Ads For Controversial Car Insurance Initiative Feature “Real People” From PR Company Hired To Promote Measure Image courtesy of "We are real PR company employees"

The woman featured in this ad says she’s a recent college grad who lives at home with her parents:

Maybe everything she claims is true, but the folks at Consumer Watchdog point out what the ad doesn’t mention: That she apparently works for this company, which has been hired to do publicity for the campaign.

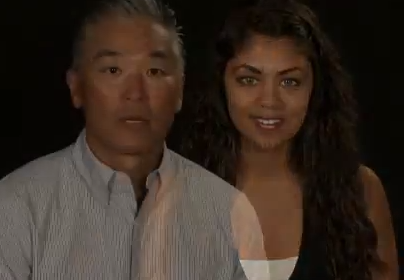

She pops up again in this ad, along with at least two more people from the same company:

Because campaign finance law requires advertisers to declare if people in the ads are paid spokespersons, Consumer Watchdog made its own video that highlights additional ads featuring apparent PR shills:

Prop 33, which is an update of a failed initiative from a couple years ago (Prop 17), is mainly backed by one billionaire, George Joseph, owner of Mercury Insurance. It would allow for insurance companies to a “continuous coverage” discount for drivers who have had insurance for the previous five years, regardless of whether it was with the same company or not.

Opponents of Prop 33 say that it will result in higher rates for people who dropped insurance while experiencing long-term unemployment, or who decided they didn’t need insurance for a few years because they could commute to work without a car.

“All drivers will be hurt,” writes the San Francisco Chronicle, “because charging higher prices to people who don’t already have insurance means more drivers will go uninsured because they can’t afford coverage. That increases uninsured motorist premiums for everyone.”

The L.A. Times recently came out against Prop 33, saying it shifts the main focus of rate calculation away from a driver’s record.

“[B]ecause there’s no relationship to risk, the discount would be equally available to bad drivers and good ones,” writes the Times.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.