The Best Way For Students To Avoid High Fees With Campus Banking Products Is To Barely Use Them Image courtesy of (kevinherzig007)

All around the country, new and returning college students are being handed IDs they can use as debit cards or they’re being told they can have their aid disbursals deposited straight onto a school-branded card. It all seems incredibly convenient, especially for those who have limited experience handling their own finances, but these school-backed banking products are rarely the best available options for students, who could end up being nickel-and-dimed into debt.

A newly released study [PDF] by our colleagues at Consumer Reports examined the terms and average costs of campus banking products offered by nine different financial firms and once again found that these products full of high, varying fees that can quickly deplete financial aid funds.

How To Avoid Going Into Debt With Your Campus Banking Card

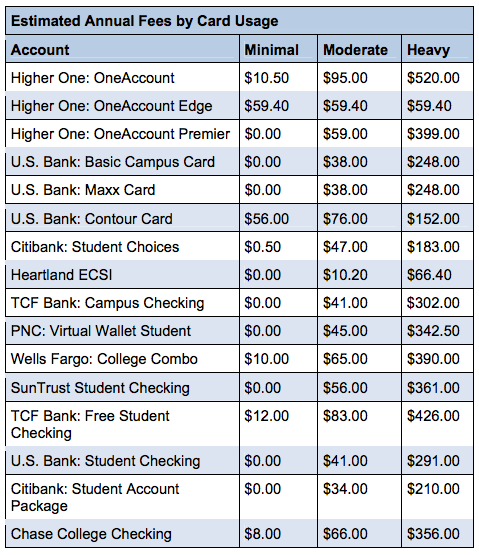

Using a campus banking card may seem convenient, but for students who use the cards everyday the fees quickly add up. (Click to enlarge.)

While we’ve come to associate high fees and little accessibility with campus banking products, it wasn’t all bad news in the CR report. In fact, the investigation found that some students might enjoy relatively low-cost fees; as long as they don’t actually use their cards much.

Consumer Reports determined that students can expect to incur low or no fees only if they use their cards minimally and are able to avoid costly out-of-network ATM fees, overdrafts and transaction fees.

But students who want to actually use their cards are at risk of incurring substantial fees. CR determined that most of the campus accounts would cost heavy users more than $250 per year in ATM charges, overdraft fees and point-of-sale PIN fees.

It’s All About The Fees

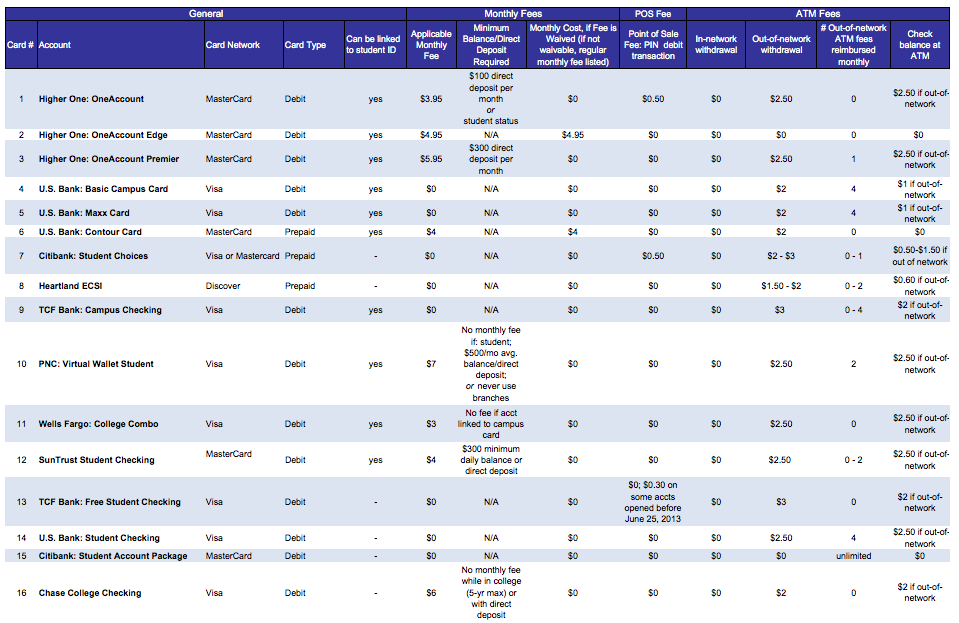

Overall, ATM fees for each of the nine banks varied considerably. Some banks offered several free out-of-network ATM visits per month, while others charged as much as $3 per out-of-network ATM visit.

Nearly all of the cards examined by Consumer Reports included a range of high-cost fees. This chart examines monthly fees, ATM fees and the cost of using PIN-debit transactions. (Click to enlarge.)

Students who want to use their cards to make debit purchases should review their options carefully. Two of the accounts – Higher One: OneAccount and Citibank: Student Choices – both charge $0.50 per PIN-debit transaction.

