Electronic Mortgage Documents Easier To Understand, Provide More Benefits For Consumers

If you’ve ever bought a house, you’re more than familiar with the mountain of paperwork you have to deal with at closing, not all of which are easy to understand. But a study claims that homeowners who utilize a newer electronic method for reviewing closing documents may better comprehend what they’re signing.

If you’ve ever bought a house, you’re more than familiar with the mountain of paperwork you have to deal with at closing, not all of which are easy to understand. But a study claims that homeowners who utilize a newer electronic method for reviewing closing documents may better comprehend what they’re signing.

This is according to research [PDF] from the Consumer Financial Protection Bureau that found electronic mortgage closings – technology for borrowers to view and sign closing documents electronically – can be a benefit for consumers, helping them navigate the mortgage process.

The report – the latest in the Bureau’s “Know Before You Owe” initiative aimed at improving the home buying experience – found that those who closed their mortgages using an electronic platform generally have a better understanding of terms and feel more empowered than borrowers who used paper forms.

The CFPB study found that consumers felt better about the mortgage closing process when given electronic documents.

The Bureau’s research on the effectiveness on eClosings was initiated after a 2014 report found that consumers felt like they didn’t have enough time to review documents and were overwhelmed by the stack of paperwork provided during the closing process.

Following that report, the CFPB identified eClosings as an option to alleviate some of consumers’ apprehension with the mortgage lending process.

An eClosing pilot program, administered by the CFPB for the study, took place over a four-month period involving seven lenders, more than 3,000 consumers, four technology companies and several settlement agents and real estate professionals.

While some consumers in the pilot used traditional paper documents, others used a complete eClosing process, and others used a combination of the two.

After the closing process was completed, borrowers provided the Bureau with a survey about their feelings on their given method.

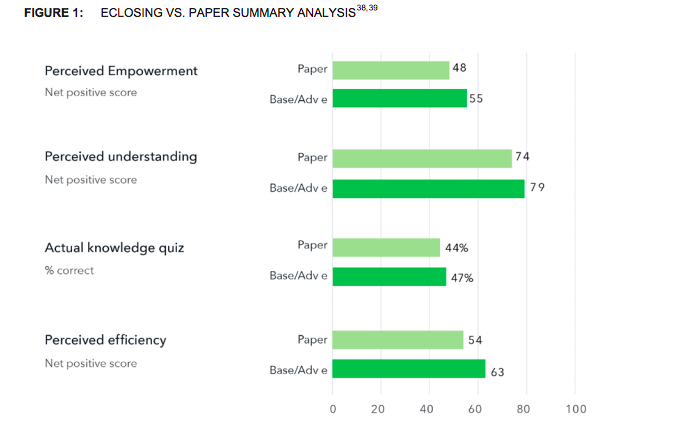

When it came to having a better understanding of terms and fees, consumers who used eClosing were about 7% more likely to believe they understood the contracts compared to borrowers who used paper documents.

Asked about their perceptions of the process’s overall efficiency, the study found a 17% positive difference in scores for borrowers using eClosings.

Additionally, the study found that consumers were 15% more likely to feel empowered by having more time to review documents, ask questions and flag concerns during the closing process.

“The CFPB finds the results of this study encouraging for industry participants that are currently completing eClosings, working toward eClosing implementation, or are still in early discussions on eClosing,” the report states.

Still, the Bureau believes the study shouldn’t be used as a final verdict on the potential of eClosing, because of constraints in the data used and consumers reported mixed feeling on some of the technology-focused processes, specifically when it came to refinancing options.

“Given these constraints and results, we instead view this study as confirmation of growing interest in eClosing as an option for consumers and as a platform to spur further research,” the Bureau states.

Today’s report comes just two months before the CFPB’s “Know Before You Owe” mortgage disclosure rule takes effect.

The new rules requires two redesigned, easier-to-use mortgage disclosure forms that clearly lay out the terms of the loan for a homebuyer.

The first form is the Loan Estimate, which provides a summary of the key loan terms and estimated loan and closing costs. This form will be provided to consumers within three business days after they submit a loan application.

The second form is the Closing Disclosure, which offers a detailed accounting of the transaction. The rule requires the delivery of the Closing Disclosure three days before closing.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.