Bank Accidentally Deposits $31K In Account Of Teen, Who Promptly Spends It

The Athens Banner-Herald reports that a teen in Georgia is now in hot water after he went on a spending spree with a pile of money that wasn’t intended for his use.

It all began about three weeks ago, when the First Citizens Bank customer to whom the money does belong made a $31,000 deposit. Unfortunately for this customer, he’s apparently got a commonly used name (we’re guessing Ebenezer Von Tasselhound), so the bank teller goofed and deposited the money into the account of another Ebenezer Von Tasselhound at the bank.

When the real Von Tasselhound noticed that that his substantial amount of money wasn’t showing up in his account after 10 days, he contacted the bank, which realized it had gotten the many Von Tasselhounds confused, and that an 18-year-old with the same name had been the unwitting beneficiary of a bank error.

Meanwhile, Von Tasselhound the younger wasted no time in taking advantage of the bank’s goof, withdrawing some $20,000 in cash and spending another $5,000 using his debit card.

The teen subsequently tried to withdraw even more cash but by that point the bank knew it had mixed up its Von Tasselhounds.

The teller at the bank told the teen about the error and asked him to, ya know, return all those thousands in cash he’d taken out of the bank in the last few days.

Apparently not one to give in very easily, the teen insisted that the windfall was not an error but was an inheritance that was rightly his.

He even tried to repeat this claim when a sheriff’s deputy came knocking on his door to ask for the money’s return.

The teen reportedly promised the deputy that he’d promptly visit the bank to work out a deal that would get the money back in the First Citizens vault and keep the little Von Tasselhound from going to jail.

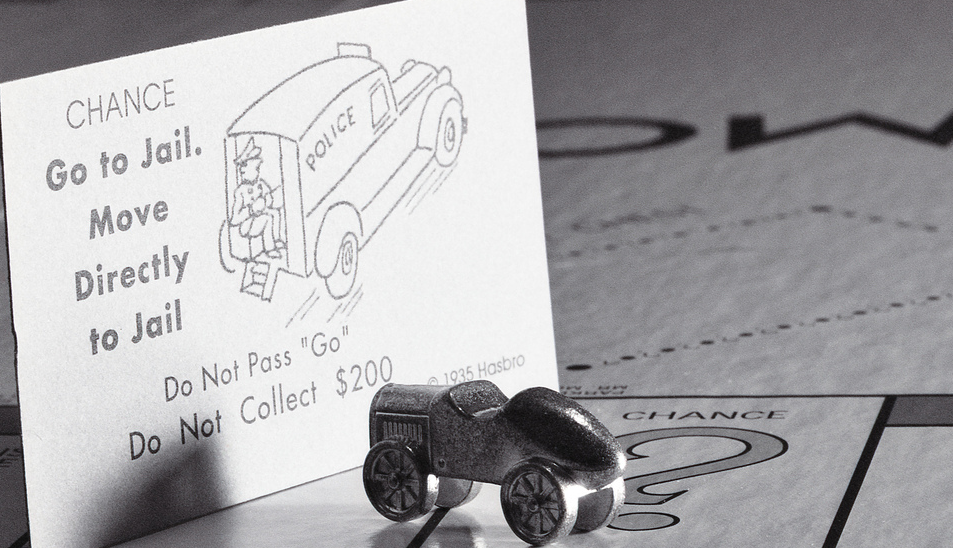

Alas, he has yet to make good on that promise and now officials are considering whether or not to prosecute.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.