Chase Resets Marketing Preferences, Asks You To Opt-Out Again

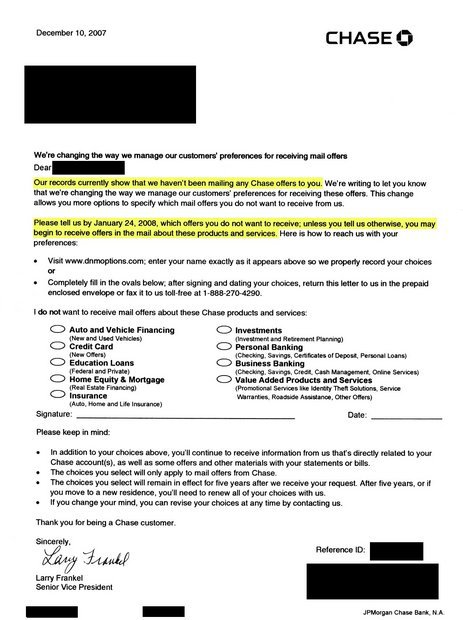

Chase will reset everyone’s marketing preferences under the guise of providing “more options to specify which mail offers you do not want.” Remember when you originally opted-out? They didn’t quite understand. What about their Value Added Products And Services and Used Vehicle Financing? Unless you opt-out again by January 24, Chase will acknowledge your implied change of heart. Read their notice after the jump.

(Photo: Maulleigh)

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.