FTC Asks Congress To Require Transparency From Data Brokers

(Mr Seb)

The fact that many consumers don’t know about these data miners is reason enough for the Federal Trade Commission to call for more transparency and accountability of the industry though legislation.

THERE NEEDS TO BE CHANGE

A new report [PDF] filed by the FTC Tuesday details how nine data broker companies, including Acxiom, CoreLogic, Datalogix and eBureau, collect and share the vast amounts of consumer information from the shadows.

“Data Brokers: A Call For Transparency and Accountability” points out that while consumers sometimes benefit from data brokers, industry practices raise a number of issues related to privacy concerns.

“The extent of consumer profiling today means that data brokers often know as much – or even more – about us than our family and friends, including our online and in-store purchases, our political and religious affiliations, our income and socioeconomic status, and more,” FTC Chairwoman Edith Ramirez said during a media call Tuesday. “It’s time to bring transparency and accountability to bear on this industry on behalf of consumers, many of whom are unaware that data brokers even exist.”

PROFILING EVERY ASPECT OF CONSUMER’S LIVES

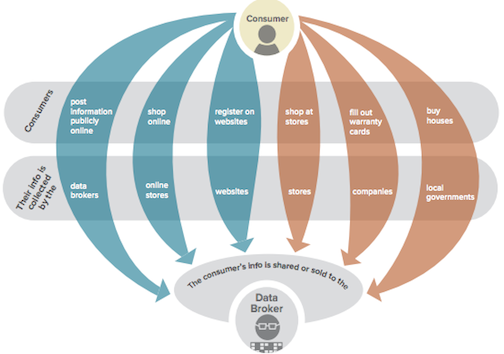

These data brokers collect and store billions of data elements for nearly all U.S. consumer through a variety of sources including social media, the Department of Motor Vehicles, retailers and more.

As consumers go about their business, data brokers may collect information about them. (Federal Trade Commission)

Acxiom, which provides data for marketing campaigns and fraud detection, reported to the FTC that its database contains information about 700 million consumers worldwide with over 3,000 stat segments for each U.S. consumer.

eBureau, which provides predictive scoring and analytics to marketers and finical services companies, reported that it adds over three billion new records each month.

THE TROUBLES WITH BIG DATA

The information, once sold to any number of different data brokers, is used to place consumers into categories such as “Dog Owner” or “Winter Activity Enthusiast,” neither of which seems especially threatening. However, some consumers are placed into potentially sensitive categories based on ethnicity, income levels and health issues, such as “Urban Scramble” and “Mobile Mixers” which are used to include high concentrations of Latinos and African-Americans with low incomes.

“These troubling classifications relate to how data broker information is uses,” Ramirez said during a media call. “Does this mean many among us will be cut off from goods and services that are offered to our neighbors? Will consumers not mind if they are put into a diabetes group if they get coupons for sugar-free products, but would they care if insurance companies use this information to list them as high risk?”

Moreover, if a consumer’s information is incorrect their options are very limited. The report found that for risk-mitigation products – often used by a retailer to determine if a consumer’s transaction will be honored – many brokers do not provide consumers with access to their data or the ability to make corrections. When consumers chose to opt-out of having their data used for certain purposes, the report found that many brokers offer confusing and limited options.

RISKY FOR CONSUMERS, PROFITABLE FOR DATA BROKERS

Additionally, the information collected by data brokers can be an appealing target for hackers and identify thieves. The report found that this risk is elevated because some data brokers store consumes data indefinitely, even if it’s outdated.

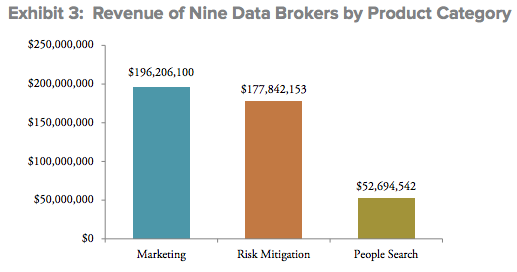

While data collection can be a risky business for consumers, it’s been profitable for data brokers. The nine brokers that participated in the FTC report combined for an approximately $426 million in annual revenue in 2012.

DATA BROKERS KNOW ALL ABOUT CONSUMERS, CONSUMERS SHOULD KNOW ALL ABOUT DATA BROKERS

To better protect consumers and to add a layer of transparency to data broker practices, the FTC has urged Congress to consider legislation that would lift the veil of secrecy from over the industry.

For data brokers that provide marketing products, the commission recommends the creation of a centralized portal that would require data brokers to identify themselves, describe the information they collect and use practices and provide links to tools and opt-out information.

Congress should also consider legislation requiring these data brokers to clearly disclose to consumers that they derive certain inferences from the raw data they obtain, such as placing consumers in groups based on income and ethnicity.

All data brokers should be required to give consumers access to their data at a reasonable level of detail and allow consumers to correct inaccuracies or opt-out of data uses.

The FTC also recommends that data sources, including consumer-facing entities such as retail stores, be required to give explicit notice to consumers that their information will be shared with data brokers. These entities should also provide the ability for consumer to opt-out of sharing.

Additionally, when a company uses a data broker’s risk-mitigation products that could limit a consumer’s ability to complete a transaction – such as check and credit card authorization machines – that company must be able to tell the consumer which data broker’s information was used.

Ramirez says the Commission hopes to work closely with members of Congress to enact the report recommendations.

While there currently is no legislation addressing data brokers specifically, she says other laws, such as the Fair Credit Reporting Act, implicate the activity of brokers.

“The FTC and other regulators have been diligent in monitoring data brokers and we will continue to enforce that and other privacy laws,” she said.

BIG DATA, BIG REPORTS

Data mining has garnered quite a bit of attention from regulators and legislators in recent months.

In March, the National Consumer Law Center investigated the inaccuracies in information provided by data brokers and reviewed the trustworthiness of products using this kind of data analysis.

The report found that while the data companies promised to make better predictive algorithms related to a consumers bankability, most of the volunteers found the information collected was inaccurate or contained incomplete information.

The Senate Commerce Committee published a report in December 2013 delving into the details of industry. The report also found that data brokers operated with minimal transparency and that no comprehensive list of data brokers exists.

Agency Report Shows Data Brokers Collect and Store Billions of Data Elements Covering Nearly Every U.S. Consumer [Federal Trade Commission]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.