Despite Lessons From Great Recession, Few Consumers Save For Emergencies

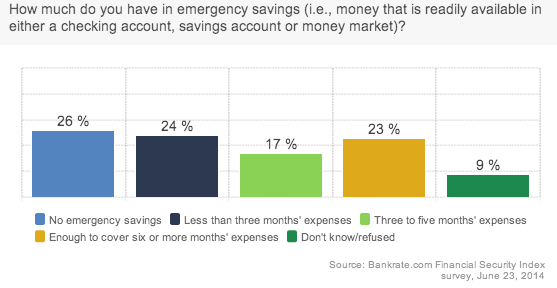

According to a new Bankrate survey, only 23% of consumers have the recommended emergency savings to cover six months’ of expenses in case they run into difficulties, such as losing a job.

In fact, nearly 26% of consumers have absolutely no emergency savings, while another 24% have enough to cover less than three months’ worth of expenses.

One might think that making more money would translate into a more robust savings account, but that’s not the case. According to Bankrate, of the consumers who make $75,000 or more a year only 46% have enough savings to cover six months’ worth of expenses.

So who is more likely to be saving for emergencies? Retirees. That age group was three times as likely to be saving as consumers ages 18 to 29. However, consumers 65 years of age an older say they feel less secure in their finances that they did a year ago, while nearly 32% of younger people feel more secure today.

With the Great Recession barely in the rearview mirror why are consumers not saving? The desire to deal with more near-term or tangible financial priorities. Additionally, financial experts tell Bankrate that it’s difficult for consumers to make progress on multiple goals such as saving for college, a house or retirement.

That’s exactly the case for Mary, a 33-year-old attorney in North Carolina. She and her husband have enough saved to pay three months of their mortgage, but the majority of their finances go toward paying down their college-related debt and childcare.

“The other financial obligations weigh more heavily on us — so if I were to stay up worrying, it would definitely be about the other things,” she says.

While the Great Recession didn’t appear to make people save more – at least not this year – it did make an impact on other financial behaviors.

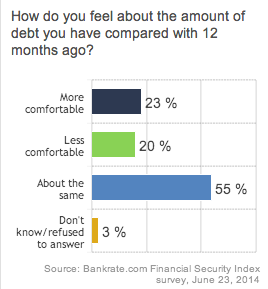

One financial expert says consumers used the recession as a wake-up call in terms of their debt levels. In fact, nearly 23% of Bankrate respondents said they were more comfortable with their level of debt today than they were a year ago.

One financial expert says consumers used the recession as a wake-up call in terms of their debt levels. In fact, nearly 23% of Bankrate respondents said they were more comfortable with their level of debt today than they were a year ago.

While many consumers might not be putting funds away for emergencies right now, that doesn’t mean they wouldn’t like to do so. Bankrate found that of those who were uncomfortable with the amount they had set aside for emergencies nearly half wish to boost their savings.

Financial Security Index: Saving for a rainy day [Bankrate]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.