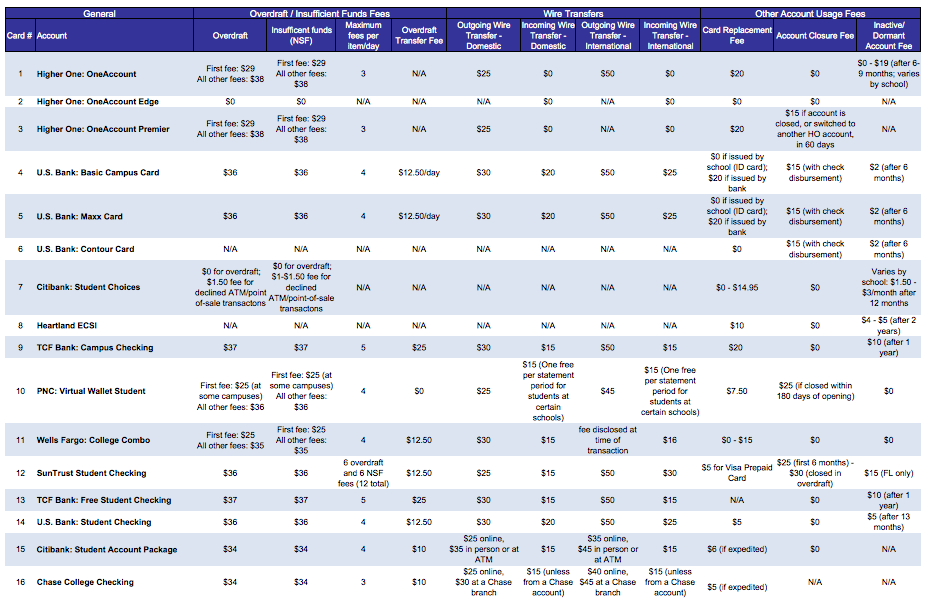

Those smaller fees pale in comparison to the exceedingly high overdraft fees charged by most of the campus banking products examined by CR.

Of the 16 products offered by the nine banks, only two don’t charge overdraft fees – Higher One: OneAccount Edge and Citibank: Student Choice. The rest carry overdraft fees between $25 and $38 per incident.

Overdraft fees were found to be the mostly costly aspect of college banking products. The fees range from $25 to $38 for each incident. (Click to enlarge.)

No Way Around

While avoiding those fees sounds great in theory, it’s much more difficult in practice. In the case of ATM fees, a Government Accountability Office report earlier this year found that most students lacked the convenient access to in-network ATMs required by the Department of Education.

Back in 2012, one of the nation’s largest providers of student debit cards, Higher One, came under fire because the company did not offer convenient access to in-network ATMs. In some instances students reported having to drive 30 to 40 minutes away from campus before finding an in-network ATM.

Additionally, students who want to actually use their cards are at risk of incurring substantial fees. CR determined that most of the campus accounts would cost heavy users more than $250 per year in ATM charges, overdraft fees and point-of-sale PIN fees.

Not In It For The Right Reasons

In recent years, the financial industry and higher education institutions have become increasingly comfortable bedfellows, but they are often careful not to flaunt that relationship when it comes to marketing their products to students.

That might be because the couple isn’t exactly looking out for students. CR found that the varying fee structure suggest that campus banking market lacks transparency and that schools may not be negotiating contracts that are in the best interest of students; a practice that often exposes students to aggressive marketing tactics and restricted choices for managing their money.

The Buck Stops Here

With at least 11% of U.S. colleges and universities, about 852 schools, party to agreements that provide debit or prepaid card services to students, consumer advocates warn that tighter regulations over the products are necessary.

“The last thing [students] need is unexpected gotcha fees that eat away at the money they are counting on to cover expenses while at school,” Suzanne Martindale, policy counsel for Consumers Union, says in a new release.

In conjunction with the CR report, officials with Consumers Union urged policymakers and regulators on Thursday to adopt a number of reforms to ensure consumer protections reach students.

• To ensure schools keep in mind the best interests of students while negotiating with financial institutions, Congress and the Department of Education should ban revenue-sharing agreements between schools and financial institutions, similar to the restrictions in place for private student loans.

• To prevent aggressive marketing practices, Congress and the Department of Education should require schools to present financial aid disbursement options in a clear and neutral manner, so students can easily set up an electronic fund transfer to an existing account to receive their funds.

• To better protect prepaid cards, the Consumer Financial Protection Bureau should adopt regulations that provide these accounts with the same consumer protections as traditional checking accounts.

• To ensure students can access their financial aid refunds in a timely manner and at no cost, the Department of Education should clarify what constitutes “convenient” access to free ATMs on or near campus, so that students have meaningful ways to access their financial aid without incurring extra charges.

• The Department of Education should consider developing its own financial aid refund disbursement card to help introduce competition into a highly concentrated market so that students can access their aid quickly and without cost.

• To bring much-needed transparency to the market for campus banking products, the Department of Education should require schools to submit their full campus banking contracts and the accompanying summaries to the Department for collection in a publicly-accessible central database.

• Congress should also require the CFPB to do an annual report analyzing the data on campus banking contracts collected by the Department.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.