More Families Are Saving For College, But It May Not Be Enough To Match Rising Tuition Costs

According to Sallie Mae’s annual “How America Saves for College” report [PDF], the average family now has a total of $115,604 saved in various forms. But while 51% of these families are saving for college, only 10% of their savings are going toward their kids’ education.

This year’s report, which surveyed 2,020 parents with children under 18 years of age, found that families’ increased their average college savings by nearly $4,000, or 30%, from the the previous year.

Families with teenagers have set aside an average savings of $21,416 for college. According to the latest College Board figures that’s enough to cover the $8,893 average tuition cost at an in-state public school but not enough to cover a single year’s tuition at private colleges ($30,094)or out-of-state residents attending public universities ($22,203).

Once again, parents say they strongly value higher education, with 89% of those surveyed saying that college was an investment in their child’s future. In fact, 90% of families are willing to stretch financially to given their child the opportunity to obtain a college education.

“The vast majority of American families – rich or poor- believe that a college education is an investment in their child’s future and are firm in their desire to have their children benefit from higher education,” the report says. “Despite difficult economic circumstances and the extensive public discussion about college costs, they remain steadfastly committed to the prospect of their children attaining a college degree.”

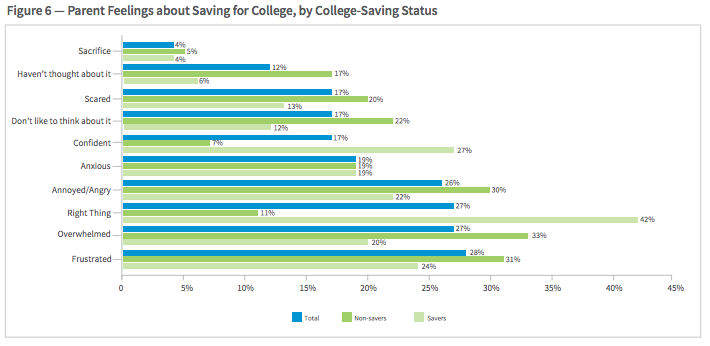

While nearly half the families with children under 18 years of age are saving for college, the other half are not, and for a number of reasons.

The primary reason for not saving is a lack of funds in general. The report found that families who aren’t saving for college are more likely to be in the low-income group and less likely to have earned a college degree themselves.

Saving for college isn’t the only planning parents are doing when it comes to their child’s future. The report found that 41% of families have started to research other options to pay for college.

That planning includes researching college costs, financial aid opportunities and borrowing alternatives. More parents are encouraging their children to study to increase the changes of scholarships and to enroll in Advanced Placement courses in high school to receive college credits.

Sallie Mae began issuing the survey in 2008 to determine how American families were planning for their child’s education.

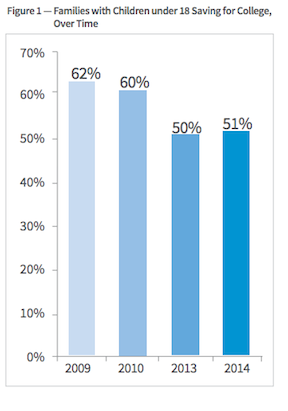

Following the recession, the survey found a significant decrease in families saving for college with the number falling from 62% in 2009 to 50% in 2013. This year, researches say the decline seems to be leveling off with 51% of families saving for the cause.

“Following a decline in the ability of American families to save for college, this year there has been an increase in savings among high- and middle-income families,” the report says. “While college-specific savings in low-income families has declined, their overall savings have gone up.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.