Don’t Rack Up ATM Fees, Buy Hot Wheels Cars

The Bank of Hot Wheels is not literally a bank, nor is it licensed by Hot Wheels. It’s a life hack that Zach Bowman of Road & Track devised that avoids ATM fees and empty calories.

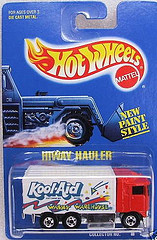

The plan is simple: instead of paying $3-5 in ATM fees, pop into the nearest grocery store, pharmacy, or discount store. You see, there are two things that all of these retailers have in common. “They offer no-penalty cash back,” notes Bowman, “and they sell Hot Wheels.” The cars cost $1-$1.50, depending on where you are. Pay with your debit card, selecting the “cash back” option. Pocket the cash and the car.

Yeah, yeah, you could buy a soda, a candy bar, or something that you actually need instead. A Hot Wheels car is just an example of a theoretical tiny and common item that you could buy that’s small, cheap, fits in a pocket, and contains no empty calories.

If you don’t like tiny cars, give it to your own kids or to a niece, nephew, friend or co-worker’s kid, or save it for a holiday season gift drive. Or keep it on your desk and drive it around making “vroom, vroom” noises with your mouth when no one else is in the office. We don’t judge. Any of these things is still better than paying fees to your bank when you don’t have to.

Beat ATM fees with my Hot Wheels lifehack [Road & Track]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.