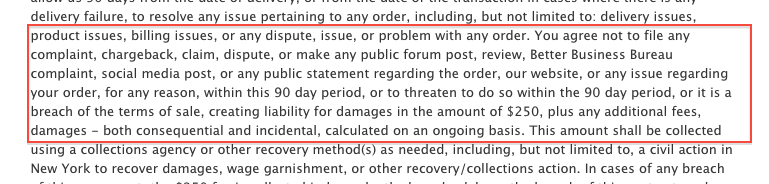

Court Sides With Consumer In Suit Against Retailer That Charges $250 When Customers Threaten To Complain

Last summer, a consumer in Wisconsin filed a lawsuit against online retailer Accessory Outlet over what she called a bogus $250 fine the company imposed, claiming she breached the terms of sale when she threatened to have the charge canceled after the iPhone case she ordered never shipped. Today, a New York court sided with the consumer by granting a default judgement in the case, essentially agreeing that Accessory Outlet’s “terms of sale” and the debt it alleged the woman owed were void. [More]

FTC Affirms Consumers’ Right To Go To Court Over Warranty Disputes

In just the last four years, the U.S. Supreme Court has twice ruled against consumers’ rights and in favor of companies that use fine print in their contracts to block wronged customers from suing in court and from joining together as a class action. In spite of these rulings, the Federal Trade Commission recently upheld rules that give warranty buyers the right to a day in court, even if they have to go through arbitration first. [More]

58 Senators Urge CFPB To Create Rules Against Forced Arbitration Clauses In Financial Products

A month after legislation was introduced to eliminate mandatory arbitration clauses in employment, consumer, civil rights and antitrust cases, a coalition of 58 lawmakers and several consumer advocate groups are urging the Consumer Financial Protection Bureau to take things a step further by protecting consumers from forced arbitration clauses in financial services contracts. [More]

Arbitration Fairness Act Would Reinstate Consumers’ Right To Sue In Court

Companies have been taking away your right to sue them when they screw up for years, using small, hidden clauses to require mandatory binding arbitration instead. After years of consumer groups voicing their concern over this anti-consumer practice, there’s finally a new bill in congress that proposes to bring back your right to sue.

More Than 100 National Consumer Groups Urge The CFPB To Issue Rules Over Forced Arbitration Clauses

Just weeks after the Consumer Financial Protection Bureau released a report showing that tens of millions of Americans have clauses in their credit card, checking account, student loan and wireless phone contracts that take away their rights to sue those companies in a court of law, more than 100 consumer groups have signed a letter urging the Bureau to address the use of forced arbitration clauses by issuing rules forbidding the clauses. [More]

Marching Band Delivers Petition To Citi Asking Banks To “Revoke License To Steal”

In a handful of recent decisions, the U.S. Supreme Court has affirmed the right of businesses to effectively break the law by putting a few carefully worded sentences into their contracts and user agreements. But just because you can add these clauses doesn’t mean you have to do so, which is why pro-consumer advocacy groups gathered more than 100,000 signatures on a petition that was delivered, with a little bit of music, to Citigroup HQ in Manhattan this morning. [More]

Online Retailer Will Fine You $250 If You Even Threaten To Complain About Purchase

If you were put off by KlearGear.com’s ridiculous “Non-Disparagement” fee, which penalizes customers for sharing their bad shopping experiences with the public, another online retailer is apparently trying to go one further, by not only banning customers from saying bad things online, but by also forbidding them from even bringing up the threat of a complaint or a credit card chargeback. [More]

Why These 5 Pro-Consumer Bills Won’t Become Law In 2014

Back in January, at the dawn of the year, we gazed into our not-quite-crystal ball and took a look at some pieces of pending legislation that could help consumers this year. Now, in July, we’re at the halfway point of the year, and so it’s a good time to take a look at those bills and see how the wheels of government have turned in 2014. [More]

Your Guide To Proposed Laws & Regulation That Could Help Consumers In 2014

2013 is gone, a collection of memories never to be dealt with again. Next week, the 113th Congress returns for its second session, ideally to enact legislation throughout 2014, some of which could help consumers if they were to become law. [More]

Comcast Lawsuit Shows Why Mandatory Binding Arbitration Is Just Plain Evil

I know, I know… lots of you hear a phrase like “mandatory binding arbitration” and your eyes gloss over and your mind drifts off like it did when your high school history teacher tried to teach you about the Monroe Doctrine or the Teapot Dome scandal. And that’s exactly how companies like Comcast — and AT&T, Time Warner Cable, American Express, Sony, Microsoft, eBay, and many, many others want you to react. But here’s a decent example of why you should give a hoot about having your rights taken away by a few words in a contract you can’t possibly alter. [More]

TiVo Adds Mandatory Binding Arbitration For Customers: Here’s How To Opt Out

We at Consumerist have crusaded against the evils of mandatory binding arbitration for most of the last decade. Companies love it, though, because it means we can’t sue them. TiVo is only the latest company to insert language requiring customers to use arbitration and give up their right to sue. You can opt out of that provision, though, if you want to. [More]