Fingerhut.com Uses Over-Inflated Retail Prices To Make Rent-To-Own Look Affordable

On its TV ads, Fingerhut.com shows people making peace with their “budget” alter-egos by doing their shopping on the website that allows you to make “low” monthly payments. But what the site doesn’t say is that not only do those payments add up to a lot more than the original price of what you’re buying, but that Fingerhut’s sticker prices are grossly inflated over the actual retail prices.

Just take a look at the three following examples that we picked at random from the many items for sale on Fingerhut.

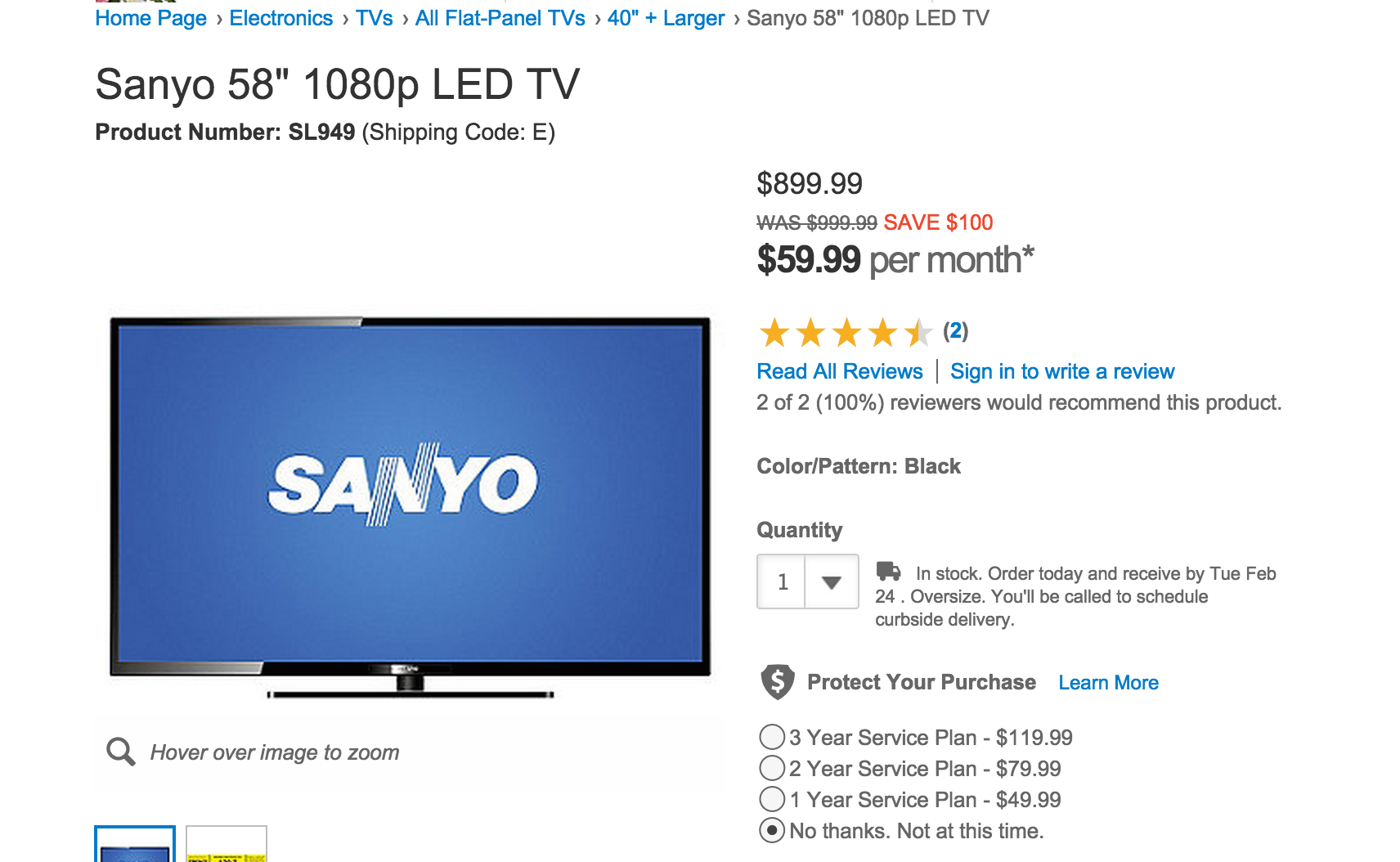

On Fingerhut, this Sanyo LED TV (it’s finally revealed in the details far down the product page that the model is a Sanyo DP58D34) lists a $999.99 retail price, which has been discounted to $899.

At that price, a $59.99/month payment might seem like an affordable alternative, even though you’ll end up paying around $1,300 for the TV by the time you finish.

(FYI, This total cost info is not easy to figure out as it requires scrolling through column after column of microprint on this page, where you need to find the exact right retail price, shipping category and monthly payment before learning how many months the payments go on for and what the total cost for renting-to-own will be.)

