Montel Williams-Endorsed MoneyMutual To Pay $2.1M Penalty

For years, TV personality Montel Williams has been the daytime TV face of payday loan lead generation service MoneyMutual, even as it faced investigations from federal and state agencies. Just a few days ago, Montel got into a Twitter spat with a woman who questioned why he was acting as a spokesperson the company, and showed that maybe he needed a refresher course on annual percentage rates. But as part of a deal with regulators in New York state, Montel will no longer market payday loans in the state and MoneyMutual will pay a $2.1 million penalty to settle allegations that it illegally marketed payday loans to New York residents.

For years, TV personality Montel Williams has been the daytime TV face of payday loan lead generation service MoneyMutual, even as it faced investigations from federal and state agencies. Just a few days ago, Montel got into a Twitter spat with a woman who questioned why he was acting as a spokesperson the company, and showed that maybe he needed a refresher course on annual percentage rates. But as part of a deal with regulators in New York state, Montel will no longer market payday loans in the state and MoneyMutual will pay a $2.1 million penalty to settle allegations that it illegally marketed payday loans to New York residents.

[CORRECTION: This story initially stated that Montel was barred from appearing in ads for MoneyMutual. In fact, he is only prohibited from marketing the service as it pertains to New York state. The story has been corrected to reflect this information.]

MoneyMutual and other purely lead-generation companies don’t offer the loans directly to consumers but instead operate online portals that connect loan applicants with lending services.

Since payday loans are illegal in New York, lead-generators should not be facilitating these loans. In 2013, the state issued subpoenas to more than a dozen of these companies to investigate whether they were marketing illegal loans to New York residents. The enforcement action against MoneyMutual (aka Selling Source) is the first of its kind for the state.

In addition to the $2.1 million penalty, MoneyMutual’s agreement [PDF] with the state Dept. of Financial Services requires that Montel cease marketing the company in New York, and that MoneyMutual end its lead-generation activities in the state. It must also provide new warnings and disclosures to consumers.

According to DFS, MoneyMutual sold leads containing the personal information of approximately 800,000 New York residents for the purpose of connecting them with loans with APRs ranging from, per MoneyMutual’s own words, “between 261% and 1304%.”

Not only did these loans have interest rates upwards of 82 times the state maximum, the majority of MoneyMutual customers were repeat borrowers stuck in a debt trap. By the CEO’s own admission, at least “55% of the people that come into MoneyMutual are ‘repeat clients;'” while the company’s lender clients reported a “60 to 70%” repeat borrower rate. The real money was in targeting so-called “Gold” customers who repeatedly took out new loans to pay off the old ones.

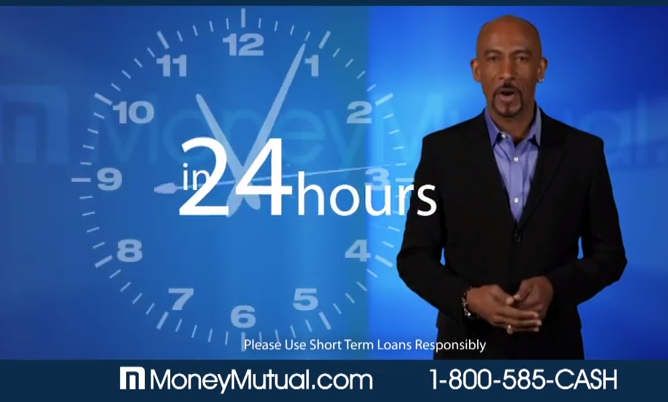

In ads, Montel referred to MoneyMutual as “the only source you can trust for finding a short term loan quickly and easily.” His status as a respected TV personality gave the company instant credibility for some borrowers.

“Using Mr. Williams’ reputation as a trusted celebrity endorser, MoneyMutual marketed loans to struggling consumers with sky-high interest rates – sometimes in excess of 1,300% – that trapped New Yorkers in destructive cycles of debt,” DFS Superintendent Benjamin Lawsky said in a statement.

Lawsky says DFS will continue investigating other payday lead-generators.

In a statement from the PR firm representing Montel, the celebrity puts a little bit of distance between himself and the company’s operations while still voicing support for MoneyMutual and for short-term loans in general.

“The DFS has made no finding of a violation of law by Mr. Williams, and the agreement does not require him to pay any fines or penalties,” reads the statement. “Mr. Williams and his staff have cooperated fully with the DFS throughout the course of the investigation.”

It continues, “As is typical of an endorsement agreement, Mr. Williams has no role whatsoever in the business operations of Selling Source, and his role is limited to that of a celebrity endorser.”

The statement also notes that Montel, during his time at the U.S. Naval Academy, took out short-term loans “on more than one occasion and paid those loans back on time.”

What the statement doesn’t point out is that this would now likely be illegal, as the Military Lending Act of 2007 effectively bans active-duty military personnel from taking out high-interest loans; specifically because it can trap soldier in debt that may make them a security risk.

“Mr. Williams is not blind to the problems of the industry – his endorsement of Money Mutual is reflective of its efforts to lead the industry in self-regulation,” concludes the statement. “Naturally, we are deeply concerned any time a consumer reports an issue with any product or service with which he is associated and, as we always have, we will fully investigate and attempt to resolve any issue brought to our attention.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.