The Article Cash4Gold Doesn't Want You To Read

By Ben Popken and Meg Marco

If you have any broken, ugly jewelry lying around in a drawer somewhere, you’ve probably taken notice of a company called Cash4Gold that promised to pay “top dollar” for your not-so-precious precious metals. If you’re like us, you might have even seen a post on ComplaintsBoard.com by a former employee exposing Cash4Gold.

The whistleblower’s post appeared on ComplaintsBoard last November. We featured it this February, as part of our ongoing coverage of Cash4Gold, after the company raised its public profile with a multi-million dollar Super Bowl ad. The post was indeed written by an ex-employee, Michele Liberis, who is now being sued by the company for defamation. Recently, Cash4Gold added Consumerist and ComplaintsBoard as co-defendants in its lawsuits (PDF) against Liberis and another former employee, Vielka Nephew (PDF), in an attempt to force us to take the information down. Liberis and Nephew have chosen to stand up to Cash4Gold’s legal attack, and so have we.

We believe citizens, consumers, and employees should be able to exercise their free-speech rights online , and journalists should be able to report on those efforts without fear of intimidation. That belief is at the core of what makes Consumerist tick. And it’s what keeps the internet from being just a brochure with hyperlinks. Below, more about this episode and what goes on behind the public facade of a company that bills itself as “World’s #1 Gold Buyer.”

Why did Michele Liberis, a 28-year-old single mother of two, decide to blow the whistle on a company that has a history of taking actions to silence its critics? It started last fall when she learned that a friend was considering selling some jewelry to Cash4Gold. Liberis had recently been fired from her job in the customer service department with the Pompano Beach, FL-based company. In its lawsuit against her, the company says she was fired in part due to “chronic absenteeism without adequate excuse” and a “disruptive attitude.” Liberis says the only blemish on her record that she is aware of is that she parked in a reserved area on one occasion. Whatever the case, while employed there from early June to early October 2008, she got a first-hand look at how the company manages to pay customers a fraction of what their gold is worth. Liberis wanted to help her friend avoid what she saw as a mistake.

Why did Michele Liberis, a 28-year-old single mother of two, decide to blow the whistle on a company that has a history of taking actions to silence its critics? It started last fall when she learned that a friend was considering selling some jewelry to Cash4Gold. Liberis had recently been fired from her job in the customer service department with the Pompano Beach, FL-based company. In its lawsuit against her, the company says she was fired in part due to “chronic absenteeism without adequate excuse” and a “disruptive attitude.” Liberis says the only blemish on her record that she is aware of is that she parked in a reserved area on one occasion. Whatever the case, while employed there from early June to early October 2008, she got a first-hand look at how the company manages to pay customers a fraction of what their gold is worth. Liberis wanted to help her friend avoid what she saw as a mistake.

As she told Consumerist:

“She [the friend] knew something was odd but it just sounded so good. When I sat down and told her everything that we did, you know, it was like, ‘Wow.’

Like, she would have never thought, you know? So I was like, “Well, if she would have never thought, who else? Who else would have never thought?”

That’s when she discovered ComplaintsBoard, a Web site that specializes in hosting consumer beefs.

“I thought this was a fair site, you know, for me to write down what I need to write down on what I know. I’m not a blogger, I’ve never blogged. I didn’t even think what I was doing was blogging. I just kinda did it because it’s a place where you could put your complaints. So I wrote down everything I did and I saw.”

We were unaware of the post when it went up, but Cash4Gold was already on our radar. We wrote about them in October, after Rob Cockerham’s Cockeyed blog posted an item about Cash4Gold offering an individual $60 for gold that a local pawnshop valued at $198. When the gold owner called Cash4Gold to complain, the company rep immediately nearly tripled the offer to $178.

A few weeks afterward, Cockerham got two emails from a marketing consultant working with Cash4Gold. The consultant wanted to know if Cockerham would agree to a “financial arrangement” to “de-optimize” his post so it wouldn’t appear so high on Google – or just take the post down for “a few thousand dollars.” Cockerham didn’t take the consultant up on the offer, but did post both emails on his site. Various media outlets, including ours, ran the story.