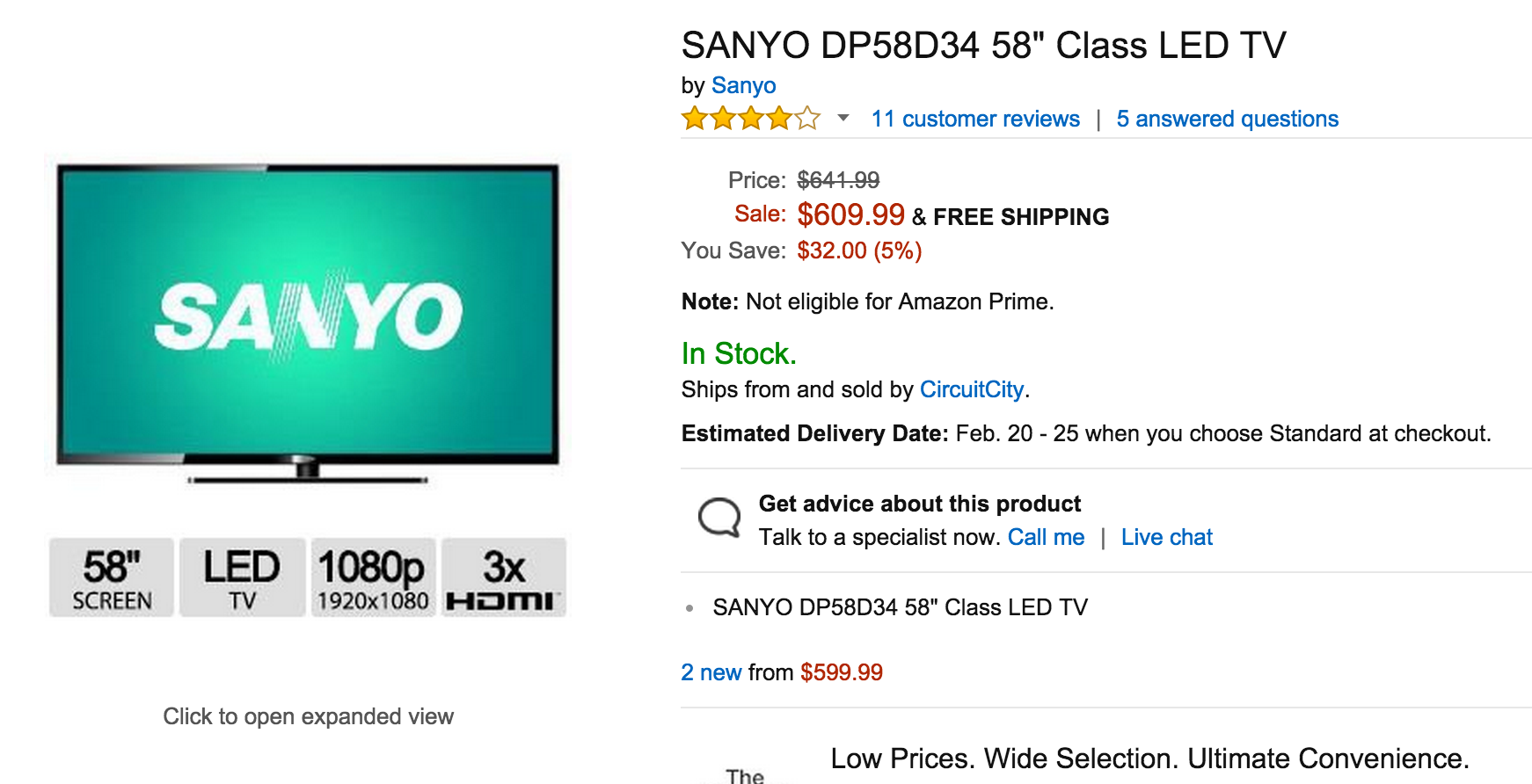

But then you look on Amazon and see that you can buy the exact same TV for $610, down from an original price of $642:

