American Express Payment Plans Won't Do Your Credit Any Favors

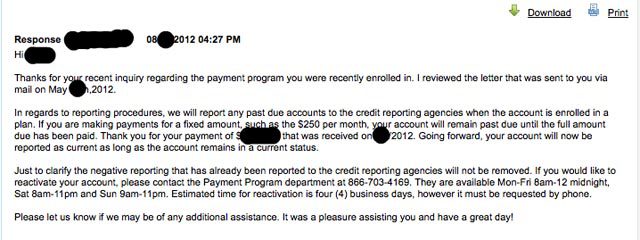

Ryan was in a tight spot, and late with the payment on his American Express account. The problem didn’t seem as scary as it could have been, though. The company’s Web interface offered him the opportunity to sign up for a payment plan, so he could pay down the outstanding balance over a period of as long as twelve months. Neat! But the plan didn’t quite have the credit-saving effects that he expected. He was reported to credit bureaus as delinquent during the entire repayment period. That’s how the plan works.

Wouldn’t you think that signing up for an AmEx-approved and Amex-administered payment plan means that they report back that your account is in good standing? Not so. Effectively, all signing up for a payment plan did for Ryan was keep the company from pestering him with collection letters and calls. It took him three months to pay off the entire balance, and the net effect on his credit report is the same as it would have been if he had stuffed all of that money under his mattress for three months.

If you are late for a payment, and are going to have trouble making it in a reasonable amount of time, calling American Express for a payment plan might not be the best idea.

I was behind on a payment and used their web interface to select a 12 month payment plan, including interest charges, to keep my account in good standing.

They did not tell me that they planned to report my account to the credit agencies as ‘past due’ for the duration of that payment plan. I fortunately paid it off well ahead of the plan, but it still looks just the same on my credit as if I completely ignored them and didn’t pay the bill for three months.

If someone is tempted by one of these offers, I hope they will be able to find this and make their decision accordingly. If I hadn’t enrolled in the plan, and just paid the total bill two weeks later, there’s a very good chance nothing would have been reported.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.