Many Homebuyers Spend More Time Shopping For A TV Than Looking For The Right Mortgage

(Allison)

Potential homeowners might spend months nitpicking and fretting over the features of a seemingly endless series of houses they could buy, but a new report from the Consumer Financial Protection Bureau claims that half of American homebuyers aren’t taking the same care when it comes to shopping around for the right mortgage, often putting themselves in precarious lending situations and missing out on savings.

To combat the rise of the uninformed mortgage borrower the Bureau is releasing a toolkit aimed at helping consumers gain greater control over the outcomes of the mortgage process, while maximizing the benefits of this major transaction.

The latest CFPB report [PDF] found that while it’s true that the mortgage industry is less risky than it was before the housing market crash, there are still varying terms and features that can wreak havoc on consumers’ finances if they aren’t fully informed about the products.

“People may well put more time and effort into shopping for smaller products such as appliances and televisions than they do in shopping for the right mortgage,” CFPB director Richard Cordray says. “The failure to look around can mean real money lost for consumers.”

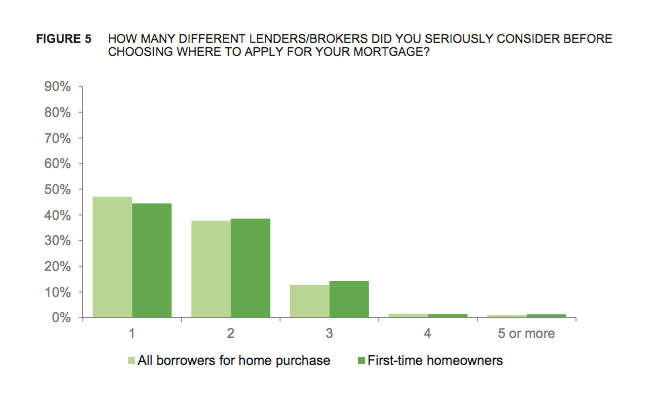

According to the CFPB report, which is based on data in the National Survey of Mortgage Borrowers, almost half of the consumers who took out a mortgage in 2013 failed to shop around prior to filling out an application for a mortgage, meaning they seriously considered only one lender or mortgage broker.

Additionally, three out of four consumers only applied with one lender or broker. The CFPB says this finding shows that consumers aren’t trying to see which lender could offer them the best deal.

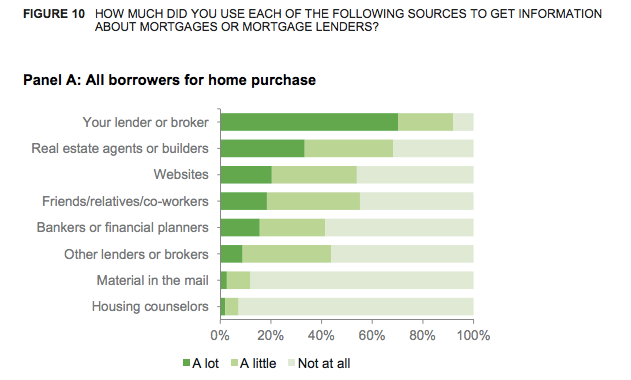

When the CFPB looked at where consumers got their information prior to applying for a mortgage, they found that most are influenced by a lender or broker that would benefit from their transaction.

When preparing to take out a mortgage, consumers were more likely to take the advice of lenders or brokers that had a stake in their decision.

Nearly 70% of consumers say they rely heavily on their lender or mortgage broker to get information about mortgages, while only 20% rely on heavily on websites and 2% rely on housing counselors.

While lenders and brokers can be valuable resources, they have a stake in the selling of the mortgage, so what is best for the lender or broker is not always best for the consumer, the CFPB reports.

Finally, the CFPB found that consumers who were confident in their knowledge about the mortgage process were more likely to shop around for the best deal.

For instance, consumers who are confident about their knowledge of available interest rates are almost twice as likely to shop as consumers who are unfamiliar with available interest rates.

The survey found that 55% of shoppers said they were very familiar with mortgage rates, while 30% of shoppers said they were not at all familiar.

The report findings led the CFPB to create the Owning A Home Toolkit to help inform and empower consumers shopping for mortgages.

The guide, which includes information on loan options, terminology and costs, takes the borrower through the entire home-buying process.

A key feature of the new program is the Rate Checker tool, which sets out to help consumers understand what interest rates may be available to them by using the same underwriting variables that lenders use on their internal rate sheets.

The data behind the Rate Checker is updated daily and includes information from large banks, regional banks, and credit unions and covers about 80% of the mortgage market.

“Knowing the rates lenders are offering to consumers in a similar situation – buying a home of equal value, in a comparable area, with the same credit score – enables a consumer to enter conversations with multiple lenders armed with greater information and prepared with better questions,” officials with the CFPB say.

Consumer Financial Protection Bureau Report Finds Nearly Half Of Borrowers Do Not Shop For A Mortgage [CFPB]

Owing A Home Toolkit [CFPB]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.