Cash4Gold’s previous tv ad

Back then, Cash4Gold was just another company promoting deals of dubious value on late-night TV and the Web. That changed in February, when Cash4Gold ran a 30-second commercial on the Super Bowl. The ad, reported to have cost $2.4 million, featured M.C. Hammer and the late Ed McMahon. The two celebs appeared to sell off valuables, including a solid gold toilet, to make ends meet. Gold fetched over $900 an ounce at the time, and the ad attracted public and media attention.

Cash4Gold’s Super Bowl Ad

The day after the game, we found Michele Liberis’ anonymous whistleblower post. Liberis’ allegations were detailed enough to be credible. Moreover, they were supported by a pattern of statements about the company that could be found on the Internet and in the media, ranging from low-ball offers with little time to respond to allegations of lost jewelry. For example, in one report by an ABC affiliate from November 2008, a reporter said she waited two weeks to get a Cash4Gold check, and then got the company to nearly triple its original offer. The final offer was still less than half of what the reporter said a local pawn shop offered her. We felt Liberis’ post was newsworthy, and we published it under the headline “10 Confessions of a Cash4Gold Employee.”

We weren’t the only news organization with questions about Cash4Gold. In February, the Los Angeles Times published a report titled “Beneath Cash4Gold.com’s shiny veneer, a dull reality.” Yahoo! Tech warned readers that Cash4Gold customers are likely “getting the short end of the stick.” In March, CEO Jeff Aronson told ABC’s Good Morning America that Cash4Gold was a “service business” that doesn’t pay the highest price for gold but offers “convenience and ease.”

Less than two weeks after we ran Liberis’ anonymous “10 Confessions,” we received our first letter from the company’s lawyers. (The company also sent letters to Yahoo!, the LA Times and reportedly a number of blogs.including some that had linked to or referenced Liberis’ post.) The letter to us asserted that the post by Liberis was “false and defamatory” and that we should “immediately remove” our coverage of it, and “block further posting.”

We decided not to remove the post, and instead replied with a 2,400-word request for additional details that might back up Cash4Gold’s claims. Reason: we felt that killing a post we deemed to be both credible and newsworthy would be a disservice to our readers and a betrayal of our responsibility as consumer journalists.

In that letter, and in several follow ups, we’ve asked Cash4Gold and its lawyers for evidence to support their broad assertions of falsehood. We’ve also lauded the company for starting its own blog, and pushed it to continue to join “the public debate” about these issues.

Instead, Cash4Gold has pursued a take-no-prisoners approach against Liberis and her former colleague Nephew. The company sued both women, who, until recently, had no legal representation. Both now await the outcome of court cases that could lead to escalating fines and perhaps even jail time based on contempt charges. For our part, we’ve continued to research the story. Since Cash4Gold’s original challenge, we’ve talked to Liberis and Nephew, Cash4Gold customers, the Better Business Bureau, the Pompano Beach fire department and the U.S. Postal Service, among others. We’ve dug through numerous web sites, legal documents, complaints to the Florida Attorney General and public records. We’ve also tried to interview Cash4Gold’s CEO, Jeff Aronson, though without success. Bottom line: the available evidence from the time Liberis was working at Cash4Gold provides ample and compelling support for her 10 points. Here’s why.

LET’S MAKE A DEAL

To understand the basic deal that Cash4Gold offers, we turned to Consumer Reports’ “mystery shoppers”, the nationwide team of anonymous consumers who help buy the gear that our parent company tests. The mystery shoppers sent 24 identical gold pendants and chains to Cash4Gold and some of its national competitors. The necklaces were purchased for $175 each. We calculated their “melt value”, which is how much the raw gold was worth, as about $70 each, based on the market price for gold when the necklaces were received by the companies (during the test period, the price of gold fluctuated, but never dropped below $900 an ounce).

