BOfA Stops Overdraft-Friendly Practice Of Re-Ordering Transactions From High To Low

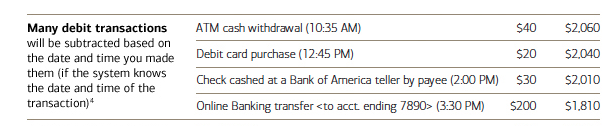

Time-stamped debit purchases will now be processed in the order in which they are made, not from highest-to-lowest in value.

A Consumerist reader noticed this page stashed away on the BofA website, indicating that the bank is now going to process multiple debit transactions in the order in which they are made.

Say a BofA customer has $500 in her checking account and in one day makes purchases for $450, $100, and $75. The way BofA currently processes transactions, the $450 purchase would go first, meaning both the $100 and $75 purchases would incur overdraft fees. If they had been processed low-to-high, as some lawmakers and regulators have called for, the $75 and $100 purchases would have gone through before the $450 charge, meaning the customer only faces one overdraft fee.

The new process would process the purchases in the order they are made, so the customer may still be hit with two overdraft fees in the above-described situation, but only if she makes that $450 purchase before either of the other two purchases.

There are some caveats, according to the BofA site. Purchases without a time-stamp will be processed in the ol’ high-low method. Since most consumers don’t know — or don’t think to find out — if a debit purchase is going to be time-stamped, there is no clear way of organizing one’s shopping day to minimize the damage from overdraft fees.

Except, of course, from simply avoiding overdraft altogether. Knowing exactly how much you have in your checking account is crucially important to staying out of debt, and overdraft availability should never be viewed as a reasonable form of credit, since many banks charge fees and interest rates on overdrafts that are in excess of the average credit card.

BofA does already automatically prevent overdrafting at the point of sale, and the bank is reportedly set to introduce a bank account that would not allow overdrafting of any sort.

According to a recent Pew Charitable Trust survey of best banking practices, around half of the country’s largest banks process transactions from high to low.

There is more information on the BofA policy change, which has been rolled out to various stages over the course of the last month, at the very bottom of this PDF.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.