How to Beat the 'Four Square' and Other Car Dealership Sales Tactics

Don’t get ripped off. We'll help you go into the dealership armed with knowledge and confidence.

Although the car business has changed dramatically in recent years, thanks to the expansion of superstores with no-haggle pricing and automakers such as Tesla offering direct online sales, some dealerships still use old-school, high-pressure gimmicks. These include the dreaded “four square” worksheet that makes it difficult to know how much you’re actually paying, and prewritten scripts designed to part you from your money.

We talked to former car salespeople to learn their tricks, and also asked our own experts—who have purchased hundreds of cars at dealerships for our test program—for their advice. In this article, we’ll let you know what sales tactics to look out for in the order you’ll encounter them, and the secrets of how to conquer them.

The Lowball Offer

Dealerships start using psychology to part car buyers with their money before they even set foot in the showroom, says former car salesperson Ray Shefska. “It starts with online advertising of prices that don’t really exist,” he says. Shefska spent 43 years selling cars, working in every role from salesperson to general manager. Now, he runs concierge car-buying service CarEdge with his son Zach.

The 'Buy Now, Or Else'

Don’t get caught up when salespeople tell you there’s a lot of interest in a particular vehicle or that a specific deal is expiring soon. “The first thing they’re trained to do is put in a sense of urgency,” says S. Lindsay Graham, a former salesperson and dealer manager who is now a car buyer’s agent and CEO of CarPal, a concierge car-buying service.

Until recently, she says, some of that urgency was real. Inventory shortages during the early days of the pandemic let dealerships name their asking prices for new vehicles, often adding a “market adjustment” that drove up the prices of popular models. “Buyers have been trained for the last three years to not negotiate,” says Graham.

But times have changed, and shoppers have more power. “The tide has turned. We’re back to dealers not having the upper hand because there’s inventory now,” she says.

How to avoid it: Graham says manufactured urgency is designed to shake buyers’ confidence. “You’re off balance right when you start,” she says.

To regain their footing, Graham says buyers should intentionally slow down the process if they feel things are moving too fast. “Go in for the test drive and say, ‘I’m very interested, but I don’t have time right now. So let’s deal with this over email or text,’” she says. Set a time limit for when you plan to leave the dealership by and stick to it.

Graphic: Consumer Reports Graphic: Consumer Reports

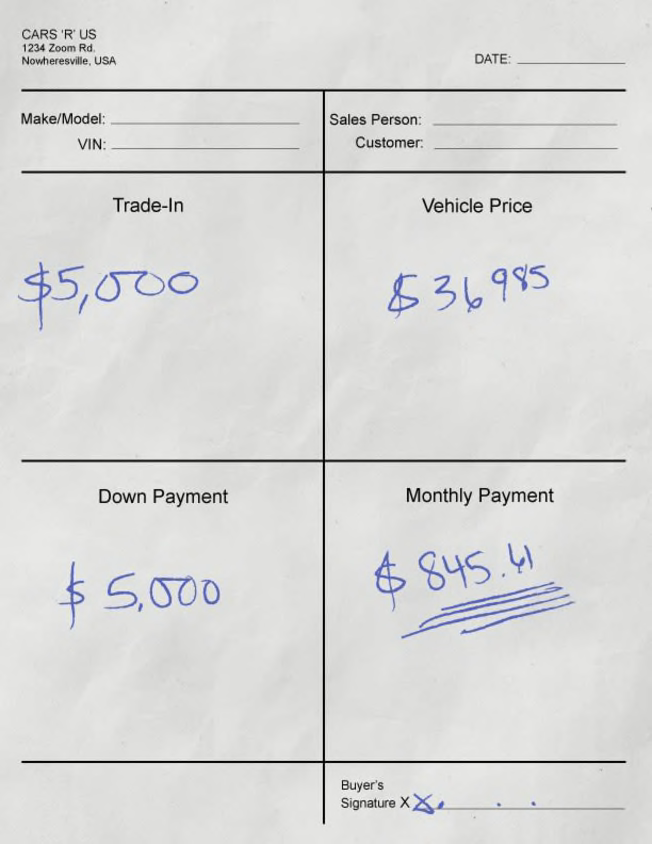

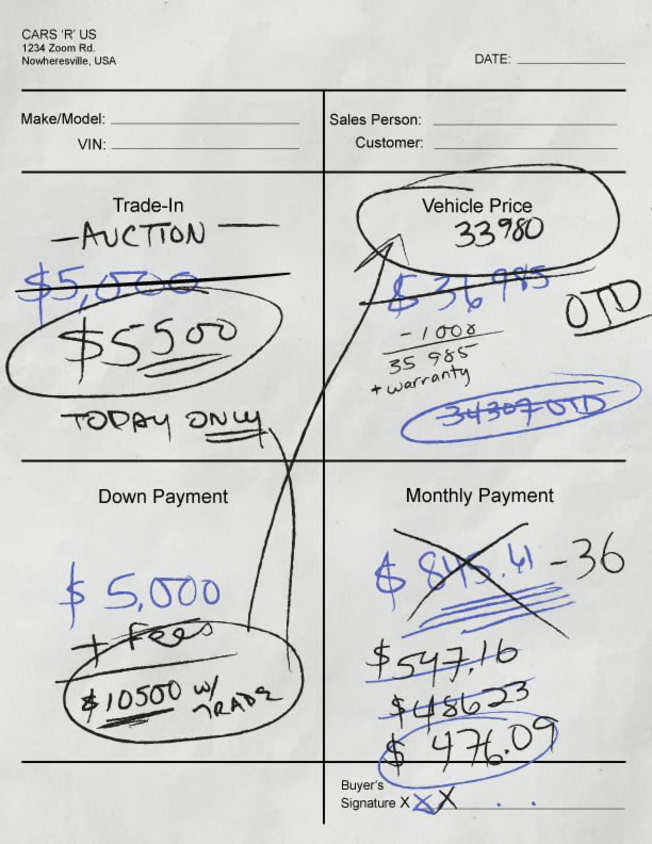

The Four Square

For years, dealerships have been using a tactic called a “four square”—a sheet of paper divided into four boxes where the salesperson will write down your trade value, the purchase price of the vehicle you’re buying, your down payment, and your monthly payment. At the top, there’s usually a place to sign your initials to indicate that you intend to buy the car if you like the deal.