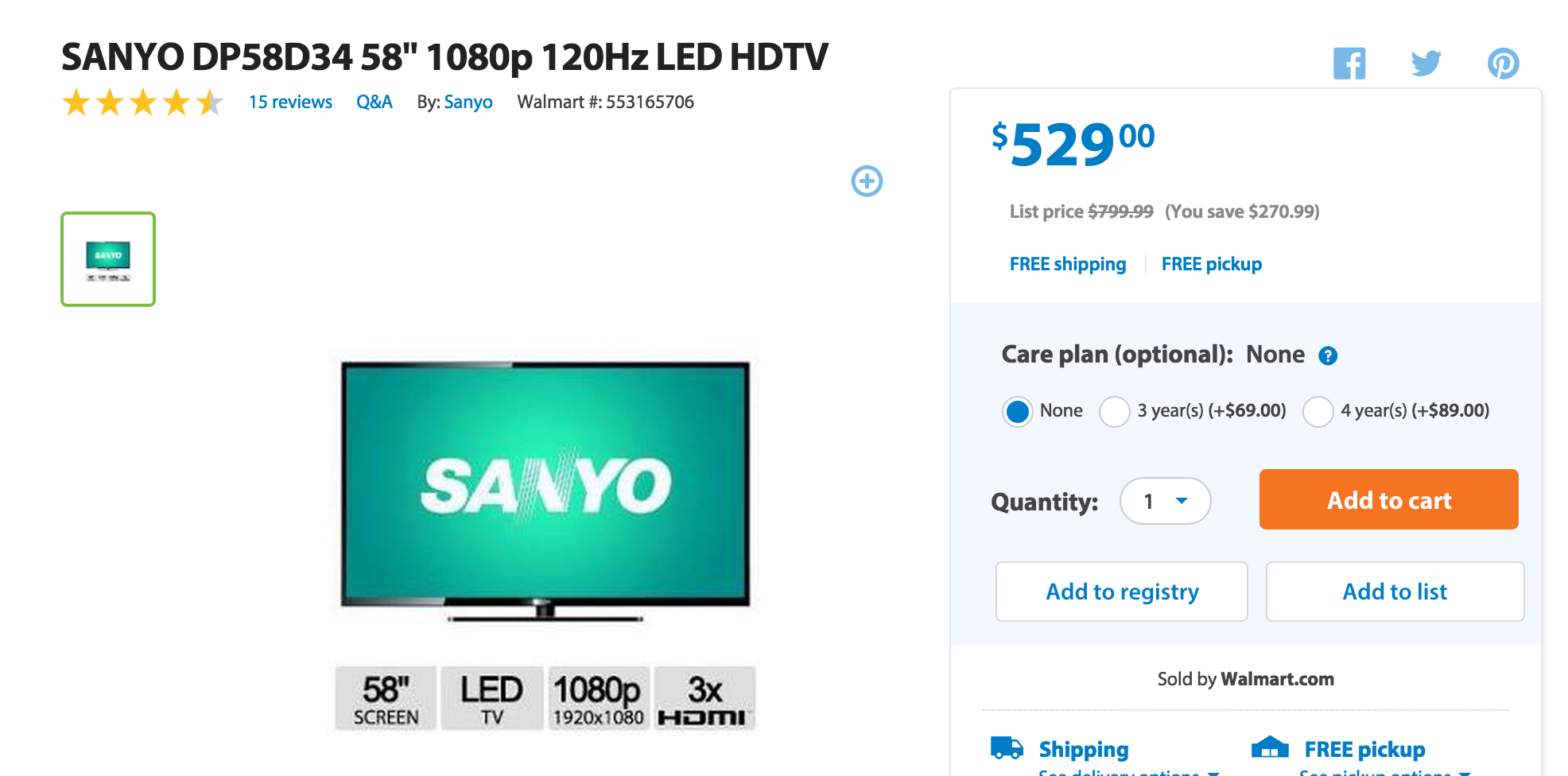

And you can get an even better deal with $529 at Walmart.com, though this site claims the original retail price was $799:

Regardless of what the original retail price was, it doesn’t appear to have ever been $999, nor $899. And if you go the Fingerhut monthly payment route, you’ll end up paying more than twice what you would at either Walmart.com or Amazon.

If, instead of paying Fingerhut $60/month for nearly two years, you just put aside $60/month for 9-10 months, you’ll be able to pay for that TV in cash.

