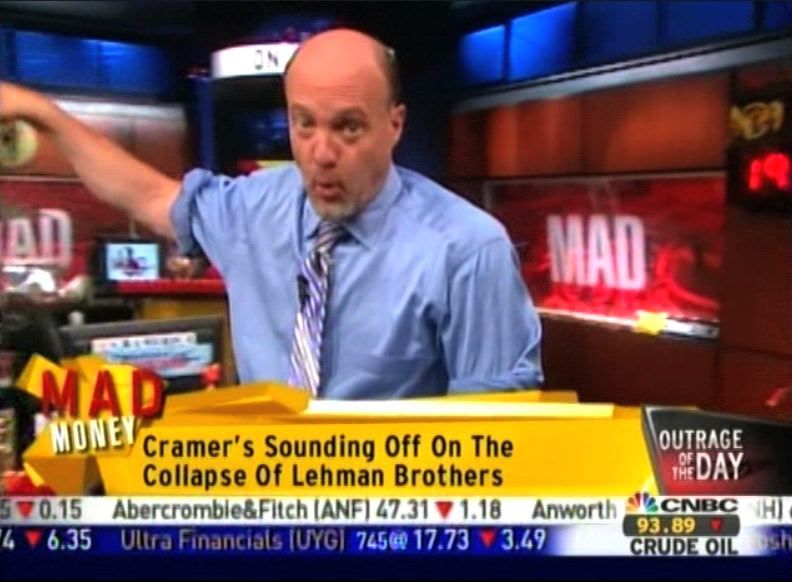

"Crazy" Jim Cramer Takes This Opportunity To Gloat

About a year ago, CNBC’s Jim Cramer completely lost his sh*t on CNBC, screaming at Bernanke to lower interest rates before millions of borrowers went into foreclosure. Now, as the “Armageddon” that he was carrying on about is in full swing, Cramer is taking this opportunity to gloat.

“Alan Greenspan told everyone to take a teaser rate and then raised the rate 17 times?” Cramer yelled back in August, pleading with Bernanke to focus on the issue. “Open the darn Fed window. He has NO IDEA how bad it is out there. HE HAS NO IDEA.”

Here’s his initial meltdown:

And here’s Jimmy’s elegy to the economy:

[via Gawker]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.