The details of the technique may have changed over the years since Consumerist reporter Ben Popken talked to car salesperson Allen Slone about the four square in 2007—we’ve seen “deal sheets” or “order sheets” without the four boxes—but the basic formula remains the same.

“It looks really unassuming on its face, but it’s designed to make you pay more and not realize what’s going on,” Slone explained in the Consumerist article. Salespeople will write in big letters, turn the sheet over, and write over and cross out numbers to make it as confusing as possible, all in an attempt “to wear you down and make you sign.”

Zach Shefska says the whole point of a four square is to focus a buyer’s mind on a monthly payment instead of the total price of the vehicle. “Sales managers are trained to talk about monthly payment. By talking about monthly payment, you’re obfuscating variables that are profit centers for the dealership,” he says. For example, dealers can raise the price of the vehicle but lower the monthly payment by stretching a loan from three years to six years.

Sometimes, salespeople will ask you to initial a piece of paper next to a written promise that you’ll buy the car if the numbers are agreeable to both parties. Ray Shefska says this is an attempt to shame buyers into purchasing a vehicle even if they aren’t ready.

“The sales manager can come out and say, ‘Doesn’t your word mean anything?’” In reality, Shefska says, “It’s just a ploy to say you signed it, you committed to it—there’s nothing legal about it, but it allows you to try and shame the customer into completing a transaction.”

How to avoid it: CR’s Shenhar says to negotiate the vehicle price separately from the financing. CR usually recommends that you get preapproved for an auto loan from a bank or credit union before you reach out to a dealership. That way the dealership can’t try to manipulate the length of the loan or the interest rate. If the dealership offers a lower rate, you can take advantage of it instead.

At the dealership, use a loan calculator on your phone—like this simple one from the Dallas Federal Reserve Bank—to figure out what the price you’ve negotiated will translate to as a monthly payment. Put in your interest rate, your loan term in months, and the total purchase price of the vehicle, and it will show you what your monthly payment should be and how much you’re paying in interest charges alone. Use it to double-check the dealership’s math, too.

Graphic: Consumer Reports Graphic: Consumer Reports

The Word Track

If you talk with car dealers as often as we do at CR, you’ll start to notice specific turns of phrase that they follow. In the industry, they’re called “word tracks”—scripts used to overcome buyer objections or subtly nudge a buyer into spending more.

For example, to move the conversation away from total price and toward monthly payments, Shefska says a salesperson might ask, “Can you give me some ideas of what you were thinking would be a monthly budget for you?”

If you tell a salesperson you’re willing to pay $500 a month for a new vehicle, the salesperson is trained to say, “Got it—$500 up to?” in the hopes you’ll increase what you’re willing to pay. Then the salesperson might write down a down payment amount and say, “Were you planning on putting that or more down?”

Graham said that some dealerships will ask buyers to split the difference between the price a buyer wants and the price a dealer is asking. “They may meet you in the middle, but that’s still a really lousy deal,” she says.

How to avoid it: You can avoid a lot of word tracks by starting your negotiations over email. Once you’re at the dealership, use some “word tracks” of your own. If a dealer tries to push the conversation toward monthly payments, tell them, “I’d rather focus on the overall cost.” If the numbers are more than you expected, say, “I’m sorry, but that’s out of my budget.” If they try to get you to initial a piece of paper, tell them, “I’m not ready to purchase today.” Deploy these like magic spells.

Best Auto Products of the Year

Car Batteries • Car Tires • SUV and Truck Tires • Winter/Snow Tires • Infant Car Seats

The Hard Sell

Over the years, we’ve met salespeople who played “good cop, bad cop” with their manager, greeting us with coffee and donuts but sending the boss out to play hardball. Salespeople have also tried “quid pro quo” tactics, telling us that we could get a lower price on a car only if we financed it through the dealership or bought an extended warranty.

How to avoid it: Graham says buyers should remain calm and speak the salesperson’s language. Instead of arguing, find something you can offer them to get them on your side. For example, many automakers use customer surveys to reward and punish dealerships and salespeople. “Tell them, ‘I know you’re super-busy, so I want to make this easy. And if it goes well, I’ll give you all tens on your survey.’”

If all else fails, walk away.

“Stand up for yourself," Zach Shefska says. "If you don’t understand something, just say no. There’s nothing wrong with that.”

Or, as his father puts it, with the quick wit and patter of a lifelong salesperson, “The most powerful two-letter word in the English language is ‘No.’”

CR's Build & Buy Car Buying Service

In addition to research and reviews, Consumer Reports offers members access to the Build & Buy Car Buying Service at no additional cost. Through this service, members can compare in-stock vehicles, see what others paid for the car they want, and customize their payments online. Once they find the vehicle they’re interested in, members can get upfront price offers online from local certified dealers. On top of national incentives, Consumer Reports members are eligible for additional incentive offers from select manufacturers through the Build & Buy Car Buying Service. Plus, members can get an instant trade-in value for their current vehicle to use toward their next car purchase.