M&T Bank Makes An Offer You Can Definitely Refuse

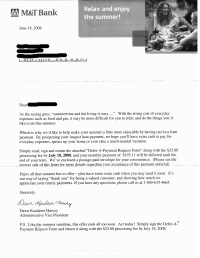

Here’s a novel way for a bank to increase revenue: offer your customers a “perk” where they can skip a payment on their loan for a neat $25 fee! Of course, interest still accrues, your total repayment amount increases slightly, and one month is added to your repayment period. No thanks. You can see the actual letter and details below.

Click for larger versions:

|

|

(Thanks to Jerry!)

(Photo: Getty)

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.