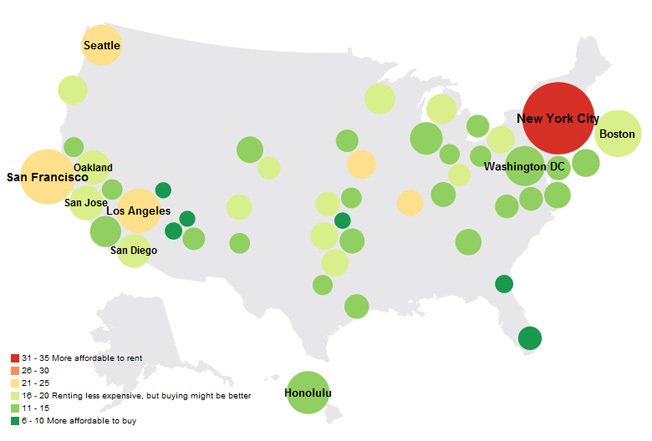

Pretty Circles Tell You Whether To Rent Or Buy

(Trulia)

For those who don’t like math but do like colored circles, here’s a graphic visualizing which cities it’s cheaper to buy in and which it’s cheaper to rent in. The redder the circler, the better it is to rent. The greener, the better it is to buy.

It’s calculated based on the rent to buy ratio, which compares the median list price with the median rent on two-bedroom apartments, townhomes, and condos.

Check the Trulia site for more cities, as well as comparisons based on unemployment, foreclosure and job growth rates.

Trulia’s Q1 2011 Rent vs. Buy Index [Trulia]

RELATED

This Number Tells You Whether You Should Buy Or Rent Your Home

Calculator Tells You Whether to Rent Or Buy

Is it Better To Buy or Rent?

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.