Regulators Ask Mortgage Marketers To Please Cut Down On The Lying In Their Ads Image courtesy of (FTC)

(FTC)

So today, the Federal Trade Commission and the Consumer Financial Protection Bureau issued warning letters to around dozen lenders and brokers — plus another 20 advertisers with mortgage-related businesses — that their ads could be in violation of the law and could they pretty please just stop with all the misleading nonsense — or face a less friendly letter.

In fact, says the CFPB, it’s already launched formal investigations into six companies it believes may have seriously violated the law.

In addition to reviewing ads that were the subject of complaints directly from consumers, the CFPB and the FTC went through around 800 mortgage-related print, online and mailed ads — for loans, refinancing, reverse mortgages — to look for violations.

Though both agencies have enforcement authority for the rule, the two groups divvied the work up, with the CFPB focusing mainly on mortgage advertisements, particularly ads targeting older Americans and veterans, while the FTC reviewed ads placed by home builders, realtors, and lead-generating companies.

The warning letters highlighted at least one of the following four possible violations:

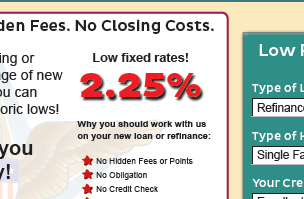

Potential misrepresentations about government affiliation: Some ads are marked with symbols, seals and names of government organizations that may mislead consumers into inferring a government affiliation.

Potentially inaccurate information about interest rates: The ads tout remarkably low “fixed” rates but provide insufficient information regarding the terms related to that rate.

Potentially misleading statements concerning the costs of reverse mortgages: Some ads for reverse mortgage products claimed the consumer will have no payments in connection with the product, even though consumers with a reverse mortgage are commonly required to continue to make monthly or other periodic tax or insurance payments, and may risk default if the payments aren’t made.

Potential misrepresentations about the amount of cash or credit available to a consumer: Some ads came complete with a mock check and/or suggested that a consumer has been pre-approved to receive a certain amount of money in connection with refinancing their mortgage or taking out a reverse mortgage. In truth, there are still numerous steps to follow and hoops to jump through before the consumer would qualify for the loan.

The warning letters give the advertisers a chance to review and clean up their act. We imagine that some will fall in line, while others will either come up with reasons to justify why their ads do not violate the rules.

Since neither agency is naming the businesses that are being warned, we can’t highlight specific ads that are problematic.

If you see an ad for mortgage-related product that you think violates the law (click here for the full text of the rule), you should file a complaint with the FTC.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.