Revealing The Hidden Cost Of PrePaid Debit Cards

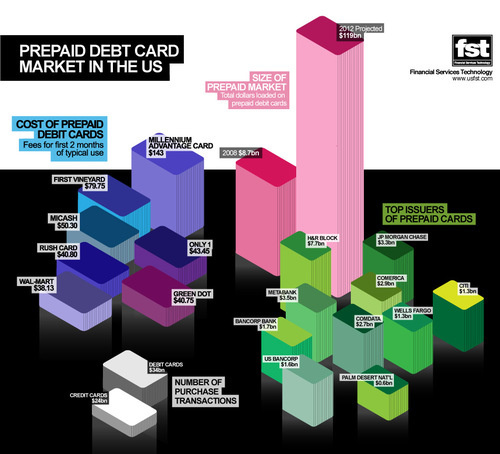

With credit cards harder to come by and more annoying to use, the prepaid debit card market is projected to explode from $8.7 billion loaded on the cards to $119 billion in 2012, but a good chunk of that is going to be eaten up by hidden fees and gotchas. This sexy graphic visualization shows how.

Fees like:

Fees like:

$1.75 for each ATM withdrawal

$1 for each ATM balance inquiry

$.50 for each purchase

$4 monthly maintenance charge

Prepaid debit cards are a way for people who can’t or won’t get a banking account to do ATM withdrawals, make purchases online and to buy stuff without carrying cash around. But the hidden fees and sparse regulation can mean the unbanked get jacked once again.

The real cost of prepaid debit cards [FST] (Graphic by GDS Digital)

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.