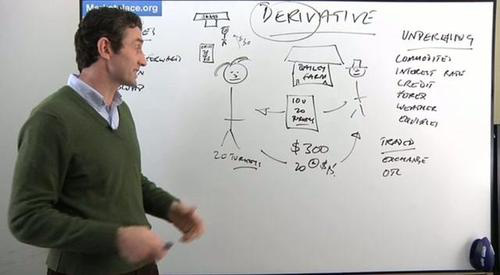

VIDEO: Derivatives Are Sort Of Like A Pre-Ordered Turkey

The business and financial news are full of something called “derivatives.” But, okay, what is that? You’re not the only one who’s wondering. That’s why Paddy Hirsch from the public radio program Marketplace put together a whiteboard, some stick figures, and a bunch of metaphorical turkeys to explain it all to us.

Derivatives from Marketplace on Vimeo.

Derivatives [Marketplace]

(Photo: Seansie)

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.