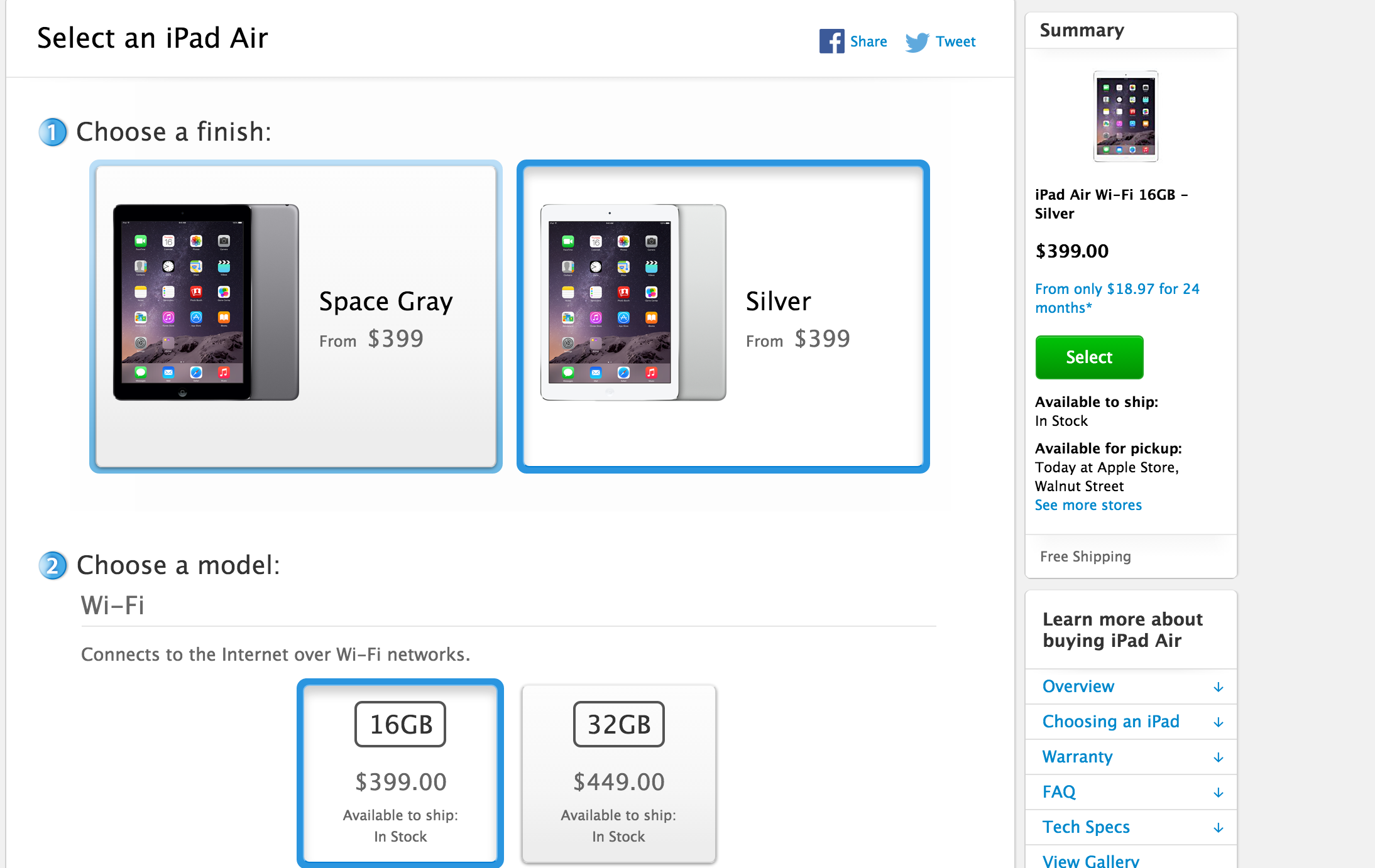

2. iPad Air (16GB WiFi)

Since there is some disagreement with the original MSRP on the Sanyo TV, let’s look at a product where we know both the original and current MSRP. This model of Apple’s iPad Air tablet originally sold for $499 and has since been dropped to $399. And yet, Fingerhut inexplicably gives the device an original retail price of $649.99, which has been discounted to $520, still much higher than this tablet was ever priced by Apple:

And at 19 months of $35/month payments, you’re doing to spend about as much as the inflated retail price that Fingerhut apparently conjured out of thin air.