To understand the basic deal that Cash4Gold offers, we turned to Consumer Reports’ “mystery shoppers”, the nationwide team of anonymous consumers who help buy the gear that our parent company tests. The mystery shoppers sent 24 identical gold pendants and chains to Cash4Gold and some of its national competitors. The necklaces were purchased for $175 each. We calculated their “melt value”, which is how much the raw gold was worth, as about $70 each, based on the market price for gold when the necklaces were received by the companies (during the test period, the price of gold fluctuated, but never dropped below $900 an ounce).

Our tests, which lasted from May through early July, found that Cash4Gold and its competitors offered simple and relatively transparent service. Online tracking systems were updated promptly, the companies generally mailed out checks within a day or two, and customer service reps were courteous and professional. The actual offers, however, were miserly. Cash4Gold sent back checks ranging from $7.60 to $12.72 (or 11% to 18% of melt value), the lowest amounts of any firm. But others weren’t far behind: GoldKit offered $7.81 to $20.59, and GoldPaq $8.22 to $13.11. Each of those deals was worse than what our mystery shoppers could get at local jewelers and pawn shops, which offered anywhere from $25 to $50. The results reinforce advice we’ve offered before, which is that consumers should not use these highly marketed services because the payments they offer are too low. No matter how nice the person is who gives it to you, a bad deal is still a bad deal.

Cash4Gold declined to discuss the test results, but other news reports suggest lowball checks are typical. CEO Aronson has said the company pays from as little as 20% to as much as 80% of the gold’s value. And in an interview with Good Morning America, he suggested that customers who want more money should take their business elsewhere. “If all you care about is the net dollar, and you’re willing to go to the seedy part of town, and you’re willing to travel around … I want you to go there,” Aronson said.

Nightline interviews Cash4Gold CEO Jeff Aronson

All this stands in contrast to Cash4Gold’s advertising claims. While its website acknowledges that a jeweler or a pawn shop might offer more, one TV ad boasts “With gold, silver and platinum at their highest value in decades, Cash4Gold.com is able to give you top dollar for your unwanted jewelry.” The same ad goes on: “Because we own our refinery, we can cut out the middleman, which means more cash in your pocket.” But we have trouble squaring that “top dollar” claim with the offers we got, suggesting that Liberis was justified in warning her friend, and alerting the internet.

All this stands in contrast to Cash4Gold’s advertising claims. While its website acknowledges that a jeweler or a pawn shop might offer more, one TV ad boasts “With gold, silver and platinum at their highest value in decades, Cash4Gold.com is able to give you top dollar for your unwanted jewelry.” The same ad goes on: “Because we own our refinery, we can cut out the middleman, which means more cash in your pocket.” But we have trouble squaring that “top dollar” claim with the offers we got, suggesting that Liberis was justified in warning her friend, and alerting the internet.

THE CONFESSIONS RING TRUE

We also delved into Liberis’ specific allegations. At one point, for example, her post asserted that Cash4Gold “was temporarily closed recently due to health and code violations.” In its blog, Cash4Gold says this is “entirely false.” Yet a check with the Pompano Beach Fire Prevention Bureau turned up numerous citations (PDF) at Aronson’s business location at 1701 Blount Rd., where Liberis worked. These included having no fire alarm system, fire extinguisher violations, blocked exits, exposed wiring, compressed gas cylinder violations, and items stored too close to electrical panels. Fire inspector Aaron Efferstein adds that they had three fires at the location, including one that set the roof ablaze.

Police report on Cash4Gold’s 10/03/08 shutdown by city inspectors

Each of these issues was eventually remedied, Efferstein says, except for the sprinkler system. He says Aronson and the building’s owner couldn’t agree on who was going to pay for it, and so after repeated delays the fire department shut down the site. Cash4Gold is now in a new Pompano Beach location, 2800 Gateway Drive, where Efferstein says there have been no compliance problems. “I gather they’ve learned their lesson because they’ve been pretty good where they’re at,” he said.

