Subprime Credit Cards Are Back, Now With Extra Interest!

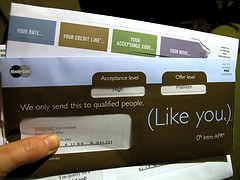

After a couple years of hiding in the shadows, credit cards targeted at consumers with less-than-stellar credit ratings are once again making a push to gain new customers.

According to SmartMoney.com, the number of credit card solicitations being sent out to the safest group of subprime borrowers — those with FICO scores between 620 and 660 — has risen up to 300% since June.

Lenders like Capital One and HSBC are jumping back on the subprime credit card bandwagon, saying they are just trying to help consumers out by extending credit to a larger group of borrowers.

It doesn’t hurt that subprime borrowers generally generate more fees and pay higher interest rates.

Experts say the banks are betting that many of the people in this higher end of the subprime category aren’t really the risks they appear to be on paper.

From SmartMoney:

Some borrowers, for example, might fall into this category because their credit lines were previously slashed or they fell behind on paying bills after a temporary job loss. For its part, an HSBC spokesman says the bank is “selectively increasing marketing activity” across its credit card business–including to subprime borrowers– as “credit conditions improve.”

But the lenders are also hedging their bets on this new group of subprime borrowers, who will have an average interest rate of around 20%, up from around 17.6% a year ago. Meanwhile the average credit lines remain about the same low level of $300 to $500.

But where it had previously taken a full year of on-time payments to get an increase on one’s credit limit, it should now only take about six months says SmartMoney.

The story says that if you’re just looking to improve your credit score by getting a credit card, it might be better to get a secured credit card, where the credit limit is equal to the amount of money the depositor hands over to the lender. These cards generally have lower interest rates and the activity on secured cards is reported to credit bureaus just like regular credit cards, meaning consumers can build credit with on-time payments and low balances.

Subprime Credit-Card Offers Pick Up [SmartMoney.com]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.