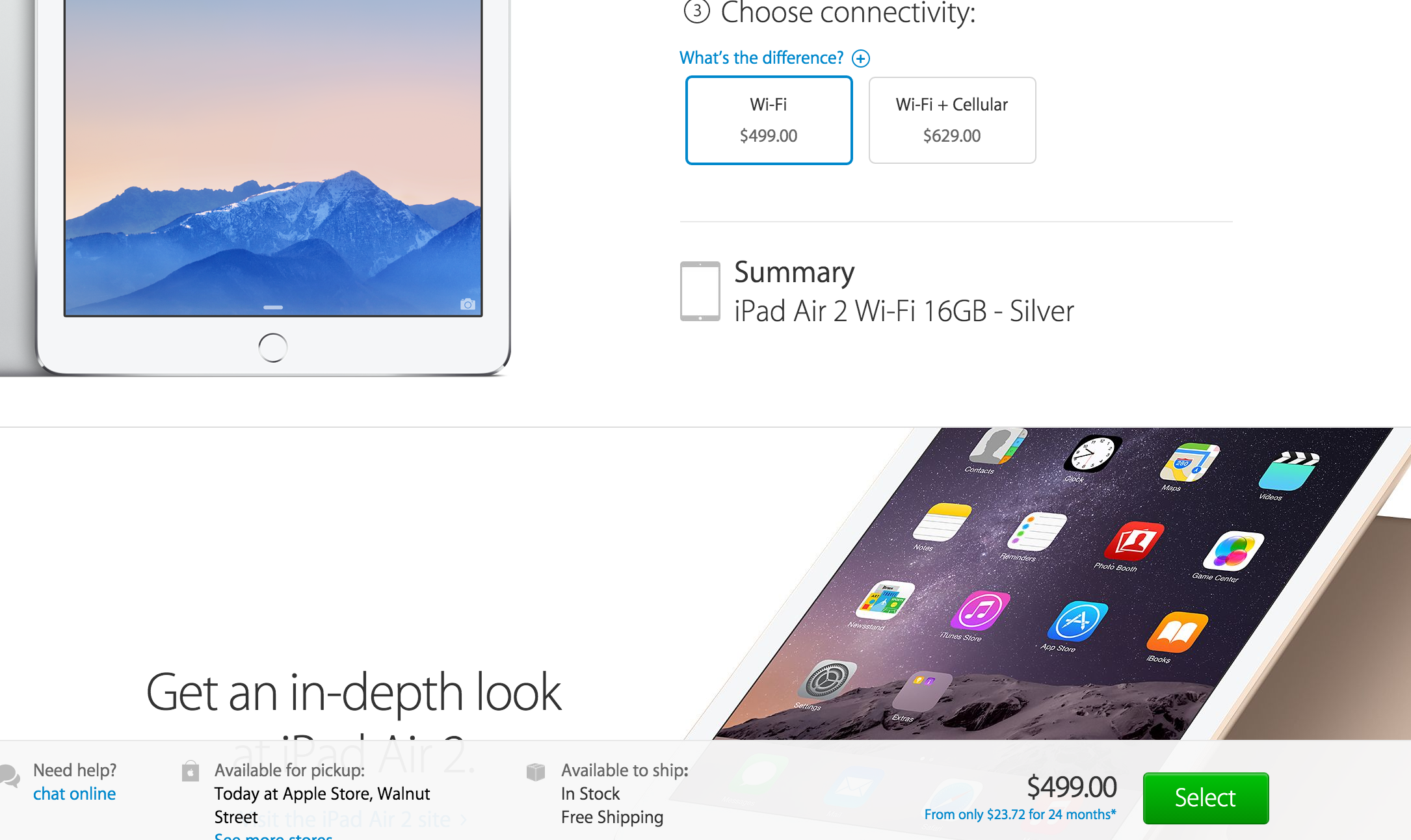

Just to make sure that Apple hadn’t suddenly decided to raise the price on the device — and to check that it was still available — we looked at Apple.com, where you can readily buy this tablet for $399 or for 24 payments of $18.97 ($455.28)

And lest someone claims that maybe Fingerhut mislabeled this product and meant to say it was a newer iPaid Air 2, we checked the price and availability on that item. Once again, all looked okay, with the device selling for $499 or 24 payments of $23.72 ($569.28).

So you could finance the newest iPad Air 2 for about $100 less than what it would cost you to get an older model through Fingerhut.

And again, rather than paying $35/month to Fingerhut for 19 months, save that same amount of money for 10-11 months and buy it at the lower price in cash.

