Former Operator Of FAFSA.com Penalized $5.2M For Illegal Billing

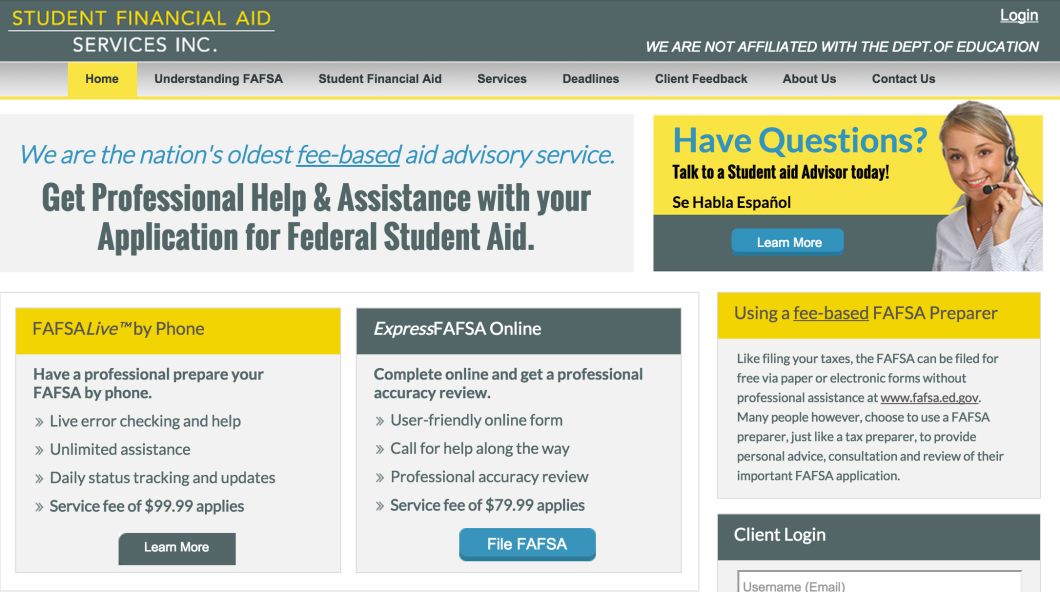

According to the complaint [PDF] filed by the Consumer Financial Protection Bureau with a federal court in California, until earlier this month a company called Student Financial Aid Services, Inc., was operating FAFSA.com, and offering FAFSA preparation services online or over the telephone, for a fee.

The site offered three different premium plans, all of which were set up as “negative option” renewal subscription plans. That means that unless the subscriber specifically told the company to halt the subscription, or unless the company decided to end the recurring charges, the user’s account would be charged each year for FAFSA prep help even if no help was requested.

The problem with the FAFSA.com model wasn’t necessarily the automatic renewals, but the deceptive ways in which the site got users to enroll.

The CFPB alleges that users were told these premium plans were available at “no additional cost,” when in fact there were annual fees of $67 to $85, which were charged automatically to the consumer’s card or bank account on file for up to four years.

Additionally, the site failed to clearly explain or disclose the recurring nature of these charges, according to the complaint. The only indication of recurring charges was a statement on the payment page that read, “worry-free annual billing.*”

The asterisk in that sentence referred to a 6,500-word Terms of Use document elsewhere on the site. But the CFPB says that even those who read the fine print would not have been able to discern they were being put into a negative option renewal subscription, as that aspect was not mentioned. Nor were the annual fees that would be charged.

And subsequent post-purchase confirmation e-mails from the site did not indicate that there would be recurring charges for service, whether it was requested or not.

It wasn’t just the website that was misleading, the company’s phone sales operation also glossed over the nature of the recurring charges.

The complaint alleges that SFAS phone reps “did not clearly disclose that the consumer’s credit card or debit card would be charged each year regardless of whether the consumer was still attending school or making use of the Company’s FAFSA preparation service in the following application year.”

Phone reps’ script also misleadingly upsold the premium tier service as an“upgrade … at no additional cost to our Gold status.”

In all, between 2011 and 2013, the CFPB alleges that SFAS processed approximately 206,000 automatic charges against the accounts of consumers who did not file a FAFSA through the company during that application year.

“Student Financial Aid Services, Inc. made millions of dollars at the expense of consumers through its illegal recurring payment scheme,” said CFPB Director Richard Cordray in a statement. “Our enforcement action will put money back in the pockets of consumers who were misled while seeking to access federal student aid.”

Per a consent order [PDF] with the CFPB, the company must pay $5.2 million that will be used to repay those who were charged for unauthorized, recurring service fees.

FAFSA.com no longer sells SFAS services. Instead, it offers visitors a portal to either the Dept. of Education website or a login for existing FAFSA.com customers to access their accounts.

“Students and families applying for federal student aid shouldn’t have any confusion about whether they’re on the official FAFSA website or a commercial website,” said United States Secretary of Education Arne Duncan. “This transfer will help provide clarity for parents and students.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.