Another of Liberis’ statements: Her post said that “although the payment (check) for your item is dated within 24 hrs of testing your jewelry, we SOMETIMES DO NOT actually send out the check until up to 3-4 days later.” On its blog, Cash4Gold countered that an audit showed that 100% of the company’s checks are dated the day they’re sent out.

Our mystery shopper test turned up no problems with mailing time, at least now. But there are many indications, aside from the aforementioned ABC affiliate report, that the company’s performance hasn’t been so good in the past. In fact, Brodie White, President of the Better Business Bureau of Southeast Florida and the Caribbean, says delayed checks, low payments and lost packages are among the most common complaints he’s received about Cash4Gold. Why were late checks a problem? “When [the customer] got the check, the time to execute the refund policy was either over or about to expire.” The BBB currently rates Cash4Gold a C on its A+ -to-F rating scale, but White said the company has been rated as low as a D-, and that the BBB revoked its membership.

Complaints about late checks, which also turn up in the Florida Attorney General’s files, suggest that Liberis was right that there were at least occasional delays in getting checks out during her time at the company.

Other Liberis statements are verified by Cash4Gold’s own blog. The first of the “10 Confessions” refers to the fact that the “refiner’s pack”, the prepaid envelope used to ship gold to the company, is insured for up to $100, based not on an actual appraisal, but on a description provided by the customer. In its action against Liberis, the company included this statement among those it deemed “false and defamatory.” Cash4Gold’s blog, however, declared: “This is correct.”

Another statement pointed out that, at the time Liberis was employed there, Cash4Gold customers would have to pay a shipping charge to have items Cash4Gold didn’t want returned to them. Suit against Liberis: “False and defamatory.” C4G blog: “…Cash4Gold did charge for returns at one point. …”

BUT WAIT, THERE’S MORE

Liberis paystub showing bonuses

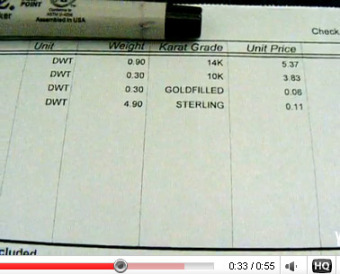

Finally, Liberis outlined a bonus system where customers who objected to tiny checks were immediately offered two to three times as much cash. As she describes it, reps got a $15 bonus for getting a customer to accept less than double the first check. And they got $10 for keeping the payout under three times as much. Liberis provided paystubs showing her earning as much as $815 in bonuses over two weeks, nearly doubling her pay of $906 for the period. Nephew also confirmed details of the system.

The company’s blog disputed these claims, saying that, “… customer service representatives have received bonuses, but they are based on the number of calls, abandon rate and customer satisfaction.” However, in the Nightline interview, Aronson admitted the company used to negotiate with dissatisfied customers. “It was something that I would do to make the customer happy,” he said. “And if it came off negatively, we have stopped it completely at this point.” Despite this assertion, a Cash4Gold rep did offer one of our mystery shoppers a slightly higher price when she complained, which would have brought the total of the company’s best offer to 29% of melt value.

We think Liberis’ and Nephew’s descriptions are credible. The logic of such a system is this: If the customer simply accepts the original check, the company can make a hefty margin, as much as 80%, based on our tests. If, on the other hand, the customer complains, such a system would reward reps who managed to offer just enough to keep the customer from demanding his/her valuables back, and no more, up to whatever limit the company allowed. Remember that even at triple the initial offer, our estimates suggest the company would in some cases still earn about a 60% margin.

Cash4Gold Customer’s video showing the checks he received

We don’t begrudge Cash4Gold the right to make a profit. And the company does have some major expenses, such as advertising, that must eat into its margins, and make it harder to offer consumers a higher price. Earlier this year, Florida Trend magazine estimated that Cash4Gold needs to “knock, on average, $155 from the metal value on which it pays per transaction to consumers” just to cover its marketing costs. Consumer Reports Money Adviser recently noted that gold buyers with lower marketing costs, such as Red Swan, may be able to make higher payouts to customers; a recent NBC Today Show report found that Red Swan’s offers could be more than double those of Cash4Gold.

