Students & Families Getting Screwed Because Schools Won’t Adopt Standard Financial Aid Letter Image courtesy of The Dept. of Ed form not many schools are using.

In their current forms, many of these letters lump all aid, whether loans, grants, or scholarships, all under one heading. Confusing matters worse, Pro Publica reports that schools often include Parent PLUS Loans, a federal program to lend parents money to pay for costs not covered by aid.

To the uninitiated, looking at a financial aid letter like this one [PDF] from Pace University in New York, it would appear as if the various financial aid being offered covers all but $2 of the expected annual $54,982 cost of attendance.

In fact, the aid package includes $18,930 in PLUS loans, which the parent begins paying interest on immediately and for which the parent may ultimately be denied.

The text and fine print of some of these letters does clarify that PLUS loans are only a suggestion and that the parent may borrow more or less than the stated amount. But they are still bundled into the larger aid amount, making it complicated for families to properly compare schools.

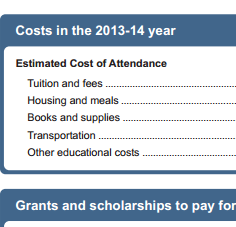

In 2011, the Dept. of Education announced a standard financial aid letter [PDF] that breaks out all forms of aid. The cost of attending is at the top, followed by grants, scholarships and any other aid that is not to be repaid. This is subtracted from the cost in the line that reads “What You Will Pay For College.” Only then does the form mention the loans, which are broken out into loans the student would be responsible for repaying and family contributions like PLUS Loans.

Unfortunately, after a year in existence, only 312 institutions had adopted the form. That only accounts for about 10% of all undergraduate students.

Minnesota Senator Al Franken sponsored legislation in May that would make the form required for all schools. It would also require the form to include some of the information that had been originally been suggested by the Consumer Financial Protection Bureau — interest rates and expected monthly payback rates — but which were dropped in the final version. Alas, that bill appears to have stalled in committee.

So to all parents and prospective students, we suggest that when you get those financial aid letters in a few months, you take a blank version of the Dept. of Education form and use that as a template for breaking down the information presented by each school. This will help give you an apples to apples comparison, rather than having to parse the language of each letter and hope you’re getting it right.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.