More Than Half Of People With Student Loans Are Worried They Can’t Repay

The report [PDF] from the Urban Institute and the FINRA Investor Education Foundation, found concerns about the ability to repay across the board, even those borrowers who now earn what most people would describe as a comfortable living.

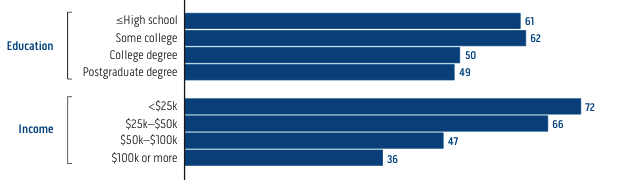

The highest level of concern was among borrowers who are currently earning less than $25,000 per year. A full 72% of these people say they are worried about being able to pay off their student loans. That number only decreases slightly to 66% when talking to borrowers earning between $25K to $50K per year. But even at the highest level of income on the survey — those earning at least six figures — there were repayment worries in 36% of borrowers.

One might assume that those with fancy degrees and letters after their names would be significantly less worried about being able to pay off their debt than those who didn’t achieve a higher level of education, but only 12 percentage points separate the entire range of education levels in this survey. The group with the most worried members (61%) are those borrowers with only a high-school education, who likely took out student loans to pay for non-college training or certification programs. While 50% of those with college degrees and 49% of borrowers with postgraduate degrees were concerned.

The Urban Institute numbers help to highlight the long-term worries about the current student loan situation. A higher number of students are graduating each year with more debt weighing on their shoulders. This burden has far-reaching implications that go well beyond the borrower’s bank account.

Another recent study found that 41% of younger people are not contributing to their retirement accounts because of student loan debt, while 40% have put off buying a car and 29% say they can’t buy a house. The economy has long relied on recent graduates to make these sort of investments, but a growing number of younger consumers have had to shift priorities in order to keep current on their student loans.

This means that these consumers will wait longer to begin saving or buy a house, which means they will need to work longer and may never have the finances to retire. The lack of savings also means that these people won’t have a safety net if they lose their jobs or come up against an expensive medical emergency.

There isn’t much one can do about current student loan debt, especially if the loans are private, as many private loans don’t allow for refinancing. Borrowers with federal student loans can look into income-based repayment options that tie your monthly payment to how much you earn.

But for parents and prospective students, there are things you can consider now before burdening the next generation with student loan debt.

THE RETURN ON INVESTMENT?

Numerous studies have shown that paying top-dollar for a college education does not guarantee that graduates will make a good living when they enter the real world. If you’re going to have to take on a massive amount of student loan debt, be sure that you’re not just doing it to say you went to a school with an impressive brand name.

COMPARISON SHOP

In addition to comparing the cost and post-graduation earning potential of possible colleges, you should also compare the schools’ financial aid offerings. A growing number of colleges are using the Dept. of Education’s new financial aid one-sheet [PDF] that makes it easier to judge aid packages side-by-side, rather than trying to decipher each school’s particular spin.

EXHAUST ALL YOUR OPTIONS

A large number of student loan borrowers are jumping right to higher-interest private loans without investigating lower-cost options, especially federal aid that generally offers lower interest rates and more repayment flexibility. There are also a large number of grant and scholarship opportunities out there for people willing to look. Why borrow money when people are willing to give it to you?

For both prospective students and those who now face the reality of repayment, the Consumer Financial Protection Bureau has created the interactive Paying For College guide to help people navigate these often confusing waters.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.