Before snapping photos of her money order with Bank of America’s mobile deposit app, April took the time to make sure that money orders were permitted. She lives 200 miles away from the nearest Bank of America (yes, there is such a place in this country) and can’t go to a branch or ATM to deposit it. The app’s “help” section said that money orders are totally allowed, so she went ahead with the deposit. They rejected it, and customer service told her that money orders can’t be deposited with the mobile app. Well, fine. Maybe she’ll just go ahead and deposit that money order at a bank that’s local to her.

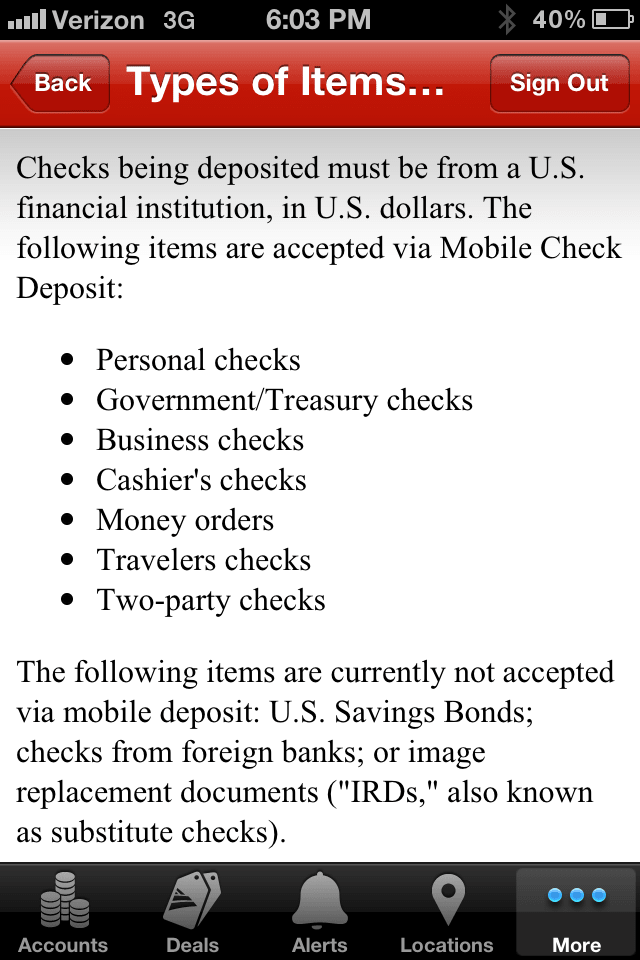

Today, I attempted to deposit a money order via Bank of America Mobile Deposit, after thoroughly checking in the Help section under “Acceptable Items” that Money Orders were, indeed, able to be deposited in this way.

When my clear, well-lit, well-framed photos were returned as “Cannot Be Read” several times, I contact customer support, who informed me that, despite the very clearly worded information available in the app’s Help menu, ONLY checks can be deposited this way, and I would need to travel to a BofA location to deposit my money order.

Now, I moved to Montana from Massachusetts recently and have only kept my 8-year-old Bank of America account despite their lack of locations in this and many neighboring states because I am able to deposit checks via Mobile Deposit. (The nearest ATM or Branch is over 200 miles away.) When I pointed this out to the Customer Service rep and said that these sorts of oversights and misinformation could result in closing my account, she told me they wanted to keep me as a customer but could offer no alternative solutions.

We sent an e-mail to Bank of America’s media contact to see whether they know what the mobile deposit policy on money order is, because the app designers and their own customer service staff clearly don’t agree.

Editor's Note: This article originally appeared on Consumerist.