You're Paying Oil Pipeline Owners' Income Taxes

Investigative reporter David Cay Johnston has discovered a dirty little tax secret pipeline owners would like to keep more hidden than a giant plume of oil under the ocean. Turns out that when you pump gas into your car, you’re actually paying oil pipeline owners’ income taxes.

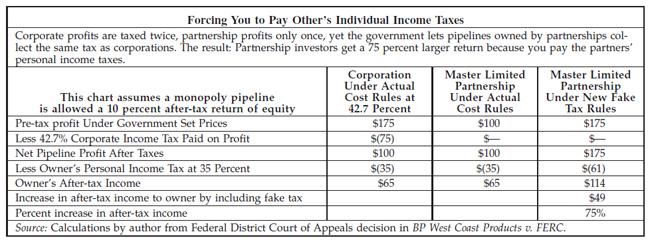

Pipelines are a legal monopoly and the rates they charge are regulated by the government. Checking out Federal Energy Regulatory Commission pipeline policy rules, Johnston found that the government has always counted the corporate income tax on pipeline profits as a cost of doing business, and included it in the price pipelines charge, but it’s never included the individual income taxes of the pipeline owners.

Since 1986 most pipelines have converted from corporations to partnerships. Corporations pay taxes on their profits. Partnerships don’t.

Which means you, the consumer, are paying their income tax.

(Chart: David Cay Johnston)The net result is that partnership investors get a 75% larger return. Pretty sweet deal, no wonder Barron’s keeps touting these “master limited partnerships” as a great investment opportunity. Note especially the first two sentences, which I have bolded for your convenience:

(Chart: David Cay Johnston)The net result is that partnership investors get a 75% larger return. Pretty sweet deal, no wonder Barron’s keeps touting these “master limited partnerships” as a great investment opportunity. Note especially the first two sentences, which I have bolded for your convenience:

IT MAY TAKE YEARS for the shotgun marriage of Washington and Wall Street to pay off for taxpayers, who are footing the wedding bill. But some partnerships — master limited partnerships — are offering double-digit returns today.

MLPs, as they’re called, typically invest in energy assets, such as oil fields and natural-gas processors. Most of their profits are passed along to their investors as juicy tax-deferred distributions, and the yields for many now hover near 11%.

Master Limited Partnerships: Paying Other People’s Taxes [Tax.com]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.