In Vermont, Debt Collectors Can’t Seize Your Goats Or Bees, But Your Car May Be Up For Grabs

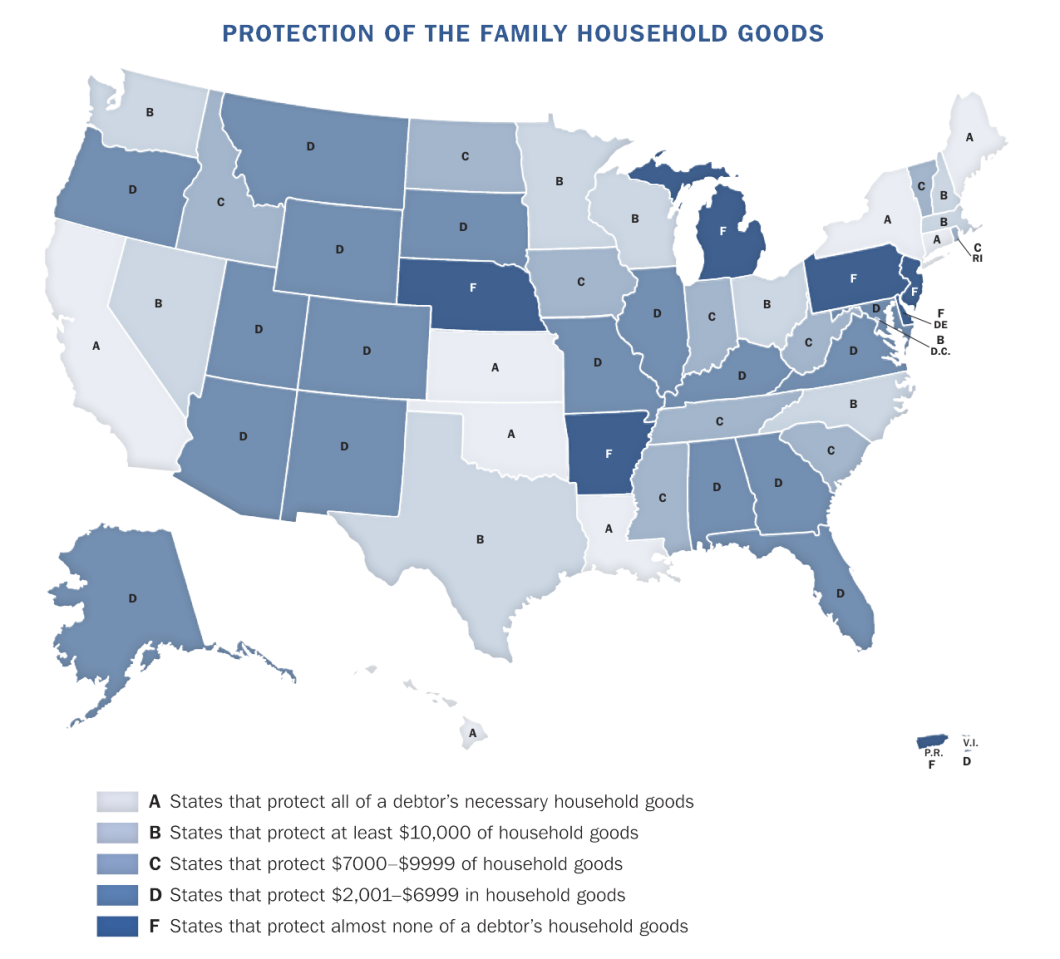

This map shows how each state’s exemption laws protect debtors from having necessary household goods seized. Click image for full-size (source: NCLC)

A new report from the National Consumer Law Center takes a state-by-state look at exemption laws, those rules governing what debt collectors can and can not lay claim to.

The report rates each state on its protections of five things collectors like to seize when they can — wages, vehicles, homes, necessary household goods, and cash.

For example, Pennsylvania gets an “A” when it comes to wage garnishment, as it is one of only four states that ban the garnishing of wages entirely for most consumer debts. The others are South Carolina, Texas, and North Carolina (if you’re supporting a family with those wages).

Meanwhile, Pennsylvania scores an “F” in all the other categories, as state law only protects a total of $300 for all household goods, cars, and other personal property. The Keystone State is also called out in the report for antiquated exemption laws that specifically protect Bibles, school books, sewing machines (so long as they are not held for resale), and military uniforms.

Another state with odd collections exemptions is Vermont, where debtors are entitled to hold onto one cow, two goats, and three swarms of bees, while any vehicle worth more than $2500 can be seized. It’s understandable, given the number of farmers in Vermont, why there might be exemptions for the cow, goats, and bees, as these can be vital, renewable sources of income. But what good is it having all money of milk, cheese, and honey if you can’t have a reliable vehicle in which to take it to market?

Not a single state scored an overall grade of an “A” over all the categories. Massachusetts, the recent subject of an exemption law overhaul, and Iowa each earned a “B+” overall grade. Other states with passable overall “B” grades were Nevada, New York, North Carolina, Oklahoma, South Carolina, Texas, and Wisconsin.

Bringing up the rear of the class were four states that shot the moon and scored overall grades of “F” — Alabama, Delaware, Kentucky, and Michigan. Not faring much better were Arkansas, Georgia, New Jersey, Pennsylvania, Utah, and Wyoming, each of which squeaked through with a “D–” overall grade.

NCLC is calling on the states to set the following standards for acceptable exemption laws:

• Prevent debt collectors from seizing so much of the debtor’s wages that the debtor is pushed below a living wage—a wage that can meet basic needs and maintain a safe, decent standard of living within the community;

• Allow the debtor to keep a used car of at least average value;

• Preserve the family’s home—at least a median-value home;

• Prevent seizure and sale of the debtor’s necessary household goods; and

• Preserve at least $1200 in a bank account so that the debtor’s funds to pay such essential costs as upcoming rent, utilities, and commuting expenses are not cleaned out.

Below is the breakdown of how each state scored on protections against wage garnishment. For details on each state’s laws, along with info and grades on the other categories, check out this PDF.

WAGE GARNISHMENT

A: Ban wage garnishment for most debts

North Carolina

Pennsylvania

South Carolina

Texas

B: Preserve 90% of debtor’s wages

Iowa

Missouri

New Jersey

New York

C: Protect enough wages for paycheck to remain above poverty level ($452.88/wk for family of four)

Alaska

Florida

D: Preserve more of a worker’s wages than required federal minimum, but less than enough to stay out of poverty

California

Colorado

Connecticut

Delaware

Hawaii

Illinois

Maine

Massachusetts

Minnesota

Nebraska

Nevada

New Hampshire

New Mexico

North Dakota

South Dakota

Tennessee

Vermont

Virginia

Washington

West Virginia

F: Protect only the federal minimum

Alabama

Arizona

Arkansas

Georgia

Idaho

Indiana

Kansas

Kentucky

Louisiana

Maryland

Michigan

Mississippi

Montana

Ohio

Oklahoma

Oregon

Puerto Rico

Rhode Island

Utah

Wyoming

Washington, D.C.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.