CFPB Wants To Let Consumers Air Financial Grievances In Publicly Viewable Forum

Don’t mind the sign, the CFPB wants to share your complaint stories. (Jim Chambers)

Sometimes consumers want to voice their complaints knowing it will remain a private matter; other times they just want to shout it for all to hear. A new proposal from the Consumer Financial Protection Bureau would give consumers that option when voicing their grievances about consumer financial products and services.

The CFPB accepts complaints on many consumer financial products, including credit cards, mortgages, bank accounts, private student loans, vehicle and other consumer loans, credit reporting, money transfers, debt collection and payday loans.

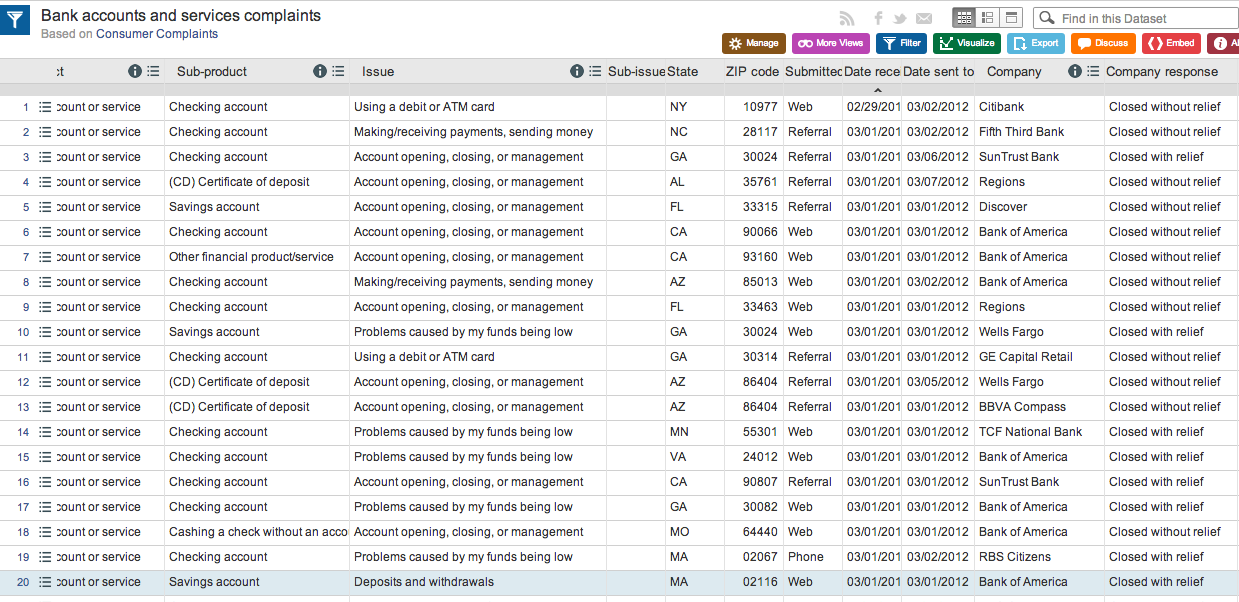

When consumers view the current CFPB complaint database they see very little information concerning the grievance.

Currently when consumers submit a complaint to CFPB’s public-facing Consumer Complaint Database, they fill in basic information such as who they are, who the complaint is against, and when it occurred. There is also an opportunity to describe what happened and attach any related documents.The complaint is then forwarded to the company for a response and the consumer is given a tracking number to keep updated on the complaint status.

When viewing the database consumers can see only a fraction of the information provided. The data fields includes the name of the company, the company’s response and a vague issue description.

The proposed policy would give consumers the option to share their account of what happened in the database. By furnishing these first-person narratives consumers could provide context to the issue and help the public detect specific trends in the market, while also aiding consumer decision-making and driving improved customer service.

The CFPB contends that by giving consumers an option to publicly share their stories, it would greatly enhance the utility of the database and provide consumers with valuable information needed to make better financial choices for themselves and their families.

One would understandably be concerned that making some personal information available to the public would increase the risk of that data being compromised or of identity theft, but the CFPB claims the proposed policy provides safeguards to protect consumers’ sensitive information.

Under the policy, the CFPB would not publish the complaint narrative unless the consumer provides informed consent. This means that when consumers submit a complaint through consumerfinance.gov, they would have to affirmatively check a consent box to give the Bureau permission to publish their narrative. Consumers would also be able to withdraw their consent to publish the narrative at any time.

Before the narrative is published, the Bureau will take steps to remove personal information from the complaint including names, phone numbers, Social Security numbers and other identifiers.

Companies will also be given the opportunity to post a written response to the consumer’s narrative. According to the CFPB, in most cases the response will appear at the same time as the consumer’s narrative so that a reviewer can see both sides concurrently.

“Hearing directly from consumers in their own words about their problems with financial products and services is fundamental to our mission,” CFPB director Richard Cordray says in prepared remarks about the new policy. “It gives us a true compass, in real time, about the issues and problems that individual consumers find themselves facing in their financial lives…Today, by proposing to share people’s stories, we are giving consumers an opportunity to be heard by the entire world and not simply by a government agency and its officials.”

Consumer Financial Protection Bureau Proposal Would Give Consumers The Opportunity To Publicly Voice Complaints About Financial Companies [Consumer Financial Protection Bureau]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.