We don’t begrudge Cash4Gold the right to make a profit. And the company does have some major expenses, such as advertising, that must eat into its margins, and make it harder to offer consumers a higher price. Earlier this year, Florida Trend magazine estimated that Cash4Gold needs to “knock, on average, $155 from the metal value on which it pays per transaction to consumers” just to cover its marketing costs. Consumer Reports Money Adviser recently noted that gold buyers with lower marketing costs, such as Red Swan, may be able to make higher payouts to customers; a recent NBC Today Show report found that Red Swan’s offers could be more than double those of Cash4Gold.

INJUNCTION JUNCTION

4-14-09 Motion for entry of a default (PDF)

4-14-09 default entered (PDF)

6-11-09 Verified Motion for Temp Injunction and Motion for Default Final Judgment (PDF)

6-25-09 Order on Verified Motion (PDF)

Meanwhile, the legal documents filed by the company present several puzzles. In its original lawsuit against Liberis (PDF), the company asserted that her statements were “false and defamatory.” Yet a later order against her (PDF) prohibited her from publishing “confidential and proprietary information” as well. Obviously a statement can’t be both proprietary (hence true) and false at the same time. We’ve asked Cash4Gold to clarify which part of Liberis’ statements were which, but it has refused.

In April, the company managed to get a default entered against Liberis. That one-sentence statement, signed by a court clerk, was obtained because Cash4Gold’s lawyers assured the court that Liberis hadn’t responded to its lawsuit. Yet Liberis had submitted detailed answers (PDF) to questions Cash4Gold had served on her with the suit, and those answers had been filed with the court. In an interview with us, Liberis made it clear that she felt she had complied with her legal obligations by responding to the company’s questions.

In June, the court granted Cash4Gold’s request for a default judgment against Liberis on the merits of the case and issued a temporary injunction (PDF), giving Liberis one day to “remove any and all postings on the Internet regarding Cash4Gold.” At Cash4Gold’s request, the order added at least one charge that wasn’t in the original suit against Liberis: the aforementioned claim that she had disclosed “confidential and proprietary” information. And the injunction then required Liberis to stop publishing confidential information or risk being held in contempt. Yet the company had never included those charges in their lawsuit, never described the supposedly confidential information at issue, and never gave Liberis a chance to respond to those new claims. The injunction was received by Liberis on or about its June 26th deadline, according to the company. In the order, the company repeated its claim that the default judgment against Liberis was justified by her “failure to serve any paper as required by law”, despite the fact that Liberis’ detailed written response to the company’s questions had been, at that time, on file with the court for about two months.

The contradictory statements and mix-ups have not stopped Cash4Gold from prevailing in the Broward County, FL courts, at least so far. On August 18th, the judge postponed determining whether Liberis should be held in contempt for violating a court order, but issued a new order giving her 10 days to ask ComplaintsBoard to delete her post, which in any event had already been replaced with a link to another site. In a separate hearing that same day, a different judge declined to hold Nephew in contempt, instead granting her two weeks to find counsel, and said the court would review her entire case then. Both women now have an attorney.

WHERE WE STAND

Just to be clear about the Consumerist’s position, we consider this a legitimate and important news story. One core mission of a consumer-oriented news site is to alert its readers to bad deals. Everything we’ve learned about Cash4Gold’s offer so far places it in that category, in our view. That’s why we have resisted the legal efforts to silence our reporting, and why we’ve continued to dig into the story, despite the company’s lack of cooperation.

As part of that effort, we reached Aronson on Aug. 12. In a brief phone conversation, we asked the Cash4Gold CEO if he’d be willing to talk to us about “some of the questions people are raising, to clear things up.” Aronson said, “Sure,” and told us to contact his office for an interview. The public relations contact instead referred us to the company’s general counsel. A couple of hours later, Cash4Gold’s law firm told our attorney that we were being sued, and that all further discussion should be lawyer-to-lawyer.

