An Ohio-based auto lender that has already been penalized for $3.28 million for using aggressive debt collection tactics against members of the armed forces is once again in hot water with the Consumer Financial Protection Bureau for failing to issue refunds to the servicemembers that were harassed. [More]

action

Feds Warn Banks: High-Pressure Incentives Can Lead To Another Wells Fargo Fiasco

As Wells Fargo continues to dig itself out of a years-long — if not decade-long — fake account fiasco perpetrated by employees under strain from high-pressure sales goals, federal regulators are warning other financial institutions that these sorts of programs could harm consumers and possibly lead to stiff penalties. [More]

State, Federal Agencies Crack Down On Companies That Allegedly Facilitate Mail Fraud Of Elderly

Each year, millions of elderly consumers are lured into mail fraud schemes by all-too-attractive claims that they have won unimaginable prizes, like millions of dollars or trips around the world. Today, the U.S. Department of Justice took unprecedented steps to ensure these scammers no longer victimize older Americans by announcing action against companies that they allege are some of the little-known perpetrators of the alleged schemes: the payment processor, mailer printers, and lead generators.

Servicemembers Twice As Likely To Submit Complaints About Unsavory Debt Collection Practices

While millions of Americans are no strangers to questionable debt-collection practices, a new report from the Consumer Financial Protection Bureau shows that the men and women in the armed forces are twice as likely than their civilian counterparts to file a complaint when a collector crosses the line.

[More]

Feds Order Debt Relief Schemes To Cease Misleading Use Of Government Logos

Even though it’s incredibly easy to slap a government agency’s logo on your website, that doesn’t make it okay. Just ask the two debt relief companies that have been ordered to stop using Department of Education logos to mislead student loan borrowers. [More]

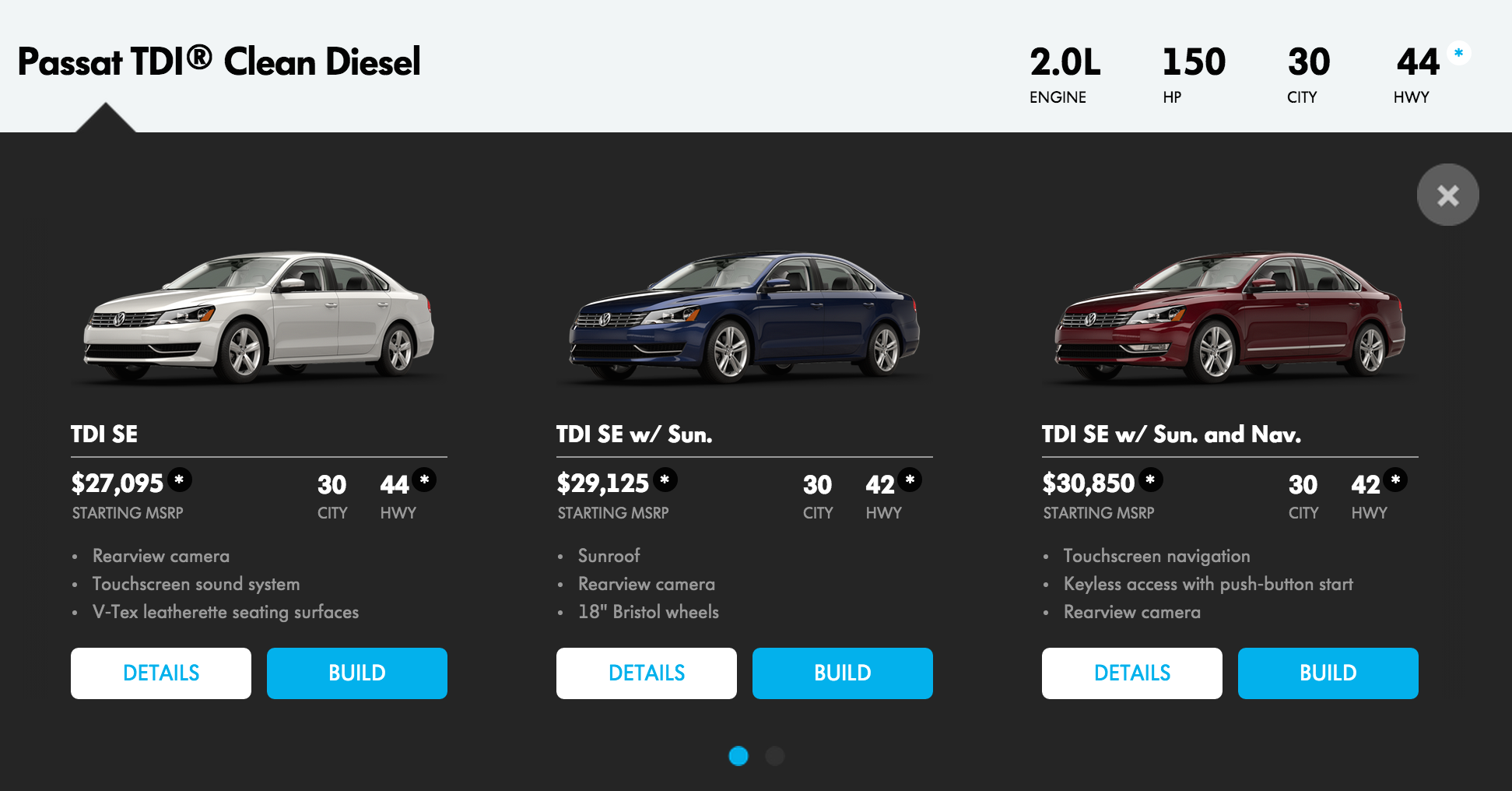

VW Previously Recalled Some Vehicles Over Emissions Standards

Five months before Volkswagen was ordered by federal regulators to recall nearly 500,000 sedans that equipped with software that tricked emissions tests, the company sent notices to some owners that their cars were in need of an “emissions service action.” [More]

Operators Of Credit Repair Business Masquerading As The FTC Must Return $2.4M To Consumers

Three months after regulators shut down a credit repair company catering mainly to Spanish-speaking consumers for falsely claiming to have a close relationship with the federal government – calling itself “FTC Credit Solutions” – and bilking thousands of dollars from individual consumers with empty promises of boosting their credit scores, the real Federal Trade Commission announced it has reached a settlement that will result in the return of $2.4 million to victims of the scam. [More]

Regulators Gearing Up To Take Action On Slow-Moving Takata, Jeep Recall Fixes

After months of expressing concern over the slow-moving pace automobile and parts manufacturers have taken to remedy defects associated with nearly 1.5 million Jeeps that can explode following low-speed rear-end collisions and more than 25 million vehicles equipped with defective, shrapnel-shooting airbags, the National Highway Traffic Safety Administration is poised to take aggressive action to better ensure the safety of owners of those vehicles. [More]

You Have Until Friday To Tell The Fed That Their Proposed New Credit Card Rules Aren't Enough

The Federal Reserve Board has set this Friday, October 12th, as the deadline for hearing any comments regarding Regulation Z, its proposed set of modified guidelines for the credit card industry. According to experts who aren’t on the credit card companies’ payrolls, the new rules are a weak fix that does little to protect consumers.