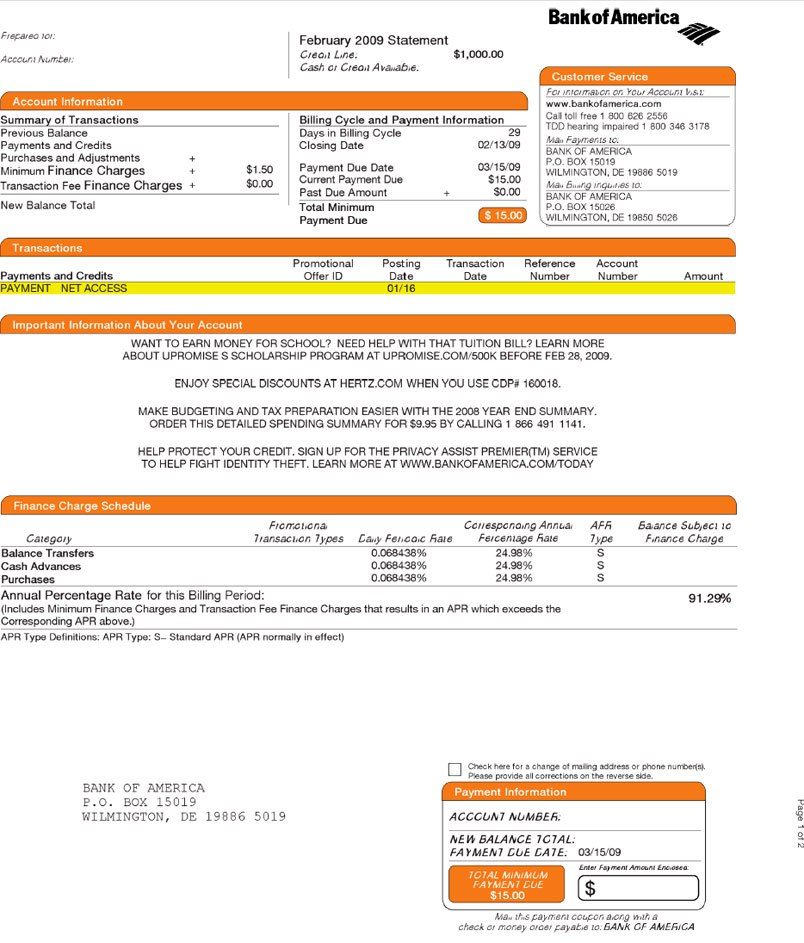

Your APR Is Now 91.29% – Yours Truly, Bank Of America Image courtesy of

David's effective APR on his Bank of America credit card is now 91.29%. It's not a typo or a scam, it's math.

David’s effective APR on his Bank of America credit card is now 91.29%. It’s not a typo or a scam, it’s math.

“This was my first credit card and I’ve had it since 1997,” writes David. “I only keep it for the history and I only use it every now and then as a backup. Am I reading this right that they bumped me up to a 91.29% APR?”

Yep, David. Your APR on this card is 24.98%, but since you have a balance near zero on it, that $1.50 finance charge makes the effective APR look huge.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.