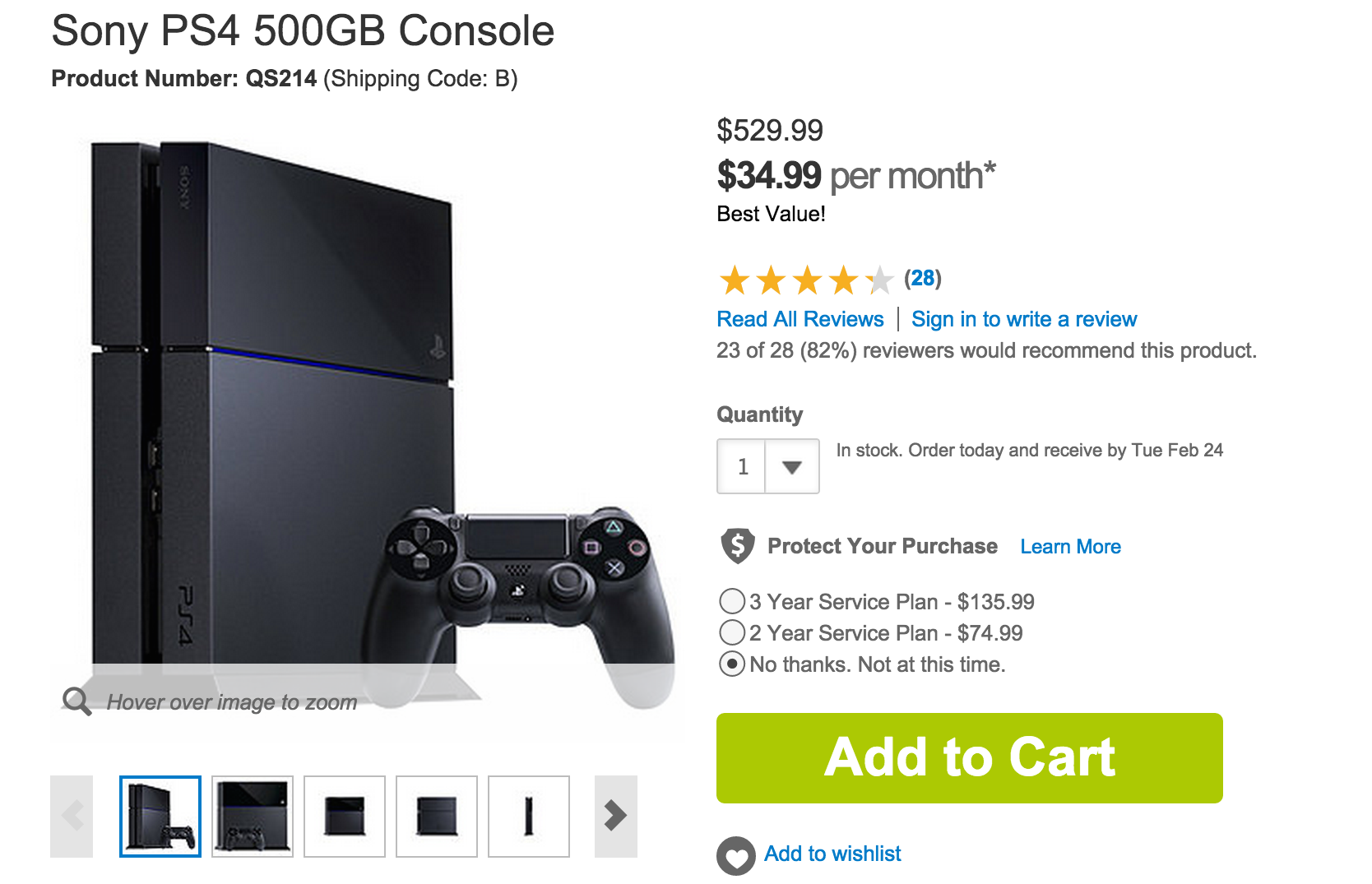

3. Sony PlayStation 4

And here’s a product where the retail price has not changed since its release (not including holiday sales and promotions). In the fall of 2013, the PS4 sold for $399.99 and it still officially sells for $399.99. So why is Fingerhut not only listing it at $529.99 but also calling it a “Best Value!”?

And after 20 payments of $34.99, you’re looking at paying around 170% of the retail price. If you saved that amount of money — just like the iPad Air example — you’d have enough to buy a PS4 with cash in 10-11 months.

The Bottom Line

We know that rent-to-own can be a really tempting proposition for people who want to buy something now but can’t afford to pay for it or lack the credit for a more affordable payment plan. But be warned that you are just throwing money down the drain and consigning yourself to further debt.

Last month, Pennsylvania Senator Bob Casey called on both the Federal Trade Commission and the Consumer Financial Protection Bureau to take a closer look at the rapidly growing rent-to-own (RTO) industry.

“I am concerned about the threat that the continued growth of the RTO market poses to the financial stability of millions of Americans,” he wrote at the time. “It is essential that customers entering into RTO deals are aware of the risks involved.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.