As part of that effort, we reached Aronson on Aug. 12. In a brief phone conversation, we asked the Cash4Gold CEO if he’d be willing to talk to us about “some of the questions people are raising, to clear things up.” Aronson said, “Sure,” and told us to contact his office for an interview. The public relations contact instead referred us to the company’s general counsel. A couple of hours later, Cash4Gold’s law firm told our attorney that we were being sued, and that all further discussion should be lawyer-to-lawyer.

The company appeared to relent last week, saying Aronson would be willing to do an in-person interview this Wednesday. But yesterday, it canceled the interview – which is why this article cannot represent Cash4Gold’s position beyond what the company has already said on its blog and in earlier interviews with other news outlets.

But as you can tell from this lengthier-than-usual post, we’re continuing to report on the story anyway, and still hope to bring you Cash4Gold’s side of it if whenever they’re willing to talk. So, Jeff, we take you at your word that you’d like to get together, and look forward to speaking soon.

UPDATE: After this post went live, Cash4Gold said the following in our comments section:

On the advice of legal counsel, Cash4Gold was unable to offer specific comments to the Consumerist for this article. It would have been highly inappropriate given the pending litigation concerning Consumerist’s refusal to remove a false and defamatory posting about Cash4Gold from its website, even after the person who authored the comments requested that they be taken down.

The “person” Cash4Gold refers to is Michele Liberis. And when Cash4Gold says she requested that we take down her posting, this is what they are referring to (PDF). This letter from her new lawyers says that Liberis continues to stand behind all of her statements and believes that the injunction the company obtained against her was improperly entered. Although she is seeking “dissolution” of the injunction, in the meantime she’s playing by the rules and is complying with its direction to send this request.

Regarding Cash4Gold’s claim that it couldn’t comment for our story because it had sued us, we note that we had requested detailed information from Cash4Gold for many months before the company sued us — since February in fact — without getting any response. The company added us as a defendant only in August.

Additional reporting by Laura Northrup and Chris Walters

UPDATES:

Cash4Gold Stops Suing Whistleblowers; FL AG Launches Investigation

Ben Popken On Today Show: Beware Mail-In Gold Services

Congressman Demands FTC Probe Of Cash4Gold

Cash4Gold Hit With Racketeering And Fraud Class Action Lawsuit

Cash4Gold Drops Consumerist From Lawsuit

Cash4Gold Threatened Jail If Negative Comments Weren’t Removed

Cash4Gold Defendant Liberis Files To Vacate Default

Cash4Gold Activates Magical Press Release Machine

Internet Alerted To Our Cash4Gold Investigation

DOCUMENTS AND LINKS

Complaint against Liberis, Consumerist, ComplaintsBoard (PDF)

Complaint against Nephew, Consumerist, ComplaintsBoard (PDF)

ComplaintsBoard post

Cockeyed post 1

Cockeyed post 2

Cash4Gold’s old TV ad

Cash4Gold Super Bowl Ad

10 Confessions of a Cash4Gold Employee [Consumerist]

Beneath Cash4Gold.com’s shiny veneer, a dull reality [LAT]

Beware Cash4Gold and other gold-buying ripoffs [Yahoo! Tech]

Good Morning America [GMA]

Cash4Gold’s Public Relations Companies Attorney Accuses Me of Defamation [FMD Consumer Blog]

Nightline interviews Jeff Arononson

Cash4Gold customer video about low checks

Cash4Gold’s blog response to ComplaintsBoard post

Cash4Gold’s Fire Bureau citations (PDF)

Police report on Cash4Gold’s 10/03/08 shutdown by city inspectors

Cash4Gold BBB Report

Cash4Gold’s Rush [Florida Trend]

Original lawsuit against Liberis (PDF)

Order against Liberis (PDF)

Liberis’ responses to Cash4Gold’s questions (PDF)

Temporary injunction against Liberis (PDF)

Defendant Michele Liberis’ Motion to Vacate and Set Aside Default (PDF)

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.