Bank Of America's ATMs With Envelopeless Deposists Are Great

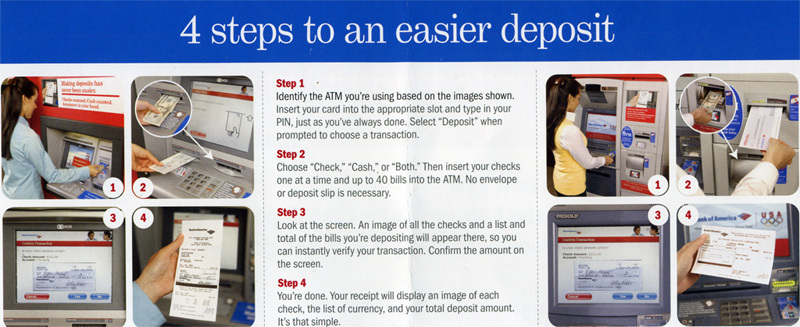

Bank of America has rolled out over the past yearATMs that don’t require you to put your money or checks in an envelope when you deposit. Just shove the bills and checks in the slot. Vincent Ferrari saw the new ATMs in Queens and sent us the scan of the flyer that was sitting next to them, writing, “I know you aren’t huge fans of Bank of America, but the new ATMs are undeniably cool…”

Hunching over with your money and checks and filling out the envelope can be a slightly annoying time-waster. More banks should incorporate this convenience. Just hope they don’t get jammed up. Full scan inside…

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.