Auto-Title Lender Skirts Law By Giving Away Cash For Free

If you can’t pay back the 0% interest loan in full within 30 days, TitleMax refers you to an out-of-town lender that can refinance the loan at a triple-digit interest rate.

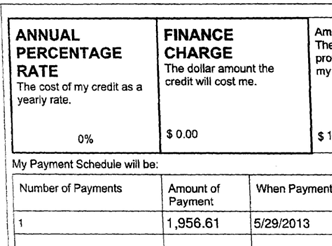

Here’s how it works, per the folks at ProPublica: A borrower in Dallas, Austin, or San Antonio visits a TitleMax location in one of those three cities and puts up his vehicle as collateral on a 0% interest, 30-day loan. He must pay the loan back in full before the end of those 30 days or that vehicle becomes TitleMax’s property.

Sounds pretty simple, right? You borrow money, have a hard deadline for repayment and lose collateral if you don’t repay. Where are all the triple-digit interest rates and revolving debt that people associate with auto-title loans?

Right there on page four of the contract.

See, while it’s against the local laws for TitleMax to charge the borrower huge amounts of interest to roll that first loan over into a new one, the contract gets around such laws by referring the borrower to any of the dozens of TitleMax locations not located in Dallas, Austin, or San Antonio. There the borrower will be allowed to repay the first loan with a new one at, in the case of the above-linked example, an interest rate of 310%.

“It’s a bait and switch,” Ann Baddour, of the non-profit group Texas Appleseed, tells ProPublica. “The practice may not be illegal, but it’s definitely unethical and unconscionable.”

While some will look at the 0% offer as an opportunity for free money, many people who take out auto-title loans are not in a position to pay back the loan in full after 30 days and must roll the loan over for several months before finally getting out from under.

In late 2012, the Texas Office of Consumer Credit Commissioner, the state’s regulator of payday and auto-title lenders, issued a bulletin voicing concern about the lack of transparency involved in TitleMax’s 0% interest model, saying it “effectively draws into a [credit access business] transaction a consumer who might not otherwise engage in one.”

“This business model could also be perceived as a deceptive practice because it appears calculated to bring the consumer into the store with the promise of one product, but later effectively requires the consumer to go to another location to purchase another product,” writes the OCCC. “The agency strongly urges any credit access business currently engaged in this practice to consider the legislative and legal consequences.”

While the OCCC bulletin does not name TitleMax, a rep for the office tells ProPublica it knows of no other lender offering a 0% deal, so it’s obvious that the bulletin is referring specifically to TitleMax’s business model.

This isn’t the first time we’ve written about TitleMax’s clever efforts to skirt laws. The company, with around 1,500 locations around the country, gets around the Military Lending Act — intended to prevent predatory lenders from providing short-term loans to servicemembers by capping interest rates on loans with terms up to six months — by referring borrowers to sister company InstaLoan, where they can get a high-interest installment loan that isn’t covered by the Military Lending Act because its terms